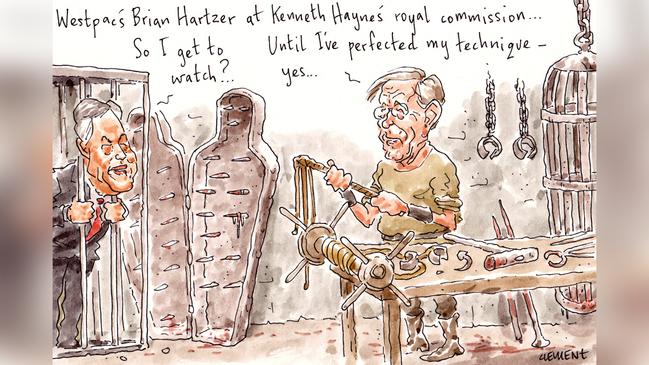

Westpac misses out on Hayne banking royal commission invite

Westpac CEO Brian Hartzer and his wealth boss Brad Cooper have gained a reprieve from the next instalment of Kenneth Hayne’s royal commission. How did they pull that off?

CBA, NAB and ANZ were all invited to attend the highly politicised round, which starts on August 6 and which will rifle through the $2.3 trillion superannuation industry.

David Murray’s AMP is also there, along with a sprinkling of industry fund giants: Heather Ridout’s AustralianSuper, David Elmslie’s Hostplus and Steve Bracks’s Cbus.

But there’s no Westpac on the just-released list.

“Maybe they just haven’t got to ‘W’,” said one banker, hopefully.

Don’t bank on it.

It seems Hayne’s legal terriers have more compelling case studies elsewhere.

Margin Call understands Hartzer’s people were as surprised as their big four peers were envious.

As the only big four bank committed to keeping its banking, advice and superannuation businesses, Westpac was sure it would appear.

We gather Cooper’s superannuation specialist Melinda Howes had been preparing for her day in Melbourne’s Federal Court.

But after all the royal commission’s subpoenaing of documents, it looks like she’s now got the fortnight off.

Too late to book a holiday somewhere warm?

Lowering the baaa

The other major development in Australian banking is that NAB CEO Andrew Thorburn has unleashed himself on Donald Trump’s favourite medium, Twitter.

Investors don’t seem to be thrilled. NAB’s shares yesterday closed down 0.5 per cent, about $500 million worth, as New Zealander Thorburn shared pictures of himself in Wagga Wagga with a flock of sheep.

Thorburn’s embrace brings to three the total number of CEOs of ASX top 20 companies actively using Twitter. The others are Telstra’s Andy Penn, who was quick to congratulate Thorburn on his decision, and Thorburn’s Melbourne-based banking rival Shayne Elliott, the agile tribal chieftain of ANZ.

IAG boss Peter Harmer still has an account but, understandably, seems to have abandoned the social media site, which most CEOs keep well away from.

Thorburn’s Sydney-based banking CEO peers Matt Comyn of CBA and Hartzereach have set up shell accounts on Twitter to have a peek around, but have each decided to keep an elegant distance from the increasingly shrill social media site.

Road to riches?

Gladys Berejiklian’s NSW government received two bids for the 51 per cent stake of the $16 billion WestConnex motorway project it is flogging.

And it seems whichever of the two consortiums wins, the biggest super fund in the land, AustralianSuper, will get a chunk of Sydney’s newest tollway.

The Ian Silk-led $140bn AustralianSuper is a member of the consortium led by Scott Charlton’s listed toll-road giant Transurban.

Whether that consortium will get bidding approval from Rod Sims’s ACCC remains a work in progress.

But that’s no biggie for AustralianSuper.

It should get significant exposure to WestConnex if the rival consortium led by Garry Weaven’s IFM wins.

More than $30bn of IFM’s $107bn of funds under management comes from the mustachioed Silk’s AustralianSuper.

And more than $6bn of that AustralianSuper contribution is in IFM’s infrastructure fund.

So whatever happens, AustralianSuper’s 2.2 million members should soon add a cut of the giant toll road to their investment portfolio.

On the block

After having their palace on the market for more than a year and a half, Radhika and Pankaj Oswal have had enough.

The Oswals— the flamboyant heirs of a contested billionaire family fortune — have put their abandoned super block in Perth’s prestigious Peppermint Grove up for auction this coming Saturday.

It’s been a long time coming.

But not everyone watching the sale is convinced this weekend will be the end of it.

“The auction is going to be a complete fizzler,” says one onlooker.

As befitting an Oswal venture Down Under, the sales process has been tortuous.

The Oswals — best known for their bombastic court case against Elliott’s ANZ — paid $23m for the place in 2007, back when Perth was booming.

Last year the couple knocked back a $19m offer.

Perth’s luxury property circles will be stunned if bidding this weekend gets anywhere near that price.

Head Turners

It has been a big few weeks in Europe for the Turner clan.

Flight Centre’s Graham “Skroo” Turner has been in Berlin for the travel group’s annual knees-up.

About 3000 Flight Centre staff were flown to Germany’s capital for the travel group’s global gathering — an all-expenses-paid affair that this year included an appearance by Chris Hemsworth and a performance by singer Kylie Minogue.

Meanwhile, over in London, Turner’s daughter Joanna Turner was in court slugging it out with American sporting giant Nike.

Turner runs a fledgling athleisure-wear brand, LNDR, whose name and promotion she claims Nike imitated in its multi-million-dollar LDNR campaign.

A judgment is expected in coming days.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout