Stockbrokers accused of breaching contract; ScoMo starts a company

It’s been a rough few months for Shaw and Partners. In March, the stockbroking firm sacked its senior adviser, Kristofer Ridgway, for allegedly investing client funds in dubious-sounding companies domiciled in a smattering of tax havens.

Now, Margin Call has learned of further alleged impropriety involving its officials that has seen the firm hauled before the NSW Supreme Court for alleged breaches of contract, fiduciary duties and a slew of other supposed misdeeds.

The case has been brought by Pure Metals Pty Ltd against listed miner Hawsons Iron over a hefty and heavily disputed sale of shares brokered by Shaw and Partners a year ago.

Broadly, Pure Metals held a 24.149 per cent interest in Hawsons’ iron ore mine at Broken Hill, in far western NSW, which it agreed to sell for 90,800,800 Hawsons shares.

These were to be delivered in two tranches and sold off by Shaw, the listed second defendant in the matter.

Exactly why did Pure Metals choose Shaw? It was introduced to the firm by Hawsons’ managing director, Bryan Granzien, in an email to Shaw traders Mark Gray and Tony ‘‘The Burglar’’ Davis. This detail becomes relevant as the story continues.

Shaw was instructed to sell the shares at a price of 4.3c once they were issued to Pure Metals, and this sale occurred as planned on May 18 for a price of $1,913,715 after brokerage fees.

Unfortunately, Pure Metals discovered that some of the buyers of its shares were principals at Shaw; this was despite the broker claiming to have lined up institutional purchasers in the lead-up to the sale of the shares.

Perhaps most offensive of all was that the market price for the shares had increased by that point to 15c, netting a substantial windfall for Shaw’s principals. They are not identified in the claim, but we are eager to determine who pocketed the sum.

“Pure Metals was unsatisfied with the responses from Shaw, leading to more questions than answers,” the statement of claim says.

Outraged by what had transpired, Pure Metals allegedly revoked the broker’s authority to sell the second tranche of Hawsons’ shares and instructed Hawsons to issue them solely to Pure Metals, to ensure they “would not be within Shaw’s reach”.

As an amusing aside, the claim even mentions an oral assurance provided by one of Shaw’s investment advisers, who allegedly told Pure Metals representatives that the shares would not be sold, per their demands, adding: “F … yeah, we would be mad to do that.”

Margin Call notes that this adviser no longer works for Shaw, having departed the company within weeks of that conversation taking place.

Regardless of Pure Metals’ requests, Hawsons is accused of persisting with issuing the second tranche of shares to Shaw, which traded them for 4.3c – on a day when they opened on market at 15c.

Pure Metals is seeking the difference in loss and damages, estimated to be around $4.3m.

“There was collusion between Shaw and (Hawsons) with the object of (Hawsons) issuing the Second Tranche of Consideration Shares to permit Shaw to sell them in a manner contrary to Pure Metals’ instructions,” the claim says.

Comment was sought from all parties.

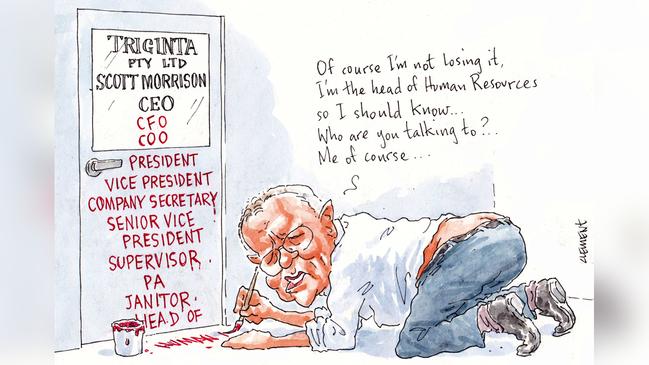

ScoMo on board

Daggy Shire dad Scott Morrison has gone and made himself a director.

Perhaps he’s just feeling bored after losing the prime ministership to Anthony Albanese in May, along with the portfolio of other jobs that we are only just learning that ScoMo was juggling from as far back as March 2020.

Losing your status as minister for health, finance, home affairs, treasury as well as industry, science, engineering and resources would leave quite the hole in your schedule.

So as of August 1, ScoMo, who now says he no longer engages in silly day-to-day politics as it unfolds, has created a company for himself, Triginta Pty Ltd, of which the Member for Cook is sole director and shareholder, as well as the company secretary. Triginta, for the record, means thirty in Latin – Morrison was PM30.

His wife and former first lady, Jenny Morrison, doesn’t get a look in on the new vehicle; unsurprising really, given what we have learned this week about the way Morrison likes to do things, keeping his own hands on the wheel.

We suspect the jack of all political trades, who was overwhelmingly returned to office by the fine folks of Cook, is keeping one eye on the future with the new corporate outfit, created via private accounting firm Jag Ludher Accountants. In the endeavour ScoMo has also enlisted the services of an outfit called ACIS, which describes itself as a specialist in business and investment structures and restructures, the core of which are company registrations, trusts and self-managed super funds.

ScoMo’s private interests while in parliament have been pretty vanilla. There is the house in the Shire which is mortgaged to the Commonwealth Bank, while his super is held with MLC and AustralianSuper.

The couple also have an approved line of credit, a few credit cards, some savings accounts and a family trust that has been dormant for some years. So Triginta Pty Ltd signals change may be afoot. Time will tell.

Fair share

For a pair of hardcore, old-school unionists, Ged Kearney and her partner, Leigh Hubbard, look a lot like committed capitalists.

A fresh disclosure from Kearney, the Assistant Minister for Health and returned Member for Cooper, reveals the former ACTU president has amassed one of the most extensive and diverse share portfolios in federal parliament.

Kearney’s registrable interests state that she and long-term partner Hubbard, a former secretary of the Victorian Trades Hall Council, have stakes in myriad managed funds and companies, far beyond what might be considered an optimally diversified portfolio.

There are even a few that could, over time, get in the way of Kearney’s new ministerial portfolio, assisting Mark Butler with the nation’s health.

Hubbard has shares in Australia’s largest private health insurer by market share, Medibank Private, while Kearney has stock in once state-owned multinational biotech giant CSL and medical device company Cochlear.

A few, then, for the likes of us to keep an eye on.

On a similar track we note that Hubbard for some time has been in the service of the Australian Nursing and Midwifery Federation – the largest national union and professional nursing and midwifery organisation in the land – as a senior industrial officer. Hubbard could be handy at the upcoming jobs summit when talk turns to the shortage of nurses here.

Margin Call notes also, albeit unrelated to Kearney’s portfolio but nonetheless a boon for the keen investors, the massive hike on Tuesday in the share price of online homewares retailer Temple and Webster.

The company’s stock, which is held by Hubbard, was up a whopping 30 per cent, or $1.27, to end at $5.67.

Happy days, unless they purchased before the big sell off earlier this year – in which case, they’re still in the red.