Thorburn makes a hasty exit

After a tough week, some good news for Andrew Thorburn.

Margin Call can confirm the banker’s longed-for second summer holiday has become a reality.

Yesterday afternoon — after popping into the bank’s Docklands headquarters for a final flap of the hands in a farewell video address to staff — Thorburn and his family were spotted in the Qantas first class lounge at Melbourne Airport.

Off to New Zealand, we understand, where he’ll put on his pinstriped shorts for a walk with the family and, no doubt, fit in a bit of fishing.

While NAB’s dramatic ASX statement on Thursday evening said Thorburn will officially finish as the bank’s CEO on February 28, word is he’s got at least next week off.

And we won’t be surprised if he ends up taking off the whole of February, just as he and his departing chair and good friend Ken Henry had planned.

Speaking of that odd couple, seasoned observers near enough to judge tell us they have never seen a CEO and chair who were as close.

Henry and Thorburn and their wives even spent weekends away together.

It seems the pair broke one of the cardinal rules of CEO-chair relationships: You can be friendly. But you can never be friends.

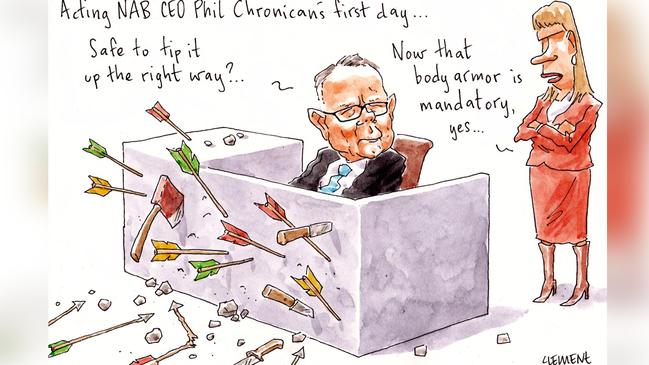

The main man

There he was at 7.30am in the breakfast crowd in the cafe underneath NAB’s Docklands fortress: Philip Chronican, the man effectively in charge of the future of the $69 billion bank.

Chronican doesn’t officially add acting NAB CEO duties to his responsibilities as a board director until March 1.

But the former ANZ and Westpac executive looked every bit the bank’s boss yesterday, as he began the fix up job at the traumatised big four.

After breakfast, Chronican briefly caught up with Andrew Thorburn, before meeting Thorburn’s stunned executive team (less Thorburn), including NAB’s two strongest internal CEO candidates Mike Baird (too early?) and Anthony Healy (too little a change agent?). Next up: calls with various of the bank’s many leadership teams.

And, finally, a video to introduce himself to devastated staff (many of whom are furious at the legalistic, Sharon Cook-led team that ran the bank’s royal commission “war room”).

Their verdict on Chronican? Seems a solid interim CEO, although he doesn’t have the “infectiousness” of the internally adored Thorburn.

Also, some of them reckon he doesn’t flap his arms enough.

Powered up

AGL’s new boss Brett Redman has begun the year in dynamic fashion.

This week he revealed a

$25 million upgrade to the energy outfit’s Victorian Loy Yang coal-fired power station, told off the Morrison government for its incoherent power agenda, revealed a half year net profit of $537m and — along with his chair Graeme Hunt — welcomed Treasurer-most-likely Chris Bowen into the AGL boardroom for a briefing.

And there’s more.

Margin Call can reveal Redman — who was confirmed as the permanent replacement to Andy Vesey the week before Christmas — has brought in an army of Excel-adoring consultants from McKinsey.

(Coincidentally, that’s the consulting tribe at which PM ScoMo’s Minister for Big Sticks Angus Taylor was once a partner).

The consultants, never a welcome sight in a workplace, are believed to be assessing AGL’s “enterprise leadership team”.

Members of that group report directly to Redman’s executive team, which is a work in progress after the turbulent end of the Vesey experiment.

We gather Redman is, quite sensibly, tidying up the peak of the $14.5bn company’s corporate structure before he announces his new, permanent team.

Chip off the old block

If anything, Tim Wilson is too connected.

This week Wilson, who chairs the House of Representatives Standing Committee on Economics, has been tangled up in familial and financial connections to fund manager Geoff Wilson.

Politician Wilson has been using the economics committee to examine Labor’s plan to scrap franking credits, while fundie Wilson as founder and manager of Wilson Asset Management has led a public charge against Labor’s proposed policy.

Treasurer-in-waiting Chris Bowen said this was a monumental conflict of interest and called for the federal member to resign as committee chair. The PM scotched that.

Now Margin Call can reveal another notable connection to Wilson, who in his role as committee chair runs twice-yearly interrogations of Australia’s four big bank chiefs.

For half of last year, Wilson employed banking royal commissioner Kenneth Hayne’s son James Hayne as an intern in his office.

Small world.

The young Hayne, predictably an overachiever, landed with Wilson last February via the Australian National University intern program.

In his time at the pollie’s office, Hayne the Younger undertook a meaty research project entitled: “Ensuring Intergenerational Equity in the Australian Housing Market through Tax Reform”.

He wrapped up with Wilson in June, while his dad’s royal commission was still terrorising the banking world.

The young Hayne — whose mother Michelle Gordon is another High Court justice — describes himself as “motivated and results driven”. He’s still in his early 20s and undertaking a combined bachelors degree, but has also managed to fit in study at Oxford and the London School of Economics, as well as another internship with the Department of Foreign Affairs and Trade at the UN in Geneva.

Another Hayne to watch.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout