As the stockmarket was collapsing last month, Dave Sharma, the member for Wentworth, saw plenty of opportunity. Whether the newly-minted MP has picked the bottom remains to be seen but so far he is running ahead.

Sharma’s biggest winner was Qantas, up around 20 per cent since the family trust share acquisition a month ago — buoyed in part from the twin collapse in oil prices and rival Virgin Australia.

His March investment in Macquarie Group is up around 10 per cent.

Sharma, who won the Liberal Party seat for Wentworth from independent Kerryn Phelps last year, has also seen gains in his frugal March acquisitions in Melbourne’s ANZ and Sydney Airport.

He did however buy up shares in the business loan specialist Prospa late last year, and they’re down around 75 per cent, despite a recent bounce.

This week Prospa was asked by the ASX to explain why it didn’t disclose to the ASX its $223m funding from the Commonwealth Treasury as part of its coronavirus SME Guarantee Scheme, until five days after its announcement. Plus Prospa has, in recent market disclosures, twice overstated its liquidity position.

Sharma is not the only pollie buying up shares. The member for Lyne, David Gillespie, bought shares in the managed fund Intelligent Investor Ethical Share Fund in late March.

His shares have gone up 8 per cent.

Portsea perch

The Deague developer family have snapped up another Portsea clifftop, this time the prized Rovina estate. It’s set to be the weekender of Camilla Deague and her husband Nick Speer.

The 2000sq m estate was sold off market by the aged care accommodation entrepreneur Russell Knowles, who had paid $13.8m just two years ago at a hotly contested boardroom auction.

The 2018 seller then was Jonathan Munz, fresh from his payday after the sale of the plumbing supplies company Reliance Worldwide Corporation.

Overlooking Portsea pier and Weeroona Bay, Rovina was first on Margin Call’s radar in 1983 when selling for $714,000 under mortgagee instructions as reclusive businessman James O’Connor’s Mercedes dealership, Kew Star Motors, hit financing bumps in that recession. It sold to Brian Davis, the octogenarian 1950s founder of the housewares company Decor Corp.

O’Connor — known as Jimmy like his hotelier father — also lost what had been Melbourne’s first $1m home, which he had bought from Sir Maurice Nathan in 1980 for $1.01m on St Georges Road.

There’s been no price disclosure yet for Rovina, just suggestions it went back in price a tad. And anyway everyone is too busy pondering the fate of the Mediterranean villa styled by 1960s society architect Geoffrey Sommers.

The family headed by David Deague are as well known for their demolitions as their monogrammed shirts.

There was the near razing of the clifftop Ilyuka in 1995, but for near neighbour Kate Baillieu’s attentiveness, and more recently a Guildford Bell-designed Sorrento trophy home.

The family have almost been a permanent fixture on the clifftop since they bought the Colwyn estate, paying Portsea’s first $1m-plus sale in 1980.

Rovina saw Sommers incorporate columns from buildings, like the demolished 1893 Colonial Mutual Life building on Collins Street, into his designs during the 1960s.

That of course was the heyday of Whelan the Wrecker.

Margin Call spotted the recent $6.5m sale of Lillirie, a former Toorak abode of the presumably still proud demolition family. Oddly they never bulldozed their 1880s single storey stucco Italianate villa on Malvern Road. It is now on the Victorian Heritage database, among the rare listings within the Stonnington municipality, where most councillors see little value in heritage.

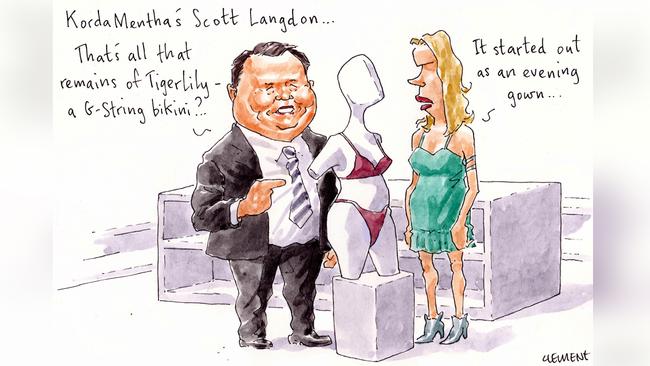

Tigerlily goes under

The collapsed designer clothing label Tigerlily did not find a buyer.

Administrator Scott Langdon from KordaMentha closed the sales process after its funder Crescent Capital rebuffed the highest offer in favour of progressing with their deed of company agreement.

Langdon, who was appointed voluntary administration in March, had seven bids in the first round, and teleconferenced with each party.

A handful went through to the second round, when Crescent Capital instead favoured their deed of company agreement (DOCA), tabled at the second creditors’ meeting yesterday.

They advised the highest offer would give no return to the unsecured creditors, and a lower return to secured creditors than proposed in the DOCA.

Langdon recommended to creditors to go with Crescent’s DOCA.

Bondi or bust

The recently sold Bondi Beach investment apartment of former Australian cricket captain Michael Clarke was initially up for rent at $4000 a week by its Bellevue Hill buyer Dana Lewis, the wife of Oceana Fund’s David Lewis.

But after some quick market feedback, this week the vacated apartment was available at $3500 a week for long term tenants.

The revised asking rental would reflect a 2.5 per cent yield as Clarke sold the Cadigan apartment through Sotheby’s agent Barry Goldman for $7.25m, according to the paperwork lodged by Bell Partners Legal.

Initially seeking $8m for the Campbell Parade property, Clarke bought the 200 sqm, three-bedroom apartment for $6m in 2009 from his accountant mate Anthony Bell.

Bell had paid $3.2m in 2005 on the building’s conversion from the Bondi Diggers’ Club.

Clarke, papped last week fishing with mate Max Shepherd, chief executive of home improvement company Mr Maintain, aboard Bell’s yacht Ghost, briefly lived there with then-fiancee Lara Bingle.

The apartment became an investment in 2011 when the asking rent was $2800.

On its listing two weeks ago Bondi Beach had 277 properties available for rent, but now its 331 properties, according to realestate.com.au.

The big issue is can landlords secure tenants before the seasonal winter doubling of the vacancy rate.

In the bunker

The golfers in the deprived state of Victoria have something to revel in while contemplating their next round.

There are Victorian golf courses selected by Greg Norman in his recent top 10 courses in the world.

The expatriate Australian, who spent 331 weeks as No 1 in the world golf rankings, put them in first, fifth and 10th place. In a year with no April Masters, the Shark’s worldly list spans three continents.

The Royal Melbourne was top of the Shark’s listed for Golf.com followed by Shinnecock Hills at Southampton, New York, and then St Andrews Scotland in third place.

Royal Dornoch in seaside Scotland was followed by Kingston Heath in Melbourne’s sand belt.

Sixth spot was Oakmont, then the eerily empty Augusta National, Machrihanish and Harbour Town on Hilton Head Island.

Coming in 10th place was one of Norman’s most recently designed courses, Cathedral Lodge, the exclusive David Evan-owned golf course at Thornton, two hours northeast of Melbourne on the Goulburn River near Alexandra.

The club that opened in 2017 costs some $50,000 to join — by invitation — and then $12,000 in yearly fees.

Evans envisaged the 18-hole private course creating something similar to the late Kerry Packer’s Ellerston Hunter Valley private course completed in 2001, and not on the list any more.

Norman always reckoned the property of the former Essendon AFL club president David Evans had the perfect terrain and climate.

Evans apparently met Norman for the first time at the Essendon-Collingwood Anzac Day match seven years ago, with the former world No 1 briefly joining the advisory board of Evan’s stockbroking and investment firm, Evans and Partners.

One Cathedral Lodge regular until the shutdown was Cricket Australia’s former boss James Sutherland.

Local golfers who play at the Alexandra Golf Club on Gordon Street no doubt have Cathedral Lodge on their bucket list.

Evans and wife Sonya, whose family have been in the central Victoria district for five generations, purchased the holding in 2003 and built a holiday home.

Meanwhile there’s whispers Macquarie has hired Evans & Partners vice chair Chris Bryan to head its institutional equities desk. Bryan co-founded Evans & Partners with Evans after the pair left Goldman Sachs in 2006.