Speculation swirls over John McGrath account

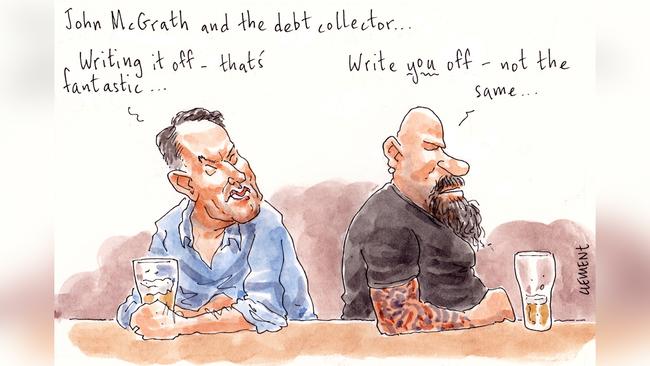

Speculation is swirling again about “Mr Real Estate” John McGrath’s account with Tom Waterhouse’s gambling outfit William Hill.

That’s the betting account reportedly $16.2 million in debt — a sum approaching 10 per cent of the mooted $200m price tag on William Hill’s up-for-sale Australian operations.

Thanks to the sales process for William Hill — which could be completed in days — the 54-year-old real estate agent’s enthusiasm for punting is once again the talk of the industry.

The current intrigue: who is going to be the bunny that has to collect McGrath’s outstanding debt?

The Walsh Bay-residing, teddy bear-collecting McGrath, whose eponymous real estate business remains deeply troubled, has described the debt as “ridiculous”.

Word from behind the scenes is that the debt, after some recent repayments, is now considerably below its $16.2m peak.

There has even been some speculation that McGrath’s owings might be forgiven, as a way of apologising for the embarrassment caused to such a loyal customer.

That sounds like the sort of wishful thinking that leads to a $16.2m gambling debt in the first place.

It’s been indicated to Margin Call that money owed by William Hill’s high-rolling customers is expected to be repaid.

That would scuttle speculation McGrath’s debt, or rather the waiving of, may have contributed to the recent $424m writedown of William Hill’s Australian operation.

None of the businesses’ would-be buyers — Dublin-headquartered, Paddy Power Betfair-owned Sportsbet, UK wagering giants Ladbrokes and bet365, and Australia’s CrownBet (more on Matt Tripp’s posse soon) — are said to be keen to assume the debt collection duties.

If the 35-year-old Waterhouse can’t sort it out before he hands over the keys to the new owner, it might be a job for Dun & Bradstreet or one of its less reputable debt-collecting peers.

There’s a guy in Adelaide who uses snakes. Apparently it never fails.

Dinelli checkout chic

Jet-setting Melbourne barrister Albert Dinelli brings an impressive professional curriculum vitae to his new role as counsel assisting banking royal commissioner Kenneth Hayne.

Dinelli — yes, the same fellow marked as a “Future Leader” in the 2017 edition of Who’s Who Legal — has been subbed on to Hayne’s team following the last-minute withdrawal of Michael Borsky QC, who as Margin Call first revealed withdrew himself from the year-long, high-profile role to manage a personal matter.

Dinelli, who turns 40 in June and also has a practice in London and Singapore, will work alongside fellow counsel assisting Rowena Orr.

And look how far the Italian-speaking, international arbitration specialist Dinelli has come since the start of his industrious working career in the mid-1990s.

Excavation in Margin Call’s extensive pictorial archives has unearthed a fresh-faced, teenage Dinelli, smart in red bow tie and crisp white shirt: the very model of a Coles checkout man, back in the industry’s glamour days.

The now barrister is all smiles as he scans groceries in a photoshoot to mark his Coles Myer scholarship. With the assistance of that funding Dinelli went on to study law at Monash University (he got first-class honours and came second in a class of 338).

It’s one of the best investments Coles Myer’s then boss Peter Bartels ever made.

Dinelli later completed a doctor of philosophy at Oxford (he went to Magdalen College) after receiving another scholarship with the Menzies Foundation.

In the name of banking transparency, it appears that Dinelli’s home in Middle Park, in inner Melbourne, is held in name of his wife Luisa Dinelli.

She bought the home early last year and has a mortgage to Westpac — although we should note the commission doesn’t think that’s any of your business.

Tripp bunkers down

Back to betting.

And, yes, it’s a red-letter week for online gaming in Oz and in particular Melbourne millionaire Matt Tripp and his consortium of CrownBet management.

Tripp was yesterday holed up in his 120 Collins Street headquarters preparing for a busy back end of the week as deadlines loom for two potentially transformative deals for the group.

Margin Call understands an announcement on Tripp’s $150m buyout of Crown’s 62 per cent stake in his online bookie could come as early as this morning. That would be just ahead of Tripp’s Thursday deadline to secure his financing for the deal with James Packer’s Crown.

The deal will effectively value all of CrownBet at $242m.

Efforts by Tripp and his execs to secure their finance have been hand-in-glove with talks about a play for UK gaming giant William Hill’s Aussie operations, which over the weekend were written down by $438 million by its burned parent.

Citigroup is running the sale process that is believed to be down to parties including CrownBet, SportsBet, Ladbrokes and bet365.

A preferred bidder could be named by the end of this week to then enter final exclusive due diligence.

A mooted sale price of around $200 million will see the British gaming giant exit with about a quarter of the capital that they ploughed into this market.

It is understood the ticket price has increased slightly over recent weeks as bid tension has heightened in the final push to secure the William Hill operation.

Sounds like the Brits can’t wait to see the back of us.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout