Casino billionaire James Packer has secured approval for his two-level Crown Residences luxury apartment at One Barangaroo.

The plans reveal a six-bedroom 1340sq m apartment in the luxury tower, which will be completed next year. The space was previously approved as six separate apartments.

Packer paid $60m for the entire floors on levels 48 and 49, which were set to hold 18 bedrooms. Instead, he’ll have six, plus a study, a home gym and a cinema.

Wilkinson Eyre and Bates Smart, the co-architects of the project, signed off on the two floors, which are linked by a staircase, last December.

Packer will be keeping all six parking spots that came with the former proposed apartments, which attracted criticism from Clover Moore’sSydney City Council. They claimed it was “excessive and counter to sound urban planning and concept plan principles”.

Parking spots are a red hot issue among the buyers. Knight Frank’s Erin van Tuil estimates that half the purchasers have a car collection for investment and enjoyment, as well as three everyday cars.

No name was attached to the application, just that Crown Resorts had advised that “the amalgamation of apartments into a single duplex apartment was necessary due to a specific buyer request”.

-

An illiquid tsunami

Insolvency industry watcher Peter Gosnell is reminded that the first sign of an impending tsunami is evidenced by the waterline receding.

He was reacting to data showing a dramatic decline in insolvency administrations — down 55 per cent in June, with just 463 administrations, compared to the prior June at 1040.

The insolvency analytics report by Tony Sivaa also calculated industry-wide declines of 17 per cent for April and 38 per cent for May, year on year, due to the impact of the COVID-19 stimulus packages.

“The numbers for the past three months lay bare the crippling effects on the insolvency sector,” advised Sivaa, who heads Sivaa Consulting, in his latest update.

“There has been commentary that with the upcoming influx of insolvency appointments, there are not enough liquidators to do the work.

“But a significant portion of liquidators this last financial year did less than 10 appointments,” he noted.

The busiest of the 630 liquidators was Worrells, which had 757 files under its supervision — reflecting 8 per cent of market share. Cor Cordis followed with 424 files, followed by SV Partners with 401.

Will JobMaker deliver the clarity business needs?https://t.co/cbGejVuRlQ

— Worrells Solvency (@Worrells_Solve) July 15, 2020

Sivaa calculated that the top 20 firms nationally hold more than 50 per cent of all appointments among some 197 firms. NSW was the busiest for appointments with more than 3250 filings.

Mackay Goodwin principal Domenic Calabretta had the highest number of files under management in 2019-20 with 162, followed by SM Solvency Accountants’ Brendan Nixon with 152.

Of the big four professional services, KPMG has the most registered liquidators, having swooped on Ferrier Hodgson.

Worrells’s 30 liquidators, which is five less than KPMG, handled the administration of Italian restaurant chain Criniti’s as well as the recent collapse of Gold Coast international phone company Travelsim, which is to be wound up after a creditor vote last week.

-

Bundy and broke

Timbercorp Finance is still seeking the bankruptcy of Greg Bundy, the Silicon Valley-based former boss of Merrill Lynch Australia and his wife, Nicola.

The application, lodged in June with the Federal Circuit Court Melbourne registry, comes 11 years after the collapse of the Timbercorp managed investment scheme. The Bundys were among the more sophisticated investors who borrowed from Timbercorp Finance to fund their speculative investment in 2007. Bundy has spent more than three decades in stockbroking and funds management.

Craig Shepard, liquidator at KordaMentha, had his lawyers in the Federal Court late last month seeking alternative means of notification, given difficulties in touching base with the couple.

Magistrate Alison Hird gave Shepard until Thursday to serve notice, including to a UPS postage box in Woodside, California, along with sending a SMS message to a mobile phone number understood to be connected with the couple.

Bundy quit Sydney in 2010 after selling a 5700sq m Pymble residence for $7.25m.

With 83 matters on foot, Shepard was ranked the second busiest practitioner in Victoria, according to the aforementioned Sivaa report.

-

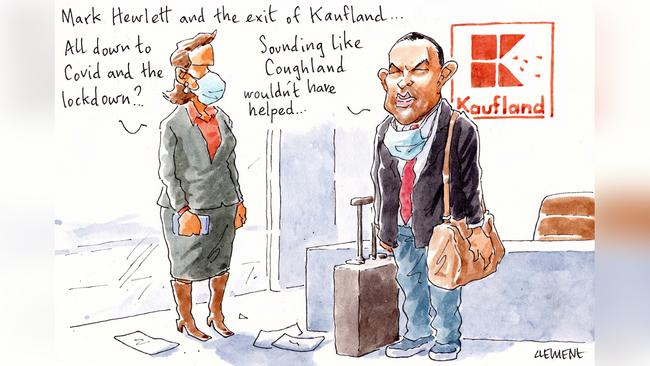

Kauf medicine

Retail executive Mark Hewlett is heading back to Britain, as soon as he gets permission, after the prescient decision by the German grocery chain Kaufland to abandon its rollout across Australia.

Despite having invested $523m in preparation, the grocery giant made their exit decision in mid-January, just before COVID-19 emerged on the retail landscape.

“Like many people, the pandemic has made me reassess what’s important,” Hewlett recently posted on LinkedIn.

“Family, friendships and community mean a lot to me but at times these have been sacrificed for career advancement, travel and personal development. We all want to be close to those we love in times of crisis and everyone needs to rebalance and reassess now and then. I guess it’s my time to do that now.”

Hewlett had been in the local supermarket industry since 2012, when he was recruited by Woolworths from Aldi UK. He headed Woolies’ convenience store strategy, then Thomas Dux and then its fuel and convenience store division.

In 2015, he was headhunted by Metcash, and in 2018, he was named in the leadership team to roll out Kaufland across Australia, spending six months training in Germany and then becoming chief financial officer before they pulled the plug.

-

Paying the Piper

Investment banker Nick Langley and his wife, the recently appointed chair of the Museum of Contemporary Art Lorraine Tarabay, have sold their strategic Point Piper holding.

It was a Wyuna Road property, offered with $14.5m hopes through Monica Tu at Black Diamondz, that last sold for $13m four years ago.

The home stood between their hillside home and their harbour views, so Margin Call gleans their purchase was principally motivated so as to pop a height restriction covenant so they could keep their views. And it was a $6750 a week rental offering.

The 1960s home was designed by John Sutton for the late racing identity Keith Harris. He served prison time in the 1980s after delivering a bribe to prisons minister Rex (Buckets) Jackson as part of the early release scheme for criminals.

The house was at the centre of a 2012 will dispute when the extended Harris family objected it being gifted to the neighbour by his widow Betty Harris after her 2009 death aged 95.

-

Anyone for Skwosh?

The fashion industry investor, and former AFL champion, Chris Judd is helping out alternative fashion labels — and the AFL community — during the COVID pandemic.

He has been papped around Brighton doing essential shopping, sporting a windcheater reading “Isolation Vacation”, with a decorative palm tree.

It’s from the Skwosh label, which was initially just swimwear when launched back in 2015 by Adam Walsh, Jack Turner and Port Adelaide footballer Jack Watts.

No sign that the investment guru Judd has put any money into the small start-up, other than the $99 windcheater acquisition. Judd retains his investment in the Jagged Group fashion outlet.

And Walsh remains the sole director and shareholder at Skwosh, which has had NBA star D’Angelo Russell sporting their gear, along with Olympic gold medal winning swimmer Kyle Chalmers. Their popular swim shorts feature giraffes, camels and crocs.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout