Virgin Australia must stay intact, says seller Vaughan Strawbridge

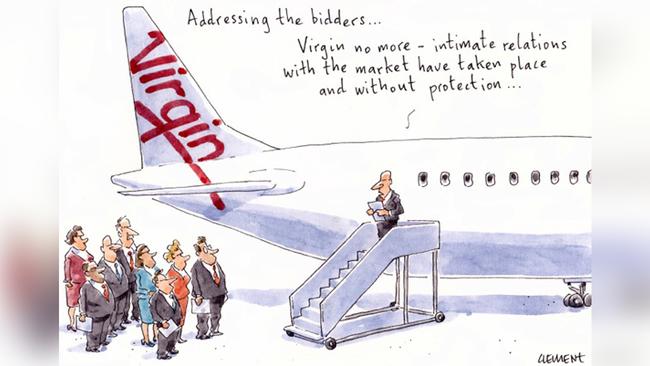

As multiple bidders for Virgin Australia put the finishing touches on their initial offers for Australia’s failed second airline, its corporate undertaker has committed to the sale of the carrier as a whole business.

Deloitte’s Vaughan Strawbridge, who heads the voluntary administration of the Paul Scurrah-led airline, has told Virgin Australia creditors that he wants to “avoid breaking up and selling parts of the business”.

“The best outcome for everyone is the preservation of the whole business,” Strawbridge is revealed to have told creditors at their first meeting on April 30, the minutes for which have just been released.

Strawbridge, who was appointed on April 20, told creditors there was no plan for any redundancies in Virgin’s 9000-plus workforce. He says he’s positioning “the business for relaunch and sale”.

Almost 20 organisations have lodged expressions of interest, with non-binding indicative bids due on Friday.

A management plan for the reinvention of the Richard Branson-founded airline is believed to have been added to Deloitte’s virtual data room.

Clayton Utz is acting as legal adviser to the administrators, while Deloitte has also engaged Morgan Stanley and Houlihan Lokey as financial advisers. All three professional services firms were working for the airline before it failed.

US law firm Akin Gump has also been engaged by Deloitte to help with bondholder relations. Virgin bondholders are unsecured and rank alongside other creditors. Coupon payments to the bondholders have been halted.

Accounting firm PwC is acting for Virgin’s Velocity rewards program, a separate legal entity that is not one of the 38 companies plunged into voluntary administration.

The meeting’s minutes reveal a host of local and international banks attended the first creditors’ meeting, including local institutions Commonwealth Bank, Westpac and ANZ, along with Macquarie, Bank of New York Mellon, BNP Paribas, Deutsche Bank and Bank of China.

Meanwhile, Strawbridge reveals he is preparing for some turbulence ahead, telling creditors he “appreciated that the administration process may become political … and come with a high degree of media interest and scrutiny”.

Buckle in for the ride.

Brierley’s rich past

The legal team for the retired corporate raider Sir Ron Brierley, who faces child pornography charges, makes another court appearance on Thursday, led by solicitor Penny Musgrave. The committal mention will be at Sydney’s Downing Centre Local Court.

Away from the court, there has been a shift in his tight inner circle as Elizabeth Rich has resigned her directorial role in the longtime private Brierley entity, Siblot Pty Ltd. Rich’s departure comes 30 years after she and Brierley took up their joint directorship. She retains her half-share interest, however.

The year 1990 was a busy one for Brierley, who became chairman of British investment company Guinness Peat Group, now known as The Coats Group, which saw him further build his business empire across Britain, Australia, New Zealand and Hawaii.

It was four years after another Brierley company secured his still retained holiday home at Great Mackerel Beach on Sydney’s Pittwater. The chalet-style home was bought from late producer Roger Mirams for $430,000 in 1986. Rich was never a co-owner, but she took on a formal long-term lease in 1988, which lapsed three years ago.

