Shark Park a hunter’s paradise

A European summer filled with expansive billionaires and taut supermodels has distracted people from a major development in celebrated golfer Greg Norman’s business empire: his House of Horrors in Colorado.

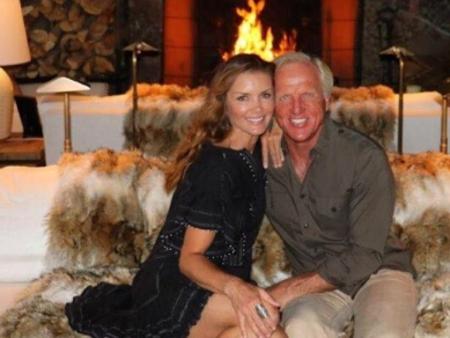

The Great White Shark’s third wife Kirsten Norman — an interior decorator whose taste veers towards the dead and stuffed — finished the fitout for the residences at his Seven Lakes Ranch a little over a week ago.

All agree it’s a National Rifle Association member’s wet dream.

Stuffed carcasses of mountain lions and elk adorn the walls, the mounted head of a buffalo leers over the fireplace and this triumph of taxidermy is set off with a tasteful chandelier made from the antlers of a herd of deer.

“Stunningly beautiful,” is the Shark’s verdict of Kirsten’s work.

And best of all, if guests at the “gold medal trophy ranch” like the look of any of Kirsten’s furry interior decoration, they can set off into the expansive mountain property and hunt — and then mount — whichever of God’s furry creatures they can set their rifles on.

The ranch is an exciting addition to Norman’s expansive business empire, which includes golf course design, property development, a Wagyu beef range and an investment fund. The whole package was last valued at $235 million in 2012.

Great White Plonk

Also in the Greg Norman business empire is a wine operation, Greg Norman Estates, which is part of the expansive portfolio of Michael Clarke’s Treasury Wine Estates.

We’ve been told Norman’s Reserve Shiraz — from South Australia’s Limestone Coast — is just the thing after slaughtering a mountain lion in “Shark Park”, Colorado.

The label’s future has not been clear after Clarke’s listed wine business last week revealed it had sold 12 of its US brands — without disclosing which were sold or at what price.

For reasons too strange for us to comprehend, Clarke won’t fill in the details until Treasury’s August 18 results. But we can now reveal to readers too impatient to wait that Greg Norman Estates will remain. Cheers to that. Shall we go knife a coyote to celebrate?

All aboard

Greg Norman isn’t the only member of the Treasury Wine Estates family aboard trucking billionaire Lindsay Fox’s Love Boat, which pulled into sparkling Corfu yesterday.

Peter Gago, the chief winemaker at Penfolds, the jewel of Treasury’s portfolio, is also on board.

He led a tasting of Penfolds’ best reds: Grange and St Henri Shiraz from their 1994, 1998, 2004 and 2008 vintages. Guests also received a bespoke Penfolds title to mark the “Lindsay Fox Conception Reception”.

It’s good to be friends with this humble trucker.

Billionaires galore

Lindsay Fox’s celebration of the 80th anniversary of his conception is the second party thrown by a billionaire in the Greek Islands that Greg Norman has been to in the past week.

The Great White Shark was along at the Mykonos wedding of former Victoria’s Secret model Ana Beatriz Barros to Karim El Chiaty, who works for his dad, Egyptian billionaire Hamed El Chiaty, at transport and travel group Travco.

The Brazilian bride wore a white one piece. The groom wore Speedos. The Shark took pictures.

Par for the course

The golfing crowd was also well represented back in Sydney at Romanian-born judo champion Nicholae Bicher’s power lunch institution, Machiavelli.

The executive chairman of The Bongiorno Group, Joe Bongiorno, was in the house yesterday, lunching with Westpac’s American born chief executive, Brian Hartzer.

Bongiorno is a confessed golf tragic, but we suspect the paperwork he brought to the lunch meeting with Hartzer related to the financial

services business he founded

in 1964 — eight years after Lindsay set up his trucking business, Linfox.

Also in the lunch crowd was publisher and fellow golfing enthusiast Peter Charlton, who was keepingLove Boatpassenger Harold Mitchell’s seat warm, while Seven’s uber spinner/burnt pie Simon Francis was looking after outgoing Seven consultant David Leckie’s table.

Alexiou taps out

Finally some good news for Shayne Elliott’s ANZ as sacked trader Etienne Alexiou dropped his $30m case against the bank.

The only money that changed hands was between ANZ (market cap $71 billion) and its lawyers, and Alexiou (market cap less than $71bn) and his lawyers.

We hear the former trader — who previously worked at Barclays Bank — paid about $300,000 in legal fees.

And what does he have to show for it?

Well, there are clippings of newspaper stories featuring his name and tales of strip clubs, cocaine-laced cakes and pervy Bloomberg chats about Home and Way starlettes.

There’s the highlights reel of his Ray Ban-clad appearance on A Current Affair.

And then there’s a friend, Garfield Lee, who lost his trading job at Ian Narev’s Commonwealth Bank, and would be forgiven for now asking, “To what end?”

Alexiou’s tapping out comes six months after sacked ANZ bond salesman Patrick O’Connor dropped his multi-million-dollar claim against the bank.

Still, there’s plenty to keep busy Elliott’s head of legal affairs Bob Santamaria, the son of Tony Abbott’s late political mentor. There’s the Oswals Bollywood drama, which still has months to run in the Supreme Court in Melbourne.

And there’s the ongoing high-stakes game of legal chicken between ANZ, NAB and Westpac, and Greg Medcraft’s ASIC over alleged rate-rigging.

And who could forget Angus Aitken? The directions hearing for his high-profile case against Elliott and his digital prophet Paul Edwards is only two weeks away.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout