Well-heeled audience for Tattarang’s Andrew Hagger

Any stage fright potentially lingering for WA-import and Tattarang chief Andrew Hagger could have been solved with an easy fix on Tuesday: just imagine the crowd in their R.M. Williams boots.

A poll by show of hands confirmed at least half of the agribusiness audience at the Global Food Forum were indeed stepping out in one of the investment group’s more recent acquisitions, with plenty more willing to stump up the $600 to buy another pair.

It’s no wonder that business is booming for Andrew and Nicola Forrest.

Taking questions from Margin Call colleague Sue Neals, Hagger noted that while there were plenty of sentimental proposals put to the highly acquisitive group, putting R.M. Williams back in Aussie hands was not one of them, noting they had been in negotiations for some years before the time and price were right.

Shedding some light on how it is to work under two of the most prolific names in business, the former bank exec Hagger shared with the crowd how the husband-and-wife duo were known for their stretch targets – aiming for production of 18 million of their Akoya oysters by 2024 (1.5 million if you’re ordering them by the dozen), over and above any of his more conservative early estimates.

“That’s just how we roll at Tattarang,” he quipped.

Dinners at some of the best restaurants in the country are part of it too, no doubt.

In a busy few days of engagements, Hagger also made an appearance at the pre-event dinner at Sydney’s Quay, with guest speaker Peter Gago, chief winemaker at Penfolds, sharing a bottle of Bin 149 and the brand’s latest foray into French champagne.

In the words of LAWD’s Danny Thomas, it is all about “putting your body on the line”.

How do we sign up?

Hungry Jack

Fast food mogul Jack Cowin has plenty of claims to fame – he’s the owner of Hungry Jacks, chairman and major shareholder of Domino’s and has amassed a personal fortune of more than $3.7 billion.

Here’s a claim we hadn’t heard before though, put to the crowd of the GFF by the man himself: that he has eaten more hamburgers than anyone else in Australia.

While we have no way to test such a theory, after 50 years of his self-described “entrepreneurial frolic” at Competitive Foods you would have to think there would have been plenty of Whoppers in the mix.

Despite such pedigree, the 78-year-old told the Global Food Forum crowd even he was fooled in a taste test for one of his investments, the plant-based meat maker v2foods, whose register also features Singaporean outfit Temasek and Sequoia China.

Cowin set out his focus on growth for the CSIRO-backed enterprise and delved into his long history with fast food in Australia, going right back to the Mosman Chinese takeaway store where it all started, and the 30 of his mates who all chipped in an initial investment back in 1969.

“Of the original group that lent me money, I think there’s two people left,” he said, “Some have died, some have cashed in.”

Fifty years later that would make for quite the return.

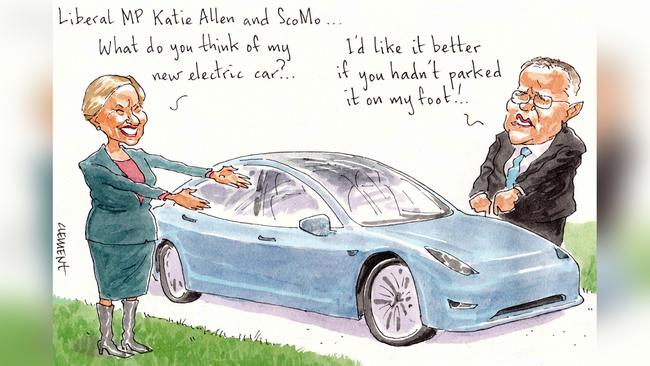

Driving reform

Member for Higgins Katie Allen has put her money where her mouth is and gone and got herself an electric car.

Allen was one of a clutch of new age Libs including Jason Falinski, Andrew Bragg and Trent Zimmerman who lobbied Treasurer Josh Frydenberg ahead of his recent budget for an exemption to the luxury car tax for electric vehicles.

The pitch was designed to help drive sales of the low emissions technology in the local car market – and in turn help stem climate change.

Now look, sitting in the driveway of Allen’s Toorak mansion is a new, shiny blue Tesla Model 3, which looks right at home in her leafy inner Melbourne electorate.

The car, which sells from $62,900, should also go down a treat in the lead-up to the next election with Higgins voters, who last time around delivered the repeat Greens candidate Jason Ball 22.5 per cent of the vote and 25.4 per cent to Labor’s Fiona McLeod.

Meanwhile as Allen’s new wheels yesterday sat in the drive, the first-term pollie was in the federal parliament doing her bit for the team, offering up a Dorothy Dixer to under-pressure Health Minister Greg Hunt on the government’s efforts to support the latest Covid outbreak in locked-down Victoria.

Retiring’s no holiday

Cochlear’s veteran chairman Rick Holliday-Smith quietly announced his retirement from the hearing aid maker this week, marking 11 years in the role by the time he bows out in August.

The move is not only his departure from one of the market’s largest and most successful biotechs – shares in the company have risen by almost seven-fold since he joined in 2005 – but also the bourse as a whole.

Could this be the exit of his spaghetti western moustache from public(ly listed) life entirely?

Recall it was only in April that he handed the chairman’s baton to Damien Roche at ASX.

Thankfully for the 70-year-old he’s accrued plenty of equity interests to keep himself off the pension.

Holliday-Smith’s time at Cochlear has offered up plenty of corporate actions and periods of shareholder unrest, but also helped him to accrue more than $2.1 million in shares, taking his total reported equity holdings, including stakes in ASX and Servcorp, to just over $3.5 million.

What is left for him then but to sit by his pool in Sydney’s eastern suburbs and watch the dividends roll in.

He wishes!

Even as new chair and former eBay head Alison Deans takes her position on August 20, after all Holliday-Smith’s years on boards, there are still a few roles set to eat into his retirement.

In the unlisted world, he remains chair of Brisbane-based anti-cancer biotech QBiotics alongside recently minted directors Nicholas Moore and TDM Partners’ Hamish Corlett.

And keeping things in the north, a board position with Burdekin cane farmer Australian Cane Farms with Alec Brennan, formerly of CSR, and led by ex-Rothschild agent Steve Kirby.

Not quite the sweet retirement we were thinking off.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout