Troubles persist at crestfallen Crestone

It’s not easy running a start-up. Just ask financial services outfit Crestone’s Mike Chisholm.

A bit over two years on from his management buyout in mid-2015 of Swiss giant UBS’s entire wealth management operations, teething problems appear to still be troubling the ambitious play.

Founding Crestone director and former UBS executive Anna Schibrowski has quietly slipped away from the Leigh Clifford-chaired group in favour of what’s believed to be a senior executive role with Ian Narev’s Commonwealth Bank.

We figure they can do with all the help they can get.

Schibrowski was instrumental in establishing the UBS wealth management buyout with Chisholm, along with chief operating officer Michelle Inns, who remains as a director of the still loss-making wealth management operation.

In the first year of Crestone’s start-up operations Chisholm, Inns and Schibrowski held no fewer than 25 board meetings.

Late last month former Westpac exec Peter Hawkins also joined as a non-exec director, in an appointment that was first foreshadowed earlier this year.

Meanwhile, we also hear that Chisholm’s long-running nasty dispute with former UBS-turned-Crestone advisers Shannon Burman and Matthew Smithyman, who left mid-last year for greener pastures at Peloton Capital, has only just been resolved.

The pair have now had their equity in Crestone paid out to the tune of a combined $825,000 in a deal that Chisholm has told shareholders eliminates the risk of further “reputational damage” to the firm.

Taking stock

Investment banker Michael Stock has parted ways with Credit Suisse exactly a week after he was anointed one of the ‘‘five most influential dealmakers’’ in Australia. Ouch.

Didn’t his Credit Suisse boss John Knox see the glossy write-up in the Financial Review mag?

“Stock is the type of banker directors want on their side of the deal: uncompromising, ultra-competitive and with excruciating attention to detail,” went his Power List mag entry.

Seems Knox was less impressed.

Stock joined Credit Suisse — chaired locally by the PM’s good friend John O’Sullivan — in late 2015 from rival Swiss investment bank UBS, where he is said to have had an imperfect relationship with Matthew Grounds.

Clearly his transition hasn’t quite gone to plan.

In banking circles, Stock’s position on the list has been a source of mirth in recent days.

It seems not everyone was laughing.

Chinese walls

Accounting giant KPMG’s work for Mark Korda in the battle for control of the Ten Network looks to be a textbook case of how to erect a Chinese wall.

KPMG’s deal advisory partner and board member Ian Jedlin and his colleague and partner in charge of valuation services Sean Collins had been working inside the corporate finance department on their 114-page independent expert’s report since July 25.

The pair were called in to determine the equity value of Ten for use in assessing CBS’s proposal to take control of the Paul Anderson-run network.

For a full month after the accountants got to work, starting with background materials, the CBS proposal via a Deed of Company Arrangement remained top secret, while media giants Lachlan Murdoch via his Illyria and Bruce Gordon via Birketu went about publicly seeking ACCC approval for their own proposal to buy Ten.

One of Gordon’s most trusted corporate advisers is Jon Adgemis, who is a partner of KPMG’s corporate finance practice too and is also its national head of mergers and acquisitions.

However, Margin Call understands the often jetsetting Adgemis wasn’t involved in this deal at all. The advisory work for Gordon and Murdoch was done by the boutique Fort Street Advisers.

But sources close to the Bermuda billionaire tell us Adgemis did flag with Gordon that KPMG had some unidentified role with Ten.

Shame the 88-year-old Gordon didn’t follow the trail to 94-year-old Sumner Redstone’s CBS.

Whatever was said from adviser to billionaire client, it clearly didn’t give up KordaMentha’s CBS bombshell, which was detonated — without enough of heads up to even strap on a helmet, let alone launch a pre-emptive strike — on August 28.

Seems the Chinese walls at Gary Wingrove’s KPMG passed this test.

Independent, sort of

So it seems things are all very modern at KPMG Corporate Finance. And, by all reports, collaborative.

Sean Collins and Ian Jedlin’s independent expert’s report into the equity value of Ten was released to the market by administrators KordaMentha late on Tuesday night, just ahead of Friday’s court deadline for Ten shareholders to oppose the CBS proposal.

The KPMG report reveals the extent to which administrator KordaMentha and the David Gordon-chaired Ten were involved in the preparation of the accounting firm’s “independent” valuation.

Down in the weeds of appendix 1, KPMG reveals that during the course of its work on Ten the accounting firm was kind enough to provide “draft copies” of its report “to management of Ten Network and to the Deed administrators and receivers and managers for comment”. It was all just for “factual accuracy” of course, as opposed to “opinions”.

“Changes made to this report as a result of those reviews have not altered the opinions of KPMG”, the “independence” section reads.

Rival bidders for Ten, Lachlan Murdoch’s Illyria and Bruce Gordon’s Birketu, are now believed to be having their own independent expert’s report prepared into the value of the failed free-to-air broadcaster.

Too many reports are never enough.

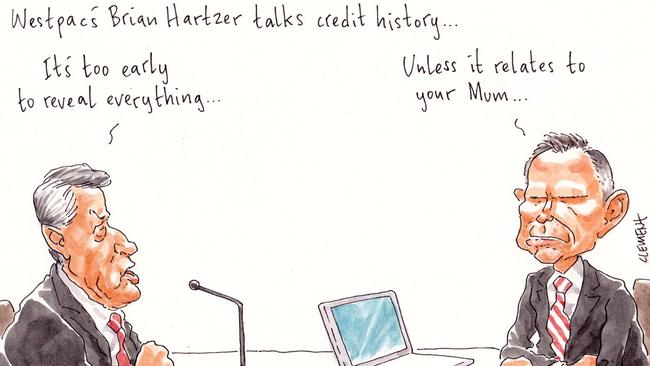

Mum’s the word

Westpac boss Brian Hartzer’s Mum has been caught up in the US-headquartered credit reporting agency Equifax data breach scandal.

Hartzer revealed his personal link to the stunning privacy failure during questioning by David Coleman’s banking inquiry about why the bank was taking so long to be more open with their customers’ credit history.

“This a real, live visceral issue for me because a couple of weeks ago I had a very long conversation with my mother in the US — who is 75 years old — and whose personal details were compromised in the Equifax breach,” Hartzer told Coleman.

“And I was on the phone with her for a very long time trying to explain to her what the consequences of having her data stolen in the way they were and whether she should sign up for credit blocks. Whether she should sign up for other fraud protection. What it would all mean. And I can tell you this is a very real issue, and this is a genie that is very hard to put back in the bottle once it gets out.

“And so our view is these are not hypothetical concerns.”

There sure isn’t anything hypothetical about Westpac’s links to the Equifax scandal, which has swept up as many as 143 million Americans and cost Richard Smith his job as Equifax’s CEO.

As well as Hartzer’s motherly connection, he has a board link: Nerida Caesar, who joined the Westpac board last month just before Equifax fessed up to the extent of the breach of social security numbers, birthdates and other personal data. Just before Caesar joined Lindsay Maxsted’s Westpac board on September 1, she ran Equifax’s Australian and New Zealand businesses, previously called Veda Group, which the US giant bought for $2.5 billion in early 2016. A handy second opinion for Hartzer’s mother.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout