The prospect of hotly contested Hamilton Island yacht races appears sunk. Or at best limited to mostly Queenslanders at the much-anticipated race week next month.

The Oatley family had been hoping there would be fewer Queensland border restrictions, not more. So Wednesday’s announcement from Premier Annastacia Palaszczuk on the border closure to Sydneysiders, along with earlier restrictions on Melburnians, effectively takes the wind from the Oatleys’ sails.

And Margin Call gleans Wild Oats X is moored at Woolwich dock, so now won’t be there.

The Oatley-owned yacht, skippered by Mark Richards, came second last year up against Marcus Blackmore’s Hooligan.

It might be the year when David Redfern’s Not A Diamond, Tam Faragher’s Karumba, James Crowley’s Javelin and Chris Morgan’s Ragtime — all from the Royal Queensland Yacht Squadron — shine, if the races don’t get abandoned altogether.

There are currently about 30 spectator vessels cruising around Hamilton Island. Marbella and Aurora are there, as is 7th Heaven, belonging to Hinkler Books founder Robert Ungar.

Ian Malouf Mischief has been in the Whitsundays for some months now, so it will be around. But Margin Call gathers accountant Anthony Bell won’t be sending Ghost north for hire during race week, which is scheduled to run from August 15.

It had been envisaged as being one of its biggest in its 37-year history, with international entrants including the Beneteau 51.1, Kiwi2, owned by Scottish New Zealander Marcus Barnetts. The largest fleet was 252 in 2016.

Maybe the skippers, crew and owners could be considered critical infrastructure?

Judd’s Spirit lifts

One of the investments of AFL legend Chris Judd has been his stake in Spirit Telecom, which reported its annual results on Wednesday showing a 14 per cent revenue jump.

Judd holds some three million shares through his company Three Zebras, an investment valued at $900,000, up $270,000 since the start of the year.

Spirit shares are trading at 30c, exceeding two-year highs. Its shares have risen more than 25 per cent since its June 26 acquisition of cloud services provider VPD Group, an acquisition that should see Spirit expand its customer base beyond Melbourne into NSW and Queensland.

Judd does their radio ads, advising he uses Spirit at the Judd Corp headquarters.

The board is chaired by James Joughin, with Sol Lukatsky its managing director. Inese Kingsmill was appointed to the board earlier this month, bringing with her experience of marketing for Telstra.

Spirit co-founder Geoff Neate, who stepped down from the company late last year, and Peter Diamond, former executive director role at Euroz, were early major shareholders.

Diamond and Judd have previously successfully backed Clean Teq and Novita Healthcare.

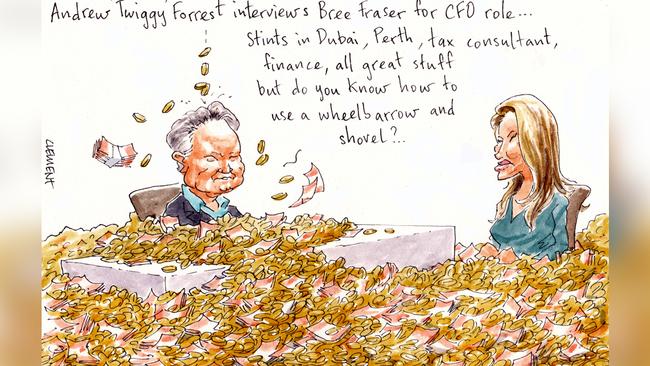

Twiggy’s execs rejig

With his wealth from his publicly listed Fortescue Group recently growing at $500m a week, Andrew “Twiggy” Forrest has taken time to sort out his key bean counters. There’s been an appointment of a new CFO at his private investment group and philanthropic venture.

Amid a strengthening of his executive team, he’s promoted his finance director, Bree Fraser,to assume CFO responsibilities for the billions at the family company, Tattarang, and the Minderoo Foundation.

Stephen Daly had been juggling the acting chief operating officer and CFO roles since last year. He’s now taken the chief operating officer role full-time, as former COO and CFO Felicity Gooding has been promoted to deputy CEO of Minderoo, reporting to Andrew Hagger.

Fraser had spent seven years in financial jobs in Dubai before moving back to Perth in 2015 to join Twiggy’s private camp. She had started her finance career back in Perth as a tax consultant at KD Johns & Co, which was later acquired by Deloitte.

Forrest saw the share price of Fortescue reach $17.10 record highs earlier this week.

Hemmes declutters

Hospitality industry leader Justin Hemmes is offloading some redundant artwork from the Hermitage estate at Sydney’s Vaucluse. Margin Call imagines Hemmes found them in a pokey gothic cupboard at the harbourfront trophy home.

The home, and its contents, are a tad more modern these days than when the 1870s home was bought by his parents, John and Merivale, in 1975 for $500,000. It was a credit squeeze fire sale by Dick Baker and his wife, a former Miss California, following the 1974 collapse of his property developer, Mainline.

The estate has been made more contemporary with the input of architect Brian Hess, of Hess Hoen, and landscapers Michael Bates and Daniel Baffsky.

Hemmes has asked Andrew Shapiro at Shapiro Auctioneers to sell 30 figurines, sculptures and paintings next month. They include an early 20th century Italian marble bust of Joan of Arc. There is an English mahogany long case clock.

The priciest offering is The Good Samaritan, an oil painting by Eric Wilson that has an estimate of $12,000-$18,000.

It was bought in 1976, a year after the family moved in, for $11,000.

Safety first for cafe

The Potts Point pandemic scare in Sydney has prompted the Onisforou family to briefly stop accepting diners at their Parisian-style Potts Point cafe. They are doing takeaways as a precaution.

Property developer Theo Onisforou bought the vacated ice cream shop on the corner of Macleay Street and Darlinghurst Road late last year, paying $1,815,000, astutely at less than its 2015 sale price of $2.15m.

His daughter, Stephanie, an architecture student at Sydney University, then opened Cafe de la Fontaine with French cafe operator Joffrey Van Asten. It quickly became a popular spot for locals and Francophiles after its opening in March, amid Sydney’s first lockdown.

The budding entrepreneur took the latest shutdown decision on her own.

“It wasn’t mandatory,” Stephanie told the ABC. “I think for me it was more a fear. The last thing I would want is for somebody to become unwell after visiting us.”

Theo’s long-term plan will see the cafe space set within the new foyer for the neighbouring 50-room 1905 hotel, The Astoria, set to become a four-star hotel. It was Andersen’s of Denmark ice cream parlour that closed after decades just opposite the 1961 Woodward & Taranto-designed Alamein Fountain, which was amusingly likened this week to the COVID-19 bacteria.

The Betoota Times editor Clancy Overell wrote that karma caught up with the bohemian artistic community, a jocular reference to what he dubbed “a giant coronafountain”.

No beef with Rudd

AACo chairman Donald McGauchie has defended Australia’s former first daughter Jessica Rudd’s decision not to hold shares in the beef producer. She’s been a director for three years, but there’s no sign she’s our next heavily invested cattle queen.

Rudd earned $115,000 last year from her seat on the board of the trailblazing 196-year-old pastoral company.

McGauchie, who owns 1.1 million shares in AACo, advised he saw no issue.

“I have yet to see an issue where any director in any company that I’ve been involved in sees any difference in the diligence that they apply to their role as a director having any relation to the shareholdings that they hold in a company,” he said.

The Australian Shareholders Association has a different view.

Maybe Rudd will now follow her chairman’s lead, and on the cheap. AACo’s share price has fallen 28 per cent since she joined the board in late 2017.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout