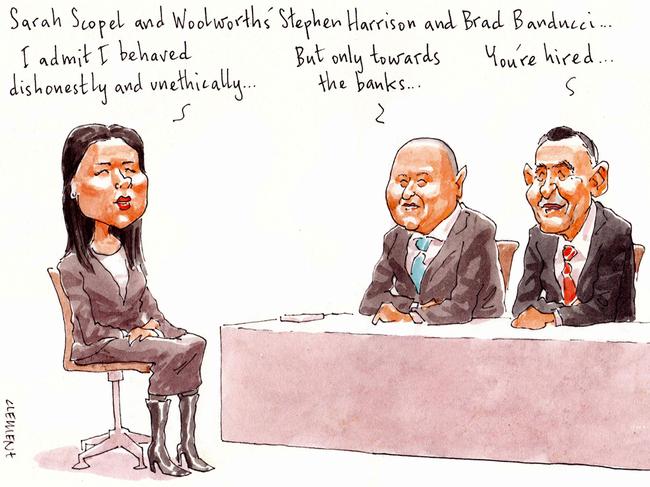

Following news that the Woolworths underpayment bill had climbed to almost $600m, the last thing the supermarket’s chief financial officer Stephen Harrison needed was the revelation the group treasurer he had hired only months ago was possibly a total shonk.

Enter Sarah Scopel, late of Star Entertainment, who last week told a NSW inquiry into the casino company run by Adam Bell SC that she had “utterly” misled the National Australia Bank and China UnionPay about hundreds of millions of dollars of transactions that ended up disguised as hotel expenses. Scopel started as group treasurer at Woolworths in December.

That was approximately two years after she was happy to deceive NAB’s head of diversified industries, Tanya Arthur, about money that was going from major gamblers alongside chief financial officer Harry Theodore and general counsel Oliver White.

To recap, the three had emailed Arthur stating some $900m had been spent on “hotels, restaurants and other entertainment facilities”. “That statement was utterly false, wasn’t it, and you knew at the time you read this email,” Naomi Sharp SC, counsel assisting the inquiry, asked Scopel last week.

“Yes,” she responded.

“We are aware that Sarah provided evidence to the inquiry on Friday,” a Woolworths spokesman told Margin Call on Monday. “We are working with her to better understand all the circumstances surrounding these events.” Phenomenal.

Scopel, once a Macquarie banker and a senior member of treasury teams at Caltex Australia and Origin Energy, also appears to remain on the board of the Australian Corporate Treasury Association. Even better.

The news out of the inquiry on Friday capped a stellar run for Harrison, who arrived in the role around the same time as Scopel was duping the poor tellers at NAB, which began with a total bollocking in December after Woolworths revealed pandemic-related costs had blown out to as much as $220m in the first six months. “We continue to prefer Coles over Woolworths,” wrote Citi equity analyst Adrian Lemme.

Then came another surprise – an extra $144m in new payment shortfalls of hourly paid retail staff disclosed in February, buried in an investor presentation despite the underpayment elevating Woolworths to the unwanted status as the company most likely to forget to pay staff.

Don’t hold your breath, there will be more to come.

–

Silks ring up the tills

The Bell inquiry has been a boon for one particular profession, and no prizes for guessing that would be the niche field of high-profile Sydney silks. Represented are not only Bell and Sharp, but Bret Walker SC, who was in the room on Monday for billionaire property developer Phillip Dong Fang Lee.

Lee has been in strife for months, with the tax office pursuing him and his wife Xiaobei Shi and in September slapping a freeze order on their various assets including the $40m Point Piper mansion Mandalay, their Star casino accounts, and a small garage of luxury cars including a Rolls Royce Ghost.

The inquiry has heard Star gave the high-roller $5m in credit in exchange for a blank cheque.

In a brief moment of levity for all involved, the inquiry’s Chinese translator had several momentary lapses, translating the name of one figure involved – Andrew – as Angel. In another moment, she referred to the microchips being traded between parties. Of course, they were gambling chips.

In both instances, she was immediately corrected by Walker and Kate Richardson SC, who is appearing for The Star.

–

Tide turns for Pyne

The ritual changing of the guard in lobbying ranks is already under way in South Australia with former defence minister Christopher Pyne’s eponymous Pyne and Partners arguably having the most to lose.

Pyne’s former staffer Adam Howard courageously set up his own outfit GC Advisory in the days leading up to the last federal election, when a Bill Shorten landslide was widely and erroneously tipped. Pyne joined the lobbying game soon afterwards.

The two firms effectively operate as one and have expanded to a staff of eight active lobbyists across Adelaide, Sydney and Canberra.

Pyne was sanguine about his ability to operate across the political divide.

“Pyne and Partners knows how government works and knows how to get results whether it’s a Liberal or Labor government at the helm,’’ he told Margin Call.

“We are optimistic about the future, that’s why we have expanded with offices in Sydney and Canberra and we have clients in every mainland state.’’

Howard’s wife Ashton Hurn, a former staffer to both Pyne and outgoing premier Steven Marshall, held the Barossa Valley seat of Schubert for the Liberal Party in this past weekend’s election, replacing former transport and infrastructure minister Stephan Knoll, who is heading back into the private sector after signalling he’d bow out of politics.

Andrew Coombe, who was chief of staff to former Liberal leader Isobel Redmond and director of policy and strategy for the Liberal Party before moving into lobbying, firstly at Barton Deakin and then under his own shingle, Coombe Government Relations, also has a strong, and very local, client list and could see some attrition.

On the other side of the ledger, Capetal Advisory, owned by former Labor staffer Brad Green with fellow former staffer Matt Clemow on board, is looking to make hay.

After a particularly bad week for Marshall back in October last year, Clemow cheekily reminded the business community that they were there to help.

Capetal, which was the undisputed lobbying powerhouse in SA in the last few years of Labor’s rule, managed to avoid a clean out of its clients, hanging on to key mandates including the Australian Hotels Association.

Green teamed up with SA’s new premier Peter Malinauskas to bring home a premiership for the Adelaide University Blacks AFL team back in 2013.

Word is the phone is already ringing off the hook at the Capetal HQ.