The daughter of Melbourne billionaire John Gandel is suing over defects with her dream home

Two of Melbourne’s wealthiest families are fighting it out in the Victorian Supreme Court over a home build in the heart of Toorak that ended disastrously many moons ago. The case was filed in 2017 and remains on foot, with recent developments setting legal precedent and keeping lawyers all atwitter.

It begins with the daughter of billionaire developer John Gandel, half owner of shopping megalith Chadstone (largest of its kind in the southern hemisphere). Lisa Thurin and her husband David demolished their Toorak home in 2006 and rebuilt it with Krongold Constructions, chaired by former rich-lister Lionel Krongold.

These days David’s the executive chairman of Tigcorp, the Gandel’s retirement village enterprise, while Lisa sits on the board of a philanthropic fund with her folks, Seek chairman Graham Goldsmith, and former Escor chief Barry Fradkin.

Construction of the home on prestigious Whernside Ave, close to Heloise Pratt and a stone’s throw from the Gandel mansion, cost upwards of $10m. Alas, the damages for defective plumbing – a water leak in the billiards room! – and a snag with the irrigation system out on the lawn, among other faults, came in at $3.5m; almost $200,000 was spent just moving soiled items into storage.

The case has been in the weeds for years, hinging on expert opinion, obscure warranty provisions in Commonwealth law and other bollockings-on between the many learned friends dipping in and out of the matter. All mere pennies to both sides, we’re sure; money talks but wealth whispers, as they say.

It’s gone twice before the Victorian Supreme Court, once before the Victorian Civil and Administrative Tribunal, and most recently the Court of Appeal, where the Krongolds engaged Jeremy Twigg KC, Kylie Weston-Scheuber and two other barristers against the Thurins, who put on Michael Roberts KC, Charles Parkinson KC and Nicholas Guenther.

The outcome was all very anticlimactic. The appeal court ruled VCAT had no jurisdiction to hear the matter, so going there in the first place was a dead end. It also means cases falling under Commonwealth law might no longer make it to the tribunal at all, which is causing some hand-wringing among the silks.

As for the Thurin family, the case is headed back to the Supreme Court and we expect further appeals to this latest decision. Still no word, however, on whether their plumbing issues have been resolved.

-

Spacetalk suspended

Some untidy business over at smartwatch enterprise Spacetalk. The company was suspended from trade on Wednesday over some tardiness with its half-year reporting.

Not an ideal start for its freshly-minted chief executive, Simon Crowther, formerly of aerial mapping unicorn Nearmap, who began at Spacetalk last month. He’s still looking for a chief financial officer, and judging by an ad he posted on LinkedIn three weeks ago it would seem the search has turned up a thin selection of candidates so far.

Nor was the suspension likely to have been a good look for Spacetalk’s investors, and we’re not even talking about the rabble who tried to kick Mike Rann off the board a few months ago – and yes, that’s the same Mike Rann who was premier of South Australia for nine years.

Billionaire Alex Waislitz recently upped his stake in the company to 10.81 per cent via his Thorney Technologies and Tiga Trading outfits. That’s while Phil King’s Regal Funds Management went the other way this year, dumping a bunch of shares and reducing its holdings from previous highs of 11.15 per cent to a more compact 4.12 per cent.

And no, Regal didn’t want to tell us why. Crowther, however, had much to say about the late filing of the company’s results. He said Spacetalk missed the deadline because of a new auditor battling a “steep learning curve”. Sounds like a fancy way of saying the dog ate my homework.

“We pushed hard but just missed the ASX window,” he told Margin Call. “The broader context is our drive to complete a reset of the business. I came on board as I believe there is a growth story to be unlocked at SPA. The situation today whilst unfortunate should not be misconstrued – it reflects mine and the board’s determination to put the business on a solid footing going forward.”

Looks like his work is cut out for him judging by the company’s half-year results, which were finally announced at lunchtime. Among the highlights, a net loss of $6.2m – that’s a tripling of the $2.3m losses reported for the corresponding period last year – and revenue of $9.2m, down 26 per cent.

-

Tribe board exodus

The fallout continues over the collapse this week of Tribe Brewing, where there’s been a significant exodus from the board over the past two months – just in time to beat the appointment of administrators.

Advent Partners’ Robert Hooke and Mark Jago stepped off on October 21 while former CUB chief John Murphy waved goodbye at the end of January. As did Tribe co-founder and enduring shareholder Stefan Szpitalak. His brother Anton, formerly the CEO, was last out the door three weeks ago.

The only man left standing has been Victor Smorgon Group executive Douglas Roem. He joined the board on February 3 and has been holding the fort until FTI was brought in to clean up the mess.

The Smorgon family and Kathmandu founder Jan Cameron are secured creditors to the failed brewer, with each having backed the company with investments in secured notes.

Advent at one stage held up to 50 per cent of Tribe and remains listed as a major shareholder on up-to-date records. Apparently it’s seeking to distance itself. We expect to find out why once the first creditors’ meeting is convened on March 9.

-

Smorgan’s pinch of salt

Meanwhile, the Smorgon family will be hoping that their other fledgling investment in a private company fares somewhat better than Tribe.

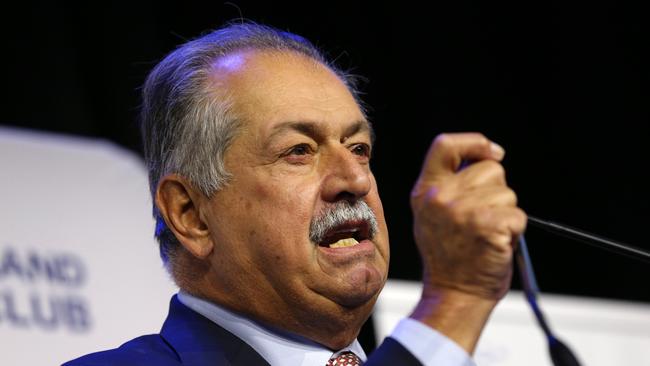

They seem to have hopped into bed with former Dow Chemicals CEO Andrew Liveris last year in a new salt venture he’s got going near Karratha, Western Australia.

Margin Call can reveal the Smorgon family office has taken almost 20 per cent ownership of Leichhardt Industrials Group, in which Liveris appears to have about a quarter stake following a recent corporate restructure and the capital raising.

Leichhardt is developing the Eramurra salt project near Karratha; it would seem the hope is to manufacture chemical salt that can be sold into the Asia-Pacific market. For anyone wondering, it’s a substance used to make chlorine and caustic soda that’s then used in the production of paper, glass, PVC and paint.

Liveris’s son Nick, an investment banker based in New York with priors at McKinsey and Merrill Lynch, is on the Leichhardt board, as is Victor Smorgon Group managing director Peter Edwards. The family office holds its stake via their VBS Investments vehicle, the same entity used to pile into Tribe