How much money would you charge to click a few buttons to agree to a Zoom meeting? We will come to that in a moment.

It is said there are two places you should never go unless it is absolutely necessary – court and a hospital. The latter can see secondary infections turn what might have been a minor niggle into a major health crisis, while the former can land you with a mountain of legal bills.

Whereas surgeons can charge a flat fee, lawyers charge by the hour, or six-minute blocks, and boy can those bills add up.

Take the ongoing soap opera/legal dispute involving Ultra Tune mogul Sean Buckley and his ex-girlfriend bikini model Jennifer Cole.

The accusations and counter-accusations are too long to list here, but in recent months Buckley has been accused of stalking and organising for a surveillance device to be placed in Cole’s residence, while Cole last year pleaded guilty to contempt after admitting to circulating an audio recording of him allegedly assaulting her.

And so Buckley’s lawyers, Belleli King & Associates, have presented in the last fortnight to the court a list of costs they are demanding Cole cover, and the itemised bill runs for almost 20 pages and well over $20,000.

There’s the usual fun and games, $2.25 for photocopying here, $42.50 for a phone call there. The going rate for sending an email seems to be around $21 these days.

But the pivot to Zoom through the pandemic has created a whole new fee stream for lawyers.

Accepting a Zoom invite, that’s $21.10 thanks, and an email to request a link for non-lawyers to observe the Zoom proceedings is another $21.

Thankfully it doesn’t look like the lawyers are charging their clients at the moment for setting up suitable background decor when on a zoom session, but we shouldn’t give them any ideas.

Time for new friends?

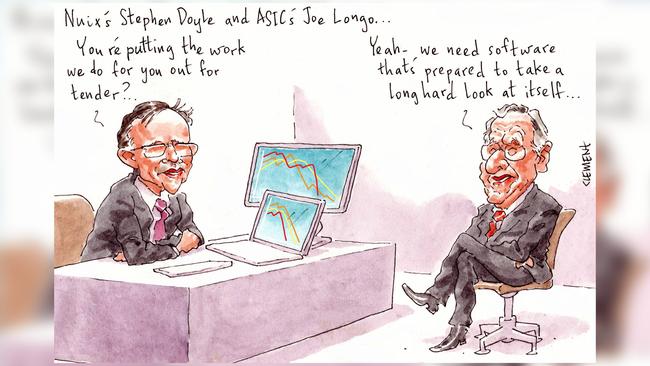

Things are set to get complicated in the relationship status between troubled tech darling Nuix and the corporate regulator.

As the brother of the company’s former chief financial officer Stephen Doyle faced court on Monday, the brains at Nuix were left wondering what’s to happen to their more than 10 years long relationship with the Australian Securities and Investments Commission.

ASIC’s investigation into the brothers Doyle hangs like a sword of Damocles above the men.

This comes as ASIC also ponders its other investigation into Nuix and misstatements on its prospectus.

However, a third ASIC-Nuix movement now looms, after a quiet entry to the federal government online tender portal Austender late last year.

Reading between the lines on the approach to market, the tender called for Australia’s tech scene to bring out their best answers to an “early case assessment and evidence management software” solution.

Could ASIC be looking at severing its longtime links with Nuix, or at least asking the tech player to stump up and show the regulator why it ought to continued to be used in the halls of regulatory power?

Nuix’s hand-in-glove business deals with ASIC were so big that the tech company touted them in its prospectus, noting proudly “in addition to Nuix’s private sector customers, Nuix’s solutions are used by government and public sector organisations globally, including the Australian Securities and Investments Commission, the Securities and Exchange Commission (SEC) and the United States Department of Justice”.

The series of bad blows ASIC has been hit with haven’t dented the internal appreciation for the regulator’s use of Nuix.

ASIC has copped a savaging before the Parliamentary Joint Committee on Corporations and Financial Services in the last year for its role in the Nuix fiasco.

New ASIC chair Joe Longo’s appearances before the committee have seen him repeatedly berated for the regulator’s role in signing off on Nuix’s prospectus.

Labor senator Deb O’Neill has reserved particular attention for the travails of Nuix and its investors, launching a salvo in parliament against the company and Macquarie Group for the destruction of shareholder capital.

This column reminds readers shares in Nuix have been on a rollercoaster ride, hitting the boards in December 2020 at $8.01, rising to a top of $11.05, before gravity took hold. At the close on Monday investors were only offering $1.47 for the tech company.

But it’s nothing personal, ASIC insiders stress. The regulator’s legal eagles like working with Nuix, the software solution works, it’s just maybe time to get out and meet other people.

–

Uneasy bedfellows

Corporate street fighter Nicholas Bolton admits his saga of ongoing takeover battles and disputes with listed investment company doyen Geoff Wilson has kept him somewhat entertained through the Covid pandemic and lockdowns.

Wilson’s Wilson Active fund has launched “four and a half” takeover bids for Bolton’s mini investment play Keybridge Capital, according to Bolton, and now the tables have turned with Keybridge on Monday launching an all-scrip bid for WAM Active using Keybridge convertible redeemable promissory notes.

The details of the notes are complex, and it’s not a straightforward scrip offer, but Bolton told Margin Call that two years ago Keybridge issued $3.6m in similar notes in 2019 which entities associated with fund manager Wilson filled their boots with.

This is true, but the attached 7 per cent yield helped, as did the steep discount, and it doesn‘t mean Wilson will bite this time. The current notes have conditions piled high that make the whole thing unlikely and Wilson pointed out to this column the yield offering is around 1.4 per cent – so why even bother.

“We are disappointed that Keybridge continues to waste shareholders’ money,” said Wilson.

Keydridge’s bid also raised the eyebrows of the ASX which reportedly contacted funds manager Wilson to discuss it, and the parties walked away from the conversation thinking Bolton’s bid was “all just a little bit too weird”.

It’s all very incestuous to be honest. Wilson entities own around 46 per cent of Keybridge and Keybridge has a 6 per cent stake in WAM Active. Bolton told Margin Call having Wilson as such a large shareholder was getting in the way and he “didn’t sit well on the register”.

Overseeing the fun and games is Keybridge major shareholder and director, media mogul and property developer Antony Catalano. The ‘Cat’ has just under 11 per cent of Keybridge.

–

Hardie horror

It appears some Mickey Mouse speak has rubbed off on James Hardie’s interim chief executive Harold Wiens.

Fresh from launching the company’s flashy “architectural collection” in Orlando, Florida this week – a stone’s throw from Walt Disney World – Wiens borrowed one of the movie giant’s choice phrases “reimagine”.

It’s all confusing but ultimately it involves dressing up fibro cement.

“This collection … comprises an innovative portfolio of new products that lets the world reimagine what’s possible for home exteriors,” Wiens said.

“We believe that these products will help to change how the world is built by reimagining … etc.”

And for a moment, it appeared during James Hardie’s quarterly earnings call that Weins wanted to “reimagine” the company’s leadership. Less than a month after sensationally sacking former chief executive Jack Truong, Weins did not want to acknowledge his predecessor’s existence, or at least not mention it.

“I wanted to flag that we will not be answering any questions regarding the termination of the prior CEO nor questions about the search for a new CEO,” Weins said before the call’s Q&A with analysts. The corporate equivalent of Walt Disney taking out the eraser to remove a character from one of his animated movies.

–

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout