Woolworths chair Scott Perkins’ sideline in abstract photography; Magnolia Capital in liquidation

Woolworths chairman Scott Perkins has been fantastically busy in recent days, but not with his role at the Fresh Food People or as chairman of Origin Energy.

Helming the boards of two ASX-listed companies would surely use up enough of the man’s bandwidth, as would sitting on the board of yet another listed company, Brambles.

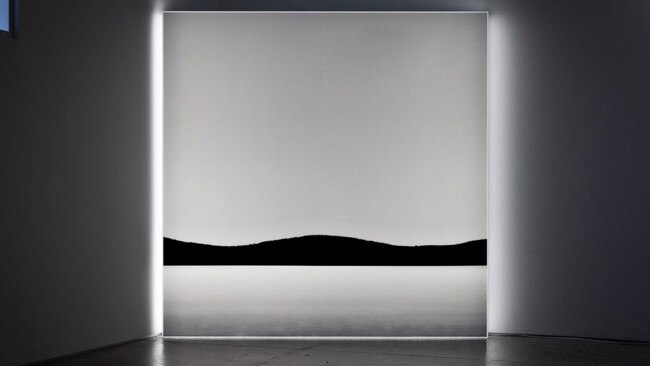

Not Perkins, who has a side hustle in abstract photography to add a bit of crema to his chairman’s fees. An exhibition of his works launched a week ago, and his pieces do not come cheaply, with prices ranging from $7000 to $12,000 a pop.

That’s much higher than what the average Australian household spends on a car load of groceries and a few heapings of coal to stay warm each year – though we doubt his exhibition, Penumbra, is geared towards the humble working family and not the lifted brows, the snoots, the idle rich.

His works are pleasant enough. Seascapes and landscapes with a “brooding, atmospheric” quality, as they’re described on the gallery’s website. As with most abstract art, the commoner’s eye falls upon them with confusion, with caution, and it’s hard not to feel that such obscure works are only beloved by those who love paying someone to rip them off.

Teal voters, basically.

Per the ad-copy: “Scott Perkins’ images of unidentified landscapes have been captured in state of balance (sic), occupying a space between light and dark. Viewers are treated to impeccably presented lightbox photographs of bespoke design that transform their surrounding spaces.”

All very fancy, see? Again, an incredible achievement that Perkins even has the time for these larks while working for shareholders at three very large companies, all of which are bracing for the opposing tempests of higher interest rates and runaway inflation.

At Brambles he’s compensated $US200,000 ($311,000) for the pleasure of his time. At Origin it’s a salary of $677,000, while at Woolworths the going rate had been $391,598 – that’s before he was appointed chairman, which should now give him double that.

But if Perkins’ foray into the nauseating realms of high art and high style were not already complete, we note that he’s very recently updated his LinkedIn profile to correct the “chairman” titles at both Origin and Woolworths to the supposedly less offensive “chairperson”.

It has been said that the former is already perfectly neutral in its usage – the suffix ‘‘man’’ being derived from the term ‘‘manus’’ or ‘‘hand’’ in Latin. Some disagree.

But don’t take our word for it – this was firmly pointed out to us by Anna Lavelle, chairman of Medicines Australia, who corrected our attempt to call her a “chairwoman” during an encounter at Labor’s budget dinner last month.

–

Magnolia wilts

The fortunes of Magnolia Capital and its seething investors appear to have gone up in smoke, with founder Mitchell Atkins placing it into liquidation last week.

Liquidators Todd Gammel and Matthew Levesque-Hocking of HLB Mann Judd were appointed after Atkins’ raised concerns with Magnolia’s solvency and an inability to continue its operations.

Asked if it was likely that investors and creditors would see their money returned, Gammel told us it was “too soon to tell”, with a team of lawyers and specialists presently working through Magnolia’s files. The developments cap a harrowing few months for Atkins, who is being pursued by clients through the courts seeking to recover their frittered investments.

One of them, David Koadlow, of Melbourne’s prominent Smorgon family, is trying to cobble back $12m that was probably blown up in a series of margin calls he claims to have known nothing about.

That case is continuing, as are two others.

It was only last year that Magnolia was being feted and sometimes puffed up with helpful, well-placed coverage in the financial press that publicised its cornerstone investments in several IPOs and, curiously, the acquisition of a rare Lamborghini that became the marketing piece for a Hypercar Investment Fund.

It’s unclear what returns that gimmick yielded, but plain to see is that the entire shop – operating from the NSW Central Coast – has folded in upon itself, mere months after Atkins repeatedly promised investors they would still get their money back.

“Magnolia Capital Group has made the difficult decision to liquidate various entities and the group is working through these legal aspects,” Atkins said. “Our priority is to maintain valued relationships and ensure the process runs smoothly.”

From our understanding, the coda to this saga will be anything but.

–

Veteran departs

Readers may recall that earlier this year Delwyn Rees, at 95 years old, was re-elected as a director of the publicly listed Sietel, marking more than five decades on the board of the Melbourne-based investor.

Such longevity is unlikely to be rivalled in this country. As this column has already noted, Rees’ tenure might have even gazumped that of Warren Buffett, the long-running boss of Berkshire Hathaway, who got his gig in 1970. Rees, by comparison, started on the Sietel board in 1967 and served as chairman for 45 years. Read that last sentence again.

As far as backstories go there were glimmers of colour and movement. A stint as an accountant to hoteliers and entertainers later led to a job as a junior auditor with Frank Crean, who went on to become treasurer in the Whitlam government.

When Christopher Skase was a cub reporter at the Financial Review he followed Rees’ investments and documented them for the masthead, building quite a rapport, we’re told.

Rees passed away over the weekend following a short illness, according to an announcement released by Sietel. “(He) will be sadly missed by the family and his many friends and business associates,” it said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout