Spotlight family fortune all tied up; Gill’s investment charged with trampling on history

Richard White isn’t the only rich-lister consumed by high drama at the moment.

Spotlight billionaire Zac Fried is basically playing adviser to his sister, Dahlia, as she and ex-husband Nathan Sable navigate the rough seas of an asset carve-up.

We reported in August that the Fried family was alleging that Sable shouldn’t have a claim on Dahlia’s wealth because he’s already a man of means.

Never mind that they were together for nearly two decades when they split up in December.

Now we hear the Frieds are claiming they don’t even own any assets (including a $60m yacht, R. M. F, moored somewhere off the Italian Riviera) because all of the collective treasure is held behind the bulwarks of discretionary trusts.

These, it should be said, were established by the late family patriarch Ruben Fried, who established the Spotlight group with brother Morry Fraid in 1973 and grew it into a retail, property and investing behemoth now worth more than $4bn (according to the company website).

Brands owned by the privately-held Spotlight group include Spotlight (duh!) but also Anaconda, Mountain Designs and homewares outfit Harris Scarfe.

Fraid runs the show with his nephew, Zac, who holds the title of executive deputy chairman. And when he’s not busy managing the empire, he’s staying very much involved with this troublesome separation involving his sister. The earlier talk, published by this column, was that he’d sought out a private investigator to keep an eye on Sable.

But it’s not all bad news for the family.

Zac, Dahlia and their mother are due to settle next year on three penthouse apartments located in the Mondrian towers at Burleigh Heads in Queensland.

Purchased off-plan four years ago for about $10m each, they’re more than likely to have appreciated substantially in value since.

Not that they’ll end up owning these assets, of course. They belong to the trust, right?

Trail blazers

Former AFL boss Gillon McLachlan has been linked to a national outrage in the Northern Territory.

Well, sort of.

McLachlan is an investor in a cattle company facing 70 charges of damaging the birthplace of the Aboriginal land rights movement, or what’s remembered in the archives as the Wave Hill Walk-Off site.

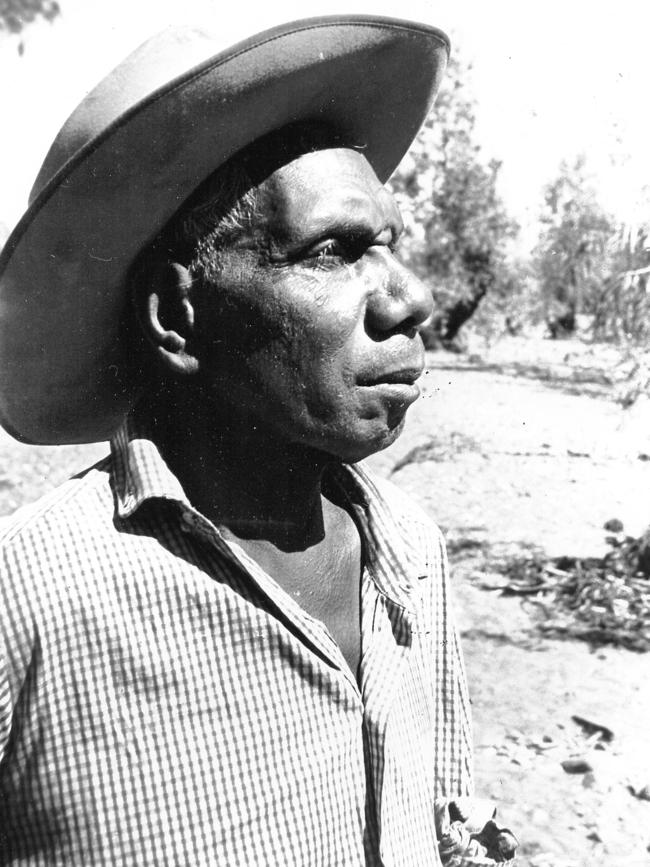

For anyone unfamiliar with this historic site, it’s where Indigenous leader Vincent Lingiari famously walked off the Wave Hill Cattle Station with 200 stockmen, house servants and their families in August 1966 over claims of worker exploitation.

Their strike led to a demand for the return of traditional land (so they could develop their own cattle station) and eventually, years later, to the passage of groundbreaking land title legislation.

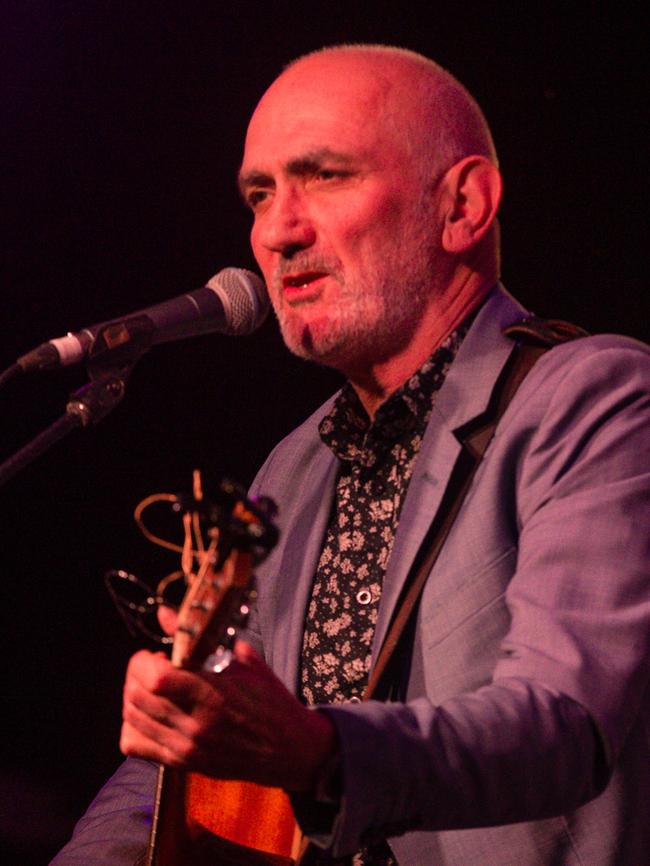

And if absolutely none of that chimes, either, you’ve surely heard of Paul Kelly and Kev Carmody’s protest song From Little Things Big Things Grow? It was written in homage to those events.

Anyway, we raise it now because the company involved in damaging the site has indicated an intention to plead guilty and make amends.

Implicated in this violation was McLachlan’s second cousin, Callum MacLachlan, and three companies named as CHM Pastoral, Commonwealth Hill and Wave Hill Holdings.

And it turns out McLachlan, the CEO of Tabcorp, happens to be an investor in Wave Hill Holdings through Luki Pty Ltd, which lists him as a director and secretary.

Surely no one wants to be accused of trampling on anything that blazed a path towards First Nations land ownership?

McLachlan, hands clearly full with Spring Carnival preparations, couldn’t be reached.

No entry

Spotted! Podcast host and former ABC journalist Tracey Holmes having some trouble at the Qantas Business Lounge in Canberra on Wednesday.

Attempting to enter the realm of platinum-grade travellers, an attendant at reception informed Holmes that she was in the wrong area and directed her to the sub-premium Qantas Club, or the “normal lounge”, as he termed it.

A harmless mistake on Holmes’s part, surely. But our spy tells us she did not love the ignominy of being refused entry at all.

No friend inside to sign her in as a guest?

Greensill fallout

When you’re trying to avoid being dragged into a messy lawsuit worth billions, avoiding attention is better than hanging a “kick me” sign round your neck.

That’s the lesson being learned by insurance broker March, which has fallen afoul of the Federal Court in trying to escape being dragged into sprawling $7bn legal mess created by Credit Suisse’s attempts to salvage something from the wreckage of Lex Greensill’s corporate empire.

Credit Suisse was once the beneficiary of Greensill’s financial engineering, packaging up and selling debt brought in by his supply chain financing business.

But the wheels fell off when Greensill’s insurers got the wobbles about the risks they were taking, and Credit Suisse and other financiers – including US lender White Oak and Greensill’s collapsed German bank – are now suing IAG and in the Australian courts for about $7bn.

Marsh was a key player in the Greensill empire, placing insurance policies that gave investors the confidence to buy the sliced-up debt packages.

It is already the subject of a $US143m lawsuit in the UK brought by White Oak, and in July Greensill Bank flagged an intention to bring Marsh into the $7bn Australian legal fracas as well.

Which brings us to the broker’s legal hiccup in the local courts.

To avoid being drawn further into the mess, courtesy of mooted legal action from Greensill Bank and its liquidators, Marsh hoofed into the UK courts to seek an anti-suit injunction.

The problem is that Marsh used a bunch of information handed over by the bank’s liquidator to Marsh’s UK business in a separate court case, which had not yet gone into evidence.

That’s a big no-no in legal circles.

Which meant Justice Mark Moshinky has issued an “anti-anti-suit” injunction – his words, not ours – that all but ensures the broker will be joined to what promises to be the messiest legal dispute the country has seen in years.

As it stands the trial is set down for three months of hearings in March 2026.