Sydney bridge climb harbours treasures

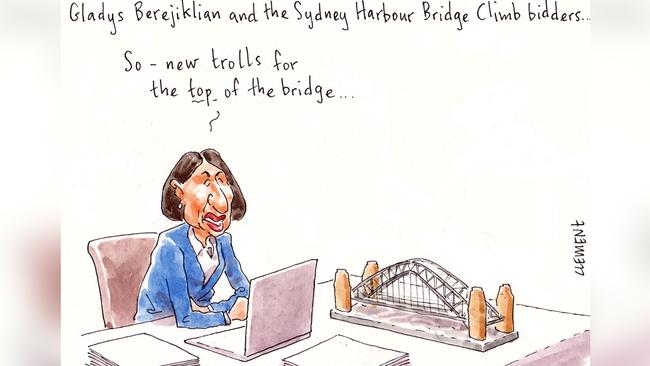

Things are getting pointy in the battle to secure the lucrative 20-year contract to run the Sydney Harbour Bridge Climb from October this year, one of the commercial jewels in Gladys Berejiklian’s Premier State.

Who wouldn’t want to run the internationally renowned tourism icon that turns over $50 million a year and last year made an almost $17m bottom line profit for its Rich Lister owners?

The current bridge climb contract, which has been held for the past two decades by fast food billionaire Jack Cowin (chairman of the besieged pizza shop Domino’s and a director of one of its pursuers, Fairfax Media), retail billionaire Brett Blundy (no longer selling bras, but still hawking cheap jewellery and things) and their millionaire ideas man Paul Cave (not to be confused with his brother Phil Cave, the chair of Anchorage Capital), expires in September.

The trio have each reaped tens of millions of dollars in dividends from the operation since its inception in 1998.

In the past financial year alone Cowin, Blundy and Cave paid themselves dividends of $13m, plus another $5.5m in the quarter after balance date, for a total of $18.5m in 15 months.

Their operating enterprise Otto Holdings (Aust) Pty Ltd is front and centre in the NSW government’s tender process to award the lucrative contract to one lucky bidder for the next two decades.

An initial call for expressions of interest last year yielded 13 responses.

Other bidders included Gary Weiss’s entertainment outfit Ardent Leisure (whose north shore offices look over the Harbour Bridge), which is seeking to reinvent itself after a horror period under the command of Neil Balnaves and, briefly, George Venardos.

Also throwing its hat in the ring is the operator of the Harbour Bridge’s neighbour Luna Park, catering outfit Trippas White, gym and leisure centre operators Belgravia Leisure and Anytime Fitness and the Nick Varney-led listed British entertainment company Merlin Entertainment, which has local interests that include the Sydney Aquarium and Falls Creek Alpine Resort.

Cash splash

Look who else is having a crack at running BridgeClimb: the Chris Hadley-led local private equity outfit Quadrant Capital’s Experience Australia Group, which all cashed-up after the mid-tier operation executed a $1.5 billion capital raising just before Christmas.

Quadrant’s Experience Australia Group was formally established in the middle of last year after the acquisition of Great South Rail, which operates The Ghan (the Adelaide to Darwin holiday train) along with cruise operations in the Whitsundays and around Rottnest Island.

Quadrant’s Simon Pither, Marcus Darville and Chris Tallent are running the operation and appear to have grand plans for their emerging tourism enterprise.

Its bid for BridgeClimb comes as Quadrant seeks to offload Neil Perry’s Rockpool Dining Group and following the PE group’s emergence as the biggest health club operator in Australia, with brands that include Fitness First and Jetts.

In January, Quadrant also bought Darrell Lea Chocolate from the Quinn family.

Margin Call understands that Gladys Berijiklian’s NSW government want the new bridge climb operator’s contract in place by the end of this financial year, ahead of the expiration of Otto’s incumbent contract at the end of September.

Only a handful of 13 bidders have been taken through to the next phase of the tender process.

Several of those second-rounders have already submitted their grand plans for the tourism venture’s next two decades.

Birthday boy

The great and the good of Sydney will congregate at a secret location on Saturday night to celebrate billionaire “High Rise” Harry Triguboff’s birthday.

Can you believe that in one day’s time the boyish Triguboff will be 85 years young?

As to be expected of a billionaire apartment developer’s milestone birthday, it promises to be quite a party.

Starlet Delta Goodrem — said to be a bit of a favourite at Meriton — has been booked to sing “Happy Birthday” and other tunes from her popular canon at the lounge suite function.

Expect an extremely senior delegation from David Gonski and Shayne Elliott’s ANZ, Triguboff’s bank of choice, a bevy of former NSW premiers (the new Labor senator Kristina Keneally is said to be another Meriton favourite), and perhaps the odd former prime minister, will be along in a crowd expected to also include Triguboff’s wealth adviser John Stensholt, who last year estimated the birthday boy’s fortune at $11.43bn.

In other Rich Lister social news, rival property billionaire Frank Lowy’s clan also have a big Sydney weekend ahead. Frank’s grandson Josh (one of Steven and Judy Lowy’s four children) is getting married to Britt Friede.

The couple have returned to Sydney’s eastern suburbs for the wedding from their San Francisco base where the groom — once an intern at the Lowy’s Westfield property empire — runs his own tech start-up Hugo and the bride is a product designer at Mark Zuckerberg’s Facebook.

Mazel tov!

BlackRock stake

As flagged in Margin Call yesterday, the world’s largest asset manager BlackRock is once again a substantial shareholder in Nick Falloon’s Fairfax Media.

A just-lodged ASX announcement reveals Larry Fink’s BlackRock now holds 5.02 per cent of the media company.

The late February buying came after a major sell-off on February 7, less than 24 hours after Fairfax’s Financial Review ran racy allegations about an alleged sex-and-drugs culture at Fairfax’s property business Domain.

Conviction investors at BlackRock responded by reducing the firm’s stake from 6.3 per cent to about 4 per cent.

The investing giant — which we understand met with Falloon and his Domain “bench strength” in the weeks before resuming its substantial status — seems to be confident that there will be a limited fallout from the “cultural review” Falloon commissioned after the Fin’s reports.

That’s presently in the hands of the “independent” cultural reviewers. Whatever will they find?

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout