WA’s finest fired up for the SAS

Kerry Stokes may be putting up the cash for the legal bills in Ben Roberts Smith’sdefamation suit, but a bevy of WA’s biggest names are behind the charity that could help to pay costs for the rest of the soldiers caught up in Judge Paul Brereton’sinquiry.

Last week, it was revealed that Smith, the former SAS corporal, had offered up his prized Victoria Cross as collateral for a $1m loan from Stokes, to help fund his defamation action against Nine Entertainment.

The SAS Resources Fund, which Stokes helped to establish in 1996, is also likely to be tapped to cover any legal bills for the 19 soldiers called out in the inquiry, over and above any assistance provided by the Defence Force itself.

The fund’s accounts for the year to June 30 reveal it has $2.85m waiting to assist.

Trustees of the fund are a who’s who of former army servicemen, all with strong links to Stokes’ hometown of Perth, recently rejigged at the group’s annual Sundowner event at the Royal Freshwater Bay Yacht Club.

Outgoing chair Greg Solomon passed the baton to his deputy Grant Walsh, also a director of risk management outfit Osprey International, while former WA Senator Chris Ellison was appointed as trustee.

They join billionaire Andrew ‘Twiggy’ Forrest, former PricewaterhouseCoopers exec Nick Brasington, ex-local Alcoa boss Alan Cransberg and James McMahon of Stoke’s Australian Capital Equity, who also sits alongside the WA heavyweight on the council of the Australian War Memorial.

Back in Canberra, the inquiry adds to the national memorial’s headaches after ongoing attempts to derail its plans for a $500m upgrade.

Director Matt Anderson ruffled feathers on Wednesday, including those of PM Scott Morrison, over speculation of plans to acknowledge the inquiry findings within the memorial’s new exhibitions.

“The war memorial board, which has oversight over this, has people on there like Tony Abbott and corporal Daniel Keighran is on there … and the list goes on so there are a lot of people with a lot of experience on there,” ScoMo said, urging the public not to get ahead of themselves.

But a spokesman for Stokes maintained he would have no part to play in the ultimate decision, making clear that any changes were for management to consider.

Boost for Maggie Beer

Call it the Ellerston effect.

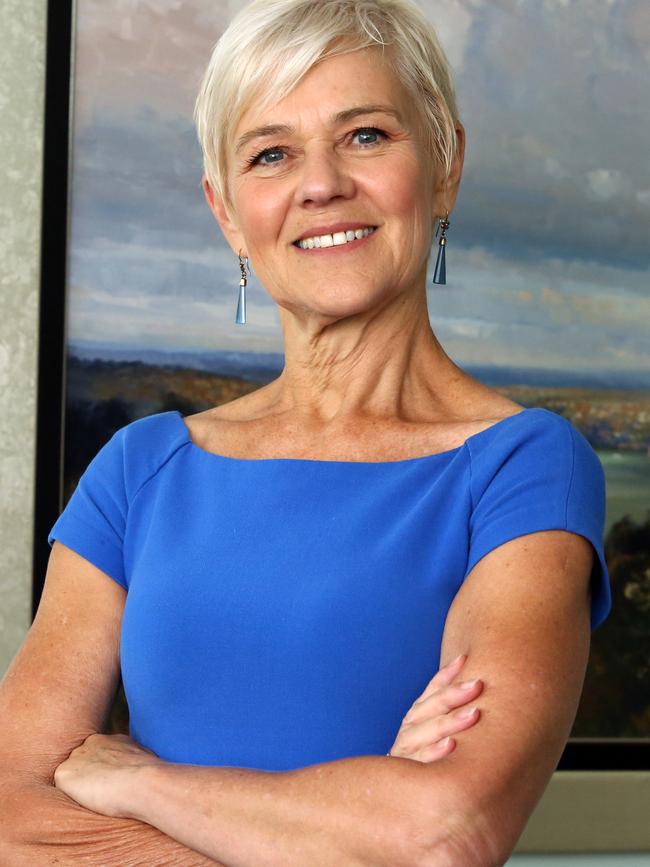

Shares in Maggie Beer Holdings shot to a two-year high yesterday after Ashok Jacob’s Ellerston Capital revealed its hand as a substantial shareholder in the now Chantale Millard -run fancy food group.

On Tuesday, Ellerston forked out $1.95m to buy five million shares at 39c each in Maggie Beer (the company, not the cook, although Maggie Beer is a non-exec director and shareholder).

That was enough to take the investment group’s holding over the 5 per cent substantial threshold requiring disclosure.

Ellerston, which has held stock since 2016, now has 14.95 million Maggie Beer shares, or 7.2 per cent of the group. The shares closed on Wednesday at 42c to value the food company at $87m and Ellerston’s stake at $6.3m.

Handy that Jacob, who was for years a trusted corporate lieutenant to the late Kerry Packer and his son James, has for some time been great mates with Maggie Beer non-executive director Hugh Robertson.

Many will know the Bell Potter broker’s connection to billionaires and influential business identities. Like Jacob, Thorney Holdings’ Alex Waislitz has also long been close to Robertson. Jacob founded Thorney with Waislitz and was an investment adviser to the billionaire Pratt family.

“Ashok is a delightful, charming, extremely able man,” Robertson told this newspaper several years back of the ever cautious Jacob.

“Whenever I am feeling a tad cocky or optimistic I go and have a chat to Ashok. Then the razor blades come out.”

Like father Matt Grounds, like daughter.

While investment banker Matt Grounds sits out the market awaiting the end of his gardening leave following his exit as boss at Swiss bank UBS, there is plenty unfolding in Grounds’ close orbit.

We already know how his old pals from UBS are rolling out their new Barrenjoey Capital Partners advisory house, with the support of Barclays and Hamish Douglass’ s Magellan.

The website is up and running, a group head company has been recently established to sit atop the other various vehicles that are forming the operations, with former ANZ chair David Gonski recently revealing he’s been asked to chair the whole shebang.

Meantime, Grounds’ clever twenty-something daughter Chloe is carrying on the family name in the marketplace, undertaking a resume-boosting internship at the Peter King-led Westpac

The young Grounds, who we understand is studying for a commerce degree at Sydney University, has been at the $75bn-plus bank since September and previously completed an internship at Kerry Stokes’ Seven West Media in Sydney back when Tim Worner was still chief.

Christine Holgate’s position not the only one vacant

Who wouldn’t want to be a headhunter right now?

The search for a new Aussie Post boss to replace Christine Holgate isn’t the only executive head hunt underway for the Morrison government.

Back in July, Austrade chief Dr Stephanie Fahey made a hasty and surprise exit from our nation’s trade and investment agency, which she joined in 2017 from Ernst & Young where she was Oceania lead partner for education.

Fahey’s deputy Tim Beresford has been acting in the top job since his boss left, while Trade Minister Simon Birmingham’s department searches for a permanent replacement.

Global search firm Egon Zehnder has been doing the legwork out of its Sydney office under a contract that’s worth more than $160,000, but five months down the track there’s still no outcome.

Add to that the hunt for a new ASIC deputy chair to replace Daniel Crennan, plus potentially the same for chair J ames Shipton depending on the outcome of an underway review.

Plenty for the headhunters to crack on with towards Christmas there.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout