Westpac beheadings soothe mob

The exit of Westpac chief Brian Hartzer, premature retirement of chairman Lindsay Maxsted and installation of previously retiring bean counter Peter King as the bank’s boss has mostly stemmed the collapse of Westpac shares.

But the catastrophic corporate accountability following financial regulator Austrac’s allegations that Westpac breached money-laundering laws millions of times and facilitated child exploitation in The Philippines has created a whole new set of issues for Australia’s second-biggest bank.

Maxsted, who will leave early next year, said on Tuesday his replacement would select Westpac’s new CEO, but there was no discussion about who would find the new chairman.

At the start of this year when Kenneth Hayne’s royal commission final report blew things up at NAB, exiting chairman Ken Henry initially seemed to want to run the process to find a replacement for sacked chief Andrew Thorburn.

The market wouldn’t have a bar of that and Henry didn’t get a say on who’d be the new broom.

(Coincidentally, incoming NAB boss Ross McEwan starts next Monday, the same day King takes over from Hartzer).

As things stand at Westpac, the board’s nominations committee is led by Maxsted and also comprises the other soon-to-depart director Ewen Crouch, tech specialist and former eCorp boss Alison Deans, ex-AMP boss Craig Dunn and former ANZ exec Peter Marriott.

So, like Henry before him, does Maxsted think he can lead the search for his own replacement?

We asked the bank, but so far no one knows and there has been no appointment of a search firm to help with either role.

If the board rules Maxsted and Crouch out of the process, that leaves Deans, Dunn and Marriott.

But there were reports on Wednesday that proxy advisers had recommended that shareholders vote against Marriott’s re-election at the bank’s December 12 AGM thanks to his role on the board risk committee.

That could reduce the ongoing members of the nominations committee to two.

And if Dunn wants to put his hand up to be considered for the chairmanship, which would be a remarkable development for an AMP alumni, that would leave Deans flying solo.

Dunn played a key role in meetings on Monday that resulted in Hartzer’s axing.

Margin Call has heard the former AMP boss volunteered at Tuesday’s fateful board meeting to resign so that Crouch didn’t have to walk the plank alone.

A noble gesture or perhaps a strategy designed to pressure Maxsted to leave sooner than he might have liked?

Just another thing for the Westpac board to ponder.

The board is meeting daily at the moment, but there’s no shortage of items filling the agenda.

Heavy hangs the head

As head of the books at Westpac, newly appointed interim chief Peter King was a key member of the deal team that has overseen the troubled bank’s $2.5bn capital raising.

King, who is 49, has been at Westpac since he was 24 and is set to earn circa $7m a year,

has amassed an impressive

swag of almost 120,000 Westpac shares that are worth almost $3m.

But the new acting CEO can’t apply for shares in the still-open $500m retail share purchase plan because of his status as an insider to the capital raising.

(For the record, exiting chair Lindsay Maxsted has already filled in the paperwork for up to 30,000 new shares that will cost him about $750,000.)

King’s role on the deal team means he was part of the group that decided on the final disclosures concerning Austrac’s investigations that were included in the capital raising’s November 4 offer documents to Westpac shareholders.

Austrac, of course, has now taken those matters to the Federal Court alleging 23 million breaches of anti-money laundering laws, with those matters now also the subject of an investigation by the James Shipton-led corporate regulator ASIC to assess whether the bank breached any of its market disclosure obligations.

So that places the new CEO, who previously announced his retirement in September (giving what was intended to be a year’s notice), right in the middle of Shipton’s inquiries about what the bank knew of Austrac’s investigations and when.

If King wants to be the boss permanently, the career accountant is going to have to clear Shipton’s hurdles first.

Simultaneous Libs

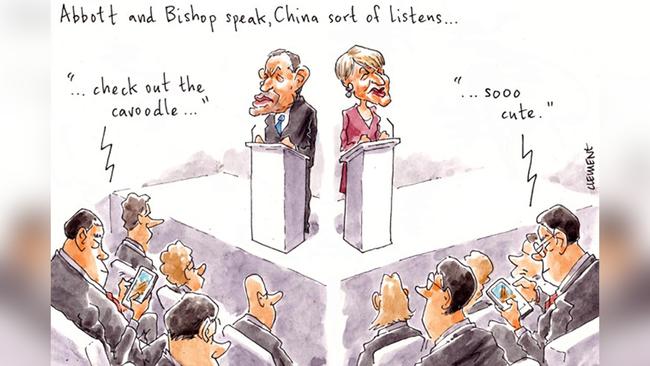

If Tony Abbott and Julie Bishop didn’t have such a famously good relationship, we’d almost expect foul play.

On Thursday, former prime minister Abbott will — for the first time since he left Kirribilli House in September 2015 — give “an address on China” at Frank Lowy’s foreign affairs think-tank.

Meanwhile, during the same lunch timeslot, all of 500m away in the Sydney CBD, Abbott’s former deputy Liberal leader Bishop will speak at the Centre for Independent Studies.

The former foreign minister’s topic? Australia’s relationship with China.

Her speech will anchor the Sydney launch of an interesting new China-focused Quarterly Essay by Peter Hartcher (who Abbott might remember as the author of a remarkable leaked exchange from his cabinet in 2015, months before the ascension of Malcolm Turnbull).

As it happens, it will be Bishop’s first substantial address on China since she left cabinet in August 2018.

In an extraordinary coincidence, the two distinguished Liberals will get going at 12.45pm and finish at 1.45pm, posing a wicked scheduling dilemma for Sydneysiders with an interest in the topic.

A suspicious mind could almost think it was deliberate.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout