Wealthy families overhaul cash cow

It is out with the old and in with the new at Mutual Trust, home of some of the oldest and most wealthy family offices.

As the group — the merged family offices of the Myer and Baillieu families started by Sidney Myer, wife Dame Merlyn Myer and brother William Lawrence Baillieu back in the early 1900s — approaches its 100th year, the firm has marked the occasion with no less than a broad sweeping restructure.

Surely a cake and a few candles could have done the trick?

As part of the shift, the firm has upturned its wealth team, including the exit of chief investment officer Graeme Bibby, which a spokesman described as a result of “a strategic review of the wealth function”.

The revamp is a means of “bringing the client-facing advisory team in closer alignment with our research team, as part of our broader corporate growth strategy”, the firm said in a statement.

“In our 100th year, Mutual Trust continues to evolve by expanding our wealth management offering to meet the needs of our diverse client base.”

That might also have something to do with the group’s rapidly dwindling staff numbers.

Earlier this year, partner and head of the group’s Sydney office Nick Lipscombe led an exodus of staff to start Perpetual Private’s new family office arm focused on ultra-wealthy clients.

His new team includes fellow partner Michelle Maynard and associate partners Frederick Cotter and Peter Whitehead, all of whom started working under Perpetual Private group exec Mark Smith just last month.

Is it any wonder Mutual Trust chief and managing partner Phil Harkness did a little rearranging? The former EY partner has had the reins of the storeyed firm since the merger of the two family offices back in 2017, alongside more recently appointed chairman Peter Hay, also the chair at Newcrest Mining.

There’s still plenty of the family names on the board though, including brothers Sid and Rupert Myer as well as Marshall and Charles Baillieu.

The former boss of Kerry Packer’sPBL Limited, Peter Yates,also gets a look-in at the firm’s long-term Collins Street HQ, as does Catherine Leahy, the board’s only female representative.

As they say, the more things change, the more they stay the same.

Bonus bonanza

While the vaccination debate grips the nation, rest assured there’s plenty of pharmaceutical types cashing in — and we don’t just mean the major drug makers.

Local outfit Sigma Health, owner of Amcal and Guardian chemist chains, lodged its annual accounts on Friday, detailing a healthy wad of bonuses for its chief Mark Hooper.

For all his help in getting the company back to profit, Hooper netted a $1.26m cash bonus, 95 per cent of his fixed salary, as well as a further $661,000 of retention bonus as prescribed in the previous year following the hit from the cancellation of its Chemist Warehouse supply agreement.

That’s roughly $3.4m for the year in which the group’s recently announced a 1c a share dividend — not bad for the middle of a global pandemic.

Chair of the people and remuneration committee Christine Bartlett was quick to note the first strike received by the company on pay last year, detailing a number of changes to the remuneration guidelines.

Still, in a separate notice to the market, chair Ray Gunston was asking shareholders to approve $800,000 in long-term incentives for the chief, as well as a $5m limited recourse loan to buy more shares.

The prospect of a board spill still looms large, if 25 per cent of shareholders vote against the remuneration report for a second time.

Only time will tell if Sigma has done enough.

Turnbull weighs in

Questions of former PM Malcolm Turnbull’splace in politics may have been answered in the wake of his dumping from the NSW net zero emission board, but that’s not stopping him from weighing in on the nation’s big issues.

On Thursday, it was time to join the chorus of voices in defence of former Australia Post boss Christine Holgate, calling for Prime Minister Scott Morrison to apologise publicly and for the top postie to be reinstated.

“It’s a big call, lots of competition, but the public bullying of Christine Holgate is one of the worst episodes of brutish misogyny I have seen in politics,” he tweeted.

Not a stranger to a little postal drama, recall it was Turnbull who blasted Holgate’s predecessor Ahmed Fahour for his $5.6m pay packet, saying it was “way too much”.

And if we weren’t seeing enough of him, Turnbull has first billing on Monday morning for the latest public hearing of the senate committee into media diversity.

The line-up includes Facebook’s local director of policy Mia Garlick and the likes of Crikey’s Peter Fray, The New Daily’s Bruce Guthrie and The Conversation’s Andrew Jaspan.

Title or not, there’s no denying he’s mixing with the activist types.

Rate your driver

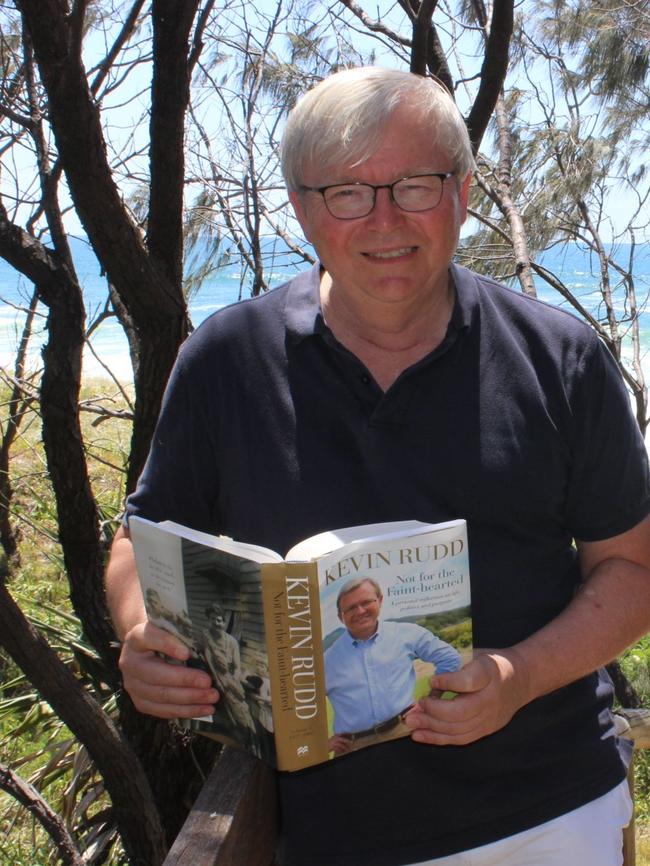

While on the subject of former PMs we’d be remiss not to mention the goings on of one of the Sunny Coast’s own, Kevin Rudd.

Daughter Jessica Rudd, a director of the listed Australian Agricultural Company, earlier this week shared an anecdote of how some tipsy Melburnian punters in Noosa had mistaken the former PM for their Uber driver.

Before he had time to object, the punters were piling into his car and requesting a lift to Hastings Street, to which Rudd obliged.

While the jokes of a part-time Uber driving role came in thick and fast, the charming mix-up got Margin Call thinking of just where the former Labor minister sat on the scale of Uber driver to his predecessor Malcolm Turnbull.

While Rudd’s property portfolio pales in comparison to the likes of Turnbull’s Point Piper pad, his recent acquisitions are adding up.

Over the past year, he and wife Therese Rein have shelled out millions to pick up not one but two new homes in the surrounds of the popular beach haven — one a former home of tennis great Pat Rafter, which they picked up for $17m, and a second, more modest $5m home close by.

That second house is in the name of Rein’s corporate vehicle, the recently rebranded Osprey Productions, an entity wholly owned by another vehicle, Confidence Nominees.

While that still is solely owned by Rein, a few directors of the company have caught this column’s attention, namely one David Gonski.

Of course, the connection is nothing new, Gonski has long had business associations with Rein, and was chair of her company Ingeus back when her husband was in office.

Only thing we have to wonder is whether his position at the company gives him first dibs on the fold-out couch or full rights to the poolside cabana?

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout