Treasurer’s ‘day spa’ treatment; Deloitte didn’t dig too deeply into Swan’s socials

Have you enjoyed some time in the Treasurer’s day spa?

We didn’t even know it existed – metaphorically – until the Productivity Commission’s Danielle Wood gave a keynote address to the geeks and freaks who convened for the annual Public Sector Economics Conference at the University of Melbourne last week.

Wood, the PC’s chair, was holding forth on stage just as Jim Chalmers was preparing to usher a suite of generational reforms to the Reserve Bank of Australia through federal parliament (or to put it more precisely, as Labor’s Katy Gallagher was furiously deal-cutting with crossbenchers such as David Pocock and Jacqui Lambie to help Chalmers’ legislative massaging through the Senate).

Normally buttoned-up in her commentary, Wood betrayed a devilish sense of humour as she spoke of ongoing government reviews of the nation’s eminent economic institutions, including her own, but also the RBA, ASIC, the Australian Taxation Office, APRA and the ACCC.

Chalmers, as many will know, is using a review-and-reform model to bring air to the many caves occupied by these belovedly stale, venerated bodies.

Wood told the crowd of these reviews: “I call it the ‘Jim Chalmers day spa’ because of the focus on being ‘refreshed’ and ‘revitalised’. The Productivity Commission has been in the day spa alongside the RBA and now ASIC,” she said, conjuring images of cucumber slices, soft music, healing jojoba oils … and the disgustingly thorough purification of colonic irrigation, which is what the RBA’s definitely experiencing at the moment.

Chalmers’ newly passed reforms for the RBA will literally cleave the RBA board into separate committees: one for interest rate setting and another for governance; the Treasurer has also given himself the power to make appointments to the rate-setting board – political or otherwise – ahead of the election.

“Not all day spa procedures are painless!” Wood sagely noted a few beats later in her speech, capturing everyone’s thoughts superbly. YB

Swan in plain sight

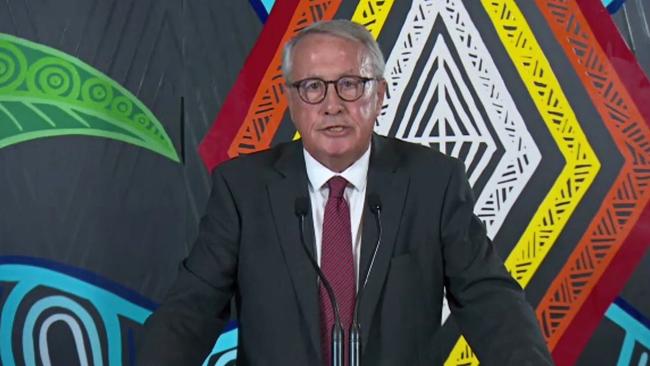

Does Wayne Swan talk too much on Twitter? Does Cbus take corporate governance seriously? The two questions bear a curious relationship.

Amid the torrent of information in Deloitte’s governance review of Cbus is an odd little indication of how seriously the fund took its background checks on its directors.

Cbus’s “fit and proper” checks on directors include the obvious – no criminal history, no bankruptcy, no ASIC bans, personal and professional references, qualification checks, that sort of thing.

They also ran a “social media check” to help provide some background on a potential director’s integrity and honesty, according to the Deloitte report.

Which, at the time of a 2023 Cbus review, found “no evidence available” to help judge Swan’s suitability as its chairman.

Seriously? Did they even bother to look? Facebook, Twitter (as it was known in the first half of 2023), LinkedIn – you name it, Swannie’s views are there. Everywhere.

If the Cbus background checks couldn’t find them, you have to wonder how seriously they took the rest of the process.

Still, despite Cbus’s rough year, at least the industry super fund’s staff got to celebrate its 40th birthday. Or maybe held a staff training day. Swan wasn’t quite clear on the subject at last week’s Senate grilling.

The venerable industry fund turned 40 in June, but hasn’t had much to celebrate since. First the CFMEU imploded, leading to questions about the fund’s governance, and then the corporate regulator launched legal action over its failure to pay out death and permanent disability insurance claims. All were the subject of close questioning by NSW Liberal senator Andrew Bragg.

Only late in the day did questions turn to Cbus’s anniversary, when Bragg asked whether a party had been held to celebrate. Turns out it had, at Melbourne’s Regent Theatre.

Swan promised to write back with the cost of the event, but wouldn’t say whether it had been a straight-up birthday shindig or a staff planning day “or something similar”.

“Well, what it did achieve was a focus on our 40th anniversary and what it meant for the reform of the fund as we went forward, so from our point of view it was a key strategic part of the uplift we were seeking to achieve and the changes we have put in place over a period of time under our new CEO,” he told the committee.

And did the Cbus board have a conversation about whether spending money on a birthday knees-up would meet the best financial interest test for the use of members’ money, Bragg wondered? Swan was confident that it would. But he couldn’t remember whether the board had actually thought to discuss the matter, bunging that one on notice with the others. NE

A Skrbis curiosity

Ah, just one more thing, as the rumpled TV detective Frank Columbo would always say – and just as the scripted crook was finally letting their guard down, too.

In that spirit, we’re raising a final curiosity over the reappointment of Zlatko Skrbis as vice-chancellor of the Australian Catholic University, which we wrote about on Tuesday.

Skrbis’s $4m contract won’t expire until January 10, 2026, yet the university’s governing Senate body is moving to renew it as early as Thursday, about 13 months in advance. A standing committee chaired by ACU chancellor Martin Daubney has already recommended that the reappointment be approved.

The timing’s interesting, you see. Education Minister Jason Clare announced barely a week ago that a new federal body would soon be established to guide executive remuneration for well-paid VCs. Skrbis’s contract, at $1m a year, would fall within its remit, and isn’t it just a fortunate turn of events for Skrbis that Clare’s concept isn’t live yet.

Not that ACU sees anything unusual about Skrbis’s early reappointment. As a spokeswoman told us: “It is common practice for a university to consider the reappointment of a vice-chancellor more than 12 months in advance. A similar time frame was employed with the reappointment of Professor Skrbis’s predecessor and we note similar periods used elsewhere in the sector.”

It’s certainly true that Skrbis’s predecessor, Greg Craven, was twice reappointed as ACU vice-chancellor, in each case to prevent him from being headhunted, which he was.

The case of Skrbis is hardly the same. His reappointment, in the face of damaging missteps and an extraordinary falling out with the Catholic Church, is designed to entrench him further at the university. Not because he’s being headhunted. YB

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout