Tal Silberman’s mansion expansion riles the residents of Vaucluse

Neighbourly tensions are bubbling in Sydney’s harbourside haven of Vaucluse, with plans by high-profile property developer Tal Silberman to subdivide and develop meeting harsh opposition.

Silberman, of Moshav Financial, bought the two neighbouring Hillside Ave properties for a total of $32m last year, with plans to demolish and subdivide the 2700sq m parcel into three separate mega-mansions.

The development applications lodged with Woollahra Council detail a three-to-four-storey home with new swimming pool and basement garage on Lot A, four-storey home on Lot B and two-storey dual occupancy with four-car garage on Lot C.

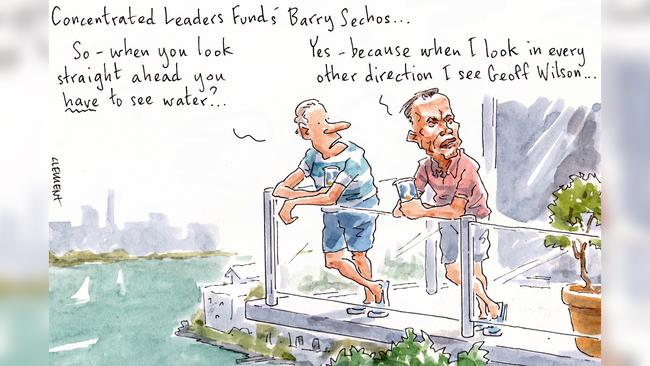

But while Silberman may be seeing only dollar signs, his Black Street neighbours, including Concentrated Leaders Fund director Barry Sechos and wife Maria, fear all they’ll be seeing is solar panels on the new digs — right in the way of their Harbour Bridge and Opera House sightlines.

No stranger to a development dispute, former Woollahra councillor and planning lawyer Anthony Boskovitz joined the chorus of opposition at the October meeting of the local planning body, chaired by former NSW government architect Peter Webber.

It was there that the local council poured cold water on Silberman’s plans, a decision he’s now taking to the NSW Land and Environment Court.

A statement of facts lodged by HWL Ebsworth partner Jane Hewitt on behalf of Woollahra Council lists loss of view and visual impact, among other concerns, as key factors for the plan’s refusal.

But losing views of Sydney’s landmarks isn’t the only battle for Sechos — his board seat at the Concentrated Leaders Fund is under threat by Geoff Wilson as he wages war on underperforming LICs.

At its last update, the Concentrated Leaders Fund noted receipt of a proposal by Wilson to push out Sechos, along with head of its investment management David Sokulsky and his Regeneus boardmate John Martin.

In their place, Wilson proposed to appoint himself and fellow WAM Capital director James Chirnside in their place.

No better place to formulate your plan of attack than under fire in another.

Gina holds court

In a red velvet-draped lounge chair and beside a crackling fireplace, mining magnate Gina Rinehart looked the very picture of a multibillionaire in her speech to the annual National Mining and Related Industries Day.

But she wasn’t messing around when it came to her address, lashing the government for “buying votes” when it came to stimulus and calling out city dwellers and left-leaning media for making mining a “dirty word”.

“We could still make savings if they took the tough decisions, cut their tape and overblown government parties,” she said.

“And certainly never let the government think it can buy our votes with any form of handouts, i.e. our tax dollars. No, we want them to act more responsibly, in our interests.”

It’s a familiar topic for the country’s richest person, covering similar ground to that of previous events since they started in 2013.

After her Hancock Prospecting posted a monster $4bn profit this year, and with her upcoming sale of rural property assets, her tax bill is likely to spike further.

While Rinehart appeared virtually for the celebrations, industry representatives and staff gathered in socially distanced groups as permitted by WA Premier Mark McGowan, as he continues to stand firm on his hard border.

That meant staff could mingle with oversized posters of Kerry Stokes’ The West Australian covers, referred to by Rinehart as showing the contribution of mining to the country.

No event could pass by without the mention of her favourite musical quintuplet, the London Essentials, the immersive entertainment troupe who have been a mainstay at the event for the past few years, and were pledged to return when the event goes coastal in the Whitsundays in 2021.

Pictures of the $994-a-night InterContinental Hayman Island flashed on the screen as Rinehart invited guests to join in the celebrations, “even on jetskis and on the water” — whether that extends to her next address we’ll just have to wait and see.

HomeCo humbled

It might have been the biggest initial public offering for the year, but David Di Pilla’s HomeCo Daily Needs REIT did little to excite investors on its first day of trading.

Even as the broader market soared to nine-month highs, the shopping centre owner finished only 1c higher from its $1.33 issue price at its $300m IPO.

That’s sure to be a dampener for the board of directors, such as chair and Cbus Property director Simon Shakesheff and Racing NSW director Simon Tuxen, who would have been hoping for a powerhouse debut, though a boost in their share rights is likely to soften the blow.

Each of the board, rounded out by chief Di Pilla, Superloop and Future Generation director Stephanie Lai and HomeCo’s Greg Hayes, are in line for an average bonus of 40,936 units as a one-off payment after the group’s listing — in recognition of “additional time and effort contributed in relation to HomeCo Daily Needs REIT achieving completion”.

At Monday’s prices that equates to roughly $54,854 apiece, and their holdings are set to be bolstered further with half of their FY21 fees to be handed out in shares.

As the largest holder with $50m tied up in the group, Di Pilla has the most to gain from the float’s success, while Hayes holds a $13.7m stake.

Beston barney

Beston Global Food Company’s annual meeting this Thursday is shaping up to be an eventful outing, with the board facing the prospect of a possible spill and a dissident shareholder looking to join the board.

The Adelaide-based cheese and meat company rewrote the corporate governance book last year when it failed to show shareholders any details of votes cast at its AGM. It was later revealed that almost 65 per cent of votes were cast against the remuneration report, over and above the 25 per cent threshold considered a “strike” under Australian corporations law.

Chairman Roger Sexton, who was then also the local head of the Australian Institute of Company Directors, told that meeting it was now considered “best practice” not to divulge votes during meetings — a notion thoroughly dismissed by the Australian Shareholders Association.

That sets the scene for a action-packed meeting this week, given a second strike would trigger a spill vote, which can turf out the entire board, including former Santos chair Stephen Gerlach or Catherine Cooper.

One of the issues in play is the management of the company through Sexton’s company Beston Pacific Asset Management, which is paid about $2m a year.

Chief John Hicks and the rest of his executive team are paid via BPAM, meaning their remuneration is not divulged, and BPAM’s fee is calculated on the value of assets under management, which is currently out of whack with the actual market value of the company.

The independent directors on the board looked at terminating the deal this year, but decided against it. Terminating the arrangement would have involved a shareholder vote and an undisclosed fee paid to BPAM.

Beston’s performance has also been troubling — while the past year has seen some positive steps towards profitability, it has lost money consistently since listing in late 2015, and at 8c, the company’s share price is 20 per cent down for the year.

Yuan Ma from 10.6 per cent shareholder Kunteng Pte Ltd is seeking to join the board this year, while directors Petrina Coventry and Jim Kouts are up for re-election.

Kunteng — a wholly owned subsidiary of Chinese private company Dalian Hairunlai Group — dropped $28m into Beston at 45c a share in 2016.

Additional reporting: Cameron England