Rich was still his holiday planner, and with her and other friends he’d make regular trips to Europe, where Italy was a favourite. Rich was waiting at the Sydney airport departure lounge when Sir Ron was detained en route to Fiji and then charged with possession of child pornography in December. No plea has yet been made, but during the February appearance the court was told he intended to plead not guilty.

From the early 1980s, the New Zealand-born bachelor businessman, now aged 82 and walking with a cane, made for quirky headlines in Australia. There was the splash on his retention of a spartan serviced bedsit at the Kings Cross Hyatt.

From the late 1980s, Sir Ron’s residence has been on the Point Piper waterfront in the home bought from one-time bra supremo Michael Hershon for $3.65m in 1987. It continues to be his home while on bail.

His last takeover play was for Mark Bouris’s Yellow Brick Road, which fizzled two years ago. His last big property play in Sydney was the $23m disposal of a Parramatta property in 2016. The property was sold by Siblow Pty Ltd, which purchased it in 1994 for $2m.

He would often catch up with old IEL and GPG colleagues, along with friends such as Sir Michael Parkinson when attending Lord’s or Wimbledon. Margin Call recalls his boast of shaking hands with the Queen for the ninth time.

He once stated his idea of a good day started working at home, attending to business in his Sydney CBD office, returning home, walking to Double Bay’s Redleaf pool, where he’d read the papers and then home for a quiet evening.

There were the occasional invites to friends to cruise aboard his 30m gin palace Lionheart, which is the name under which he has traded in stamps since he was a Wellington schoolboy. Over the decades, his guests included former New York mayor Ed Koch. Siblow retains a marina berth at Bobbin Head, its lease extended last year until 2033.

Pete brought to heal

Axed My Kitchen Rules chef Pete Evans already knows what’s next following his departure from the Channel 7 cooking show. He won’t be joining the near one million-plus in Josh Frydenberg’s Centrelink queue, but rather wants to create a “heal clinic” in Byron Bay.

He’s just secured his occupation certificate for the business last week. It is located in the Habitat precinct, where other outlets included Parkes Ave Dispensary, run by naturopath Jules Galloway.

The creative Habitat hub is owned by Bayshore Developments, directed by prominent Byron Bay investor and coalmining entrepreneur David Knappick, in partnership with a former White Mining colleague, Ian Gallow,along with music and arts events veteran Brandon Saul.

The controversial Evans, who prefers not to wear suncream because it’s full of poisonous chemicals, seems keener than ever to be in the spotlight for his other contentious views.

Earlier this week, Evans shared an image to his 232,000 Instagram followers of a chart purporting to show the financial links between the Bill and Melinda Gates Foundation — the public health-focused charity funded by the Microsoft founder and his wife — to pharmaceutical companies, which has been a popular anti-vaccination allegation.

Last month, he was in trouble with the Therapeutic Goods Administration after promoting a lamp he claimed could help treat the coronavirus.

He and nutritionist wife Nicole Robinson have owned in the hinterland since 2014, a retreat from their Malabar, Sydney home base. It’s a 10ha Round Mountain farm that cost them $1.2m.

Keys to the big room

While the global pandemic that is the new coronavirus wreaks devastation on economies around the world, there are a select few businesses for whom the crisis is proving a boon.

Have a look at Canberra-based international healthcare service provider Aspen Medical, controlled by founder Glenn Keys. If things keep going the way they have been, Keys could end up on a list of our country’s leading business folk.

Government records reveal Aspen, which was founded in 2003 and provides healthcare services in mostly remote, challenging or under-resourced locations, has been awarded $50m worth of federal government contracts relating to work involved with fighting the COVID-19 pandemic.

Its work has included efforts for Home Affairs Minister Peter Dutton’s Australian Border Force on Carnival Australia’s stricken Ruby Princess.

In the most recent financial year, Aspen generated revenue of $90m. That compared with almost $120m in receipts the year before. At the time, former federal health minister and doctor Michael Wooldridge was an Aspen director. In the two previous years, Keys and his directors approved the payout of about $5m in dividends