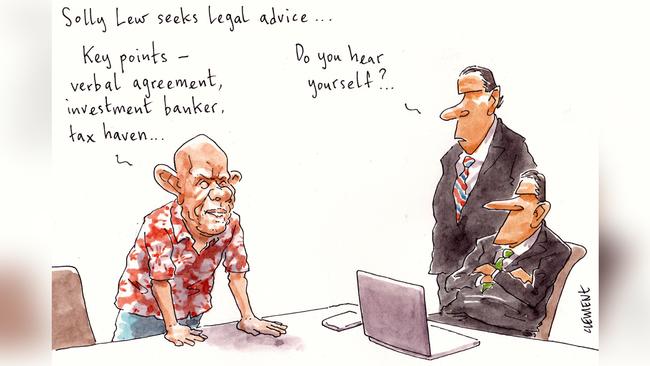

Solomon Lew digs in over pad in Thailand

Billionaire Solomon Lew is not happy. He wants his villa in Thailand. And he wants it now.

That much is clear from an “only in billionaire land” legal claim that Lew has lodged in the Eastern Caribbean Supreme Court in the Virgin Islands and which has made its way into Margin Call’s hands.

The claim, prepared by Lew’s offshore “magic circle” lawyers at Maples and Calder (a firm that specialises in commercial law in the tax havens of the Caribbean), says that on October 11, 2017, Lew agreed to acquire a villa in Thailand from “Mr and Mrs Nargolwala”, a Singaporean couple.

Who are they? The legal claim isn’t precise on that.

But Margin Call has established that the male half is Kai Nargolwala, a Singapore-based investment banker and board member of chairman Urs Rohner’s Credit Suisse.

Don’t expect John Knox’s local Credit Suisse operation to pick up Lew’s Premier Investments account any time soon.

According to the claim, to get the long lease in the property, Lew “entered into a verbal agreement” to buy the place from the Nargolwalas. That required Lew getting ownership of all the shares in a British Virgin Islands-domiciled company called Querencia Limited, which held the property.

That might seem a complicated arrangement to buy a holiday home. But as F. Scott Fitzgerald observed, the rich are different from you and me.

But it wasn’t to be.

“Despite the willingness and ability of Mr Lew to proceed with the purchase, the verbal agreement between Mr Lew and the vendors did not complete,” write Lew’s hired guns at Maples and Calder.

It certainly wasn’t because of a lack of funds. Despite his Myer misfortune, Lew’s wealth was last valued at $2.55 billion — more than enough to pay roughly $5 million for a Phuket holiday home.

So what went wrong?

It appears that Nargolwala, or his sales team, instead sold the Phuket pad — which sources plugged into the Southeast Asian property market tell us had been on the market for years — to another richie behind Lew’s back.

In the claim, Lew’s lawyers say that was in “breach” of their “agreement”.

We gather Nargolwala has a different opinion.

But in a worrying sign for Nargolwala, it seems the billionaire is taking this property dispute very personally.

The feud continues.

Fox’s new toy

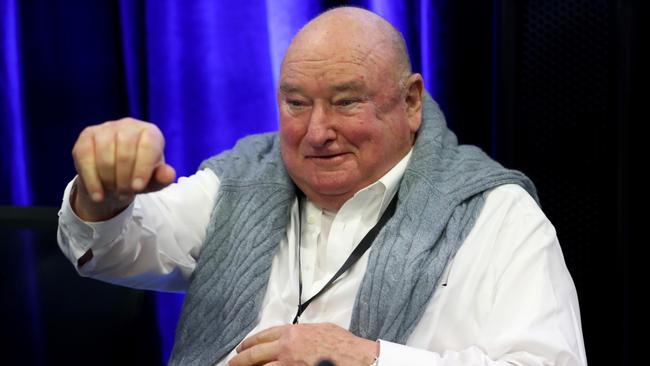

Thankfully, not all Melbourne’s sun-loving billionaires are having trouble with their holiday portfolios.

Margin Call can share the good news that trucking, logistics, airport and property billionaire Lindsay Fox has fled wintry Victoria to take possession of his new 57.7m superyacht Volpini 2.

As you read this, we gather Fox is sunning himself on the new beauty not far from Sardinia.

If you were a 81-year-old with a fortune last valued at $3.56bn and a new boat in the Mediterranean, where would you be?

Last month we revealed Fox had discreetly bought the new Tim Heywood-designed toy, the first vessel in Dutch luxe boating manufacturer Amels’ new “188” range of superyachts, one of the most sought-after shiny toys for the international super-rich.

The interiors are customised by Reymond Langton, the ship includes a 30sq m beach club, a gym and an 80sq m master suite on the main deck for Lindsay and wife Paula.

We gather the new boat was bought after the 2017 European summer, a few months after Lindsay turned 80.

Fox’s billionaire bestie Solomon Lew has also escaped the cold.

His slightly smaller, but considerably older superyacht the 54m Maridome (built almost 30 years ago) was last spotted not far from Cannes — as good a spot as any to oversee litigation against his Singaporean investment banker foe.

Meanwhile, fellow billionaire James Packer’s new, and also Amels-built, 55m superyacht EJI was last seen near Capri, Italy, not far the Benetti shipyard that is building his still under-construction 107m superyacht IJE, which is also an acronym of his children’s names (Indigo, Jackson and Emmanuelle) and which is said to have cost him more than $200m. And, after four years’ work, it’s still not done.

Sadness for Diggers

For many, next month’s Diggers & Dealers mining forum in Kalgoorlie will be tinged with sadness following the sudden passing of John Langford.

Kalgoorlie-born Langford had been responsible for running Diggers for the past two decades, managing the logistics of hosting a major conference in the outback location with ease. He arguably did more than anyone to ensure Diggers attained its status as the pre-eminent mining knees-up in Australia and one of the best events of its kind in the world.

As well as the expert extinguishment of any spot fires around the conference, Langford had a special talent for ensuring the wine selection at the annual gala dinner was always first class.

Diggers chairman Nick Giorgetta yesterday described Langford as a man who had made a significant contribution to the Australian mining industry.

“He was a character larger than life and will be fondly remembered by family, friends and colleagues for his dedication, loyalty and the humour he brought into the lives of the people he was close to,” Giorgetta said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout