Shale be right for socialite broker Oliver Curtis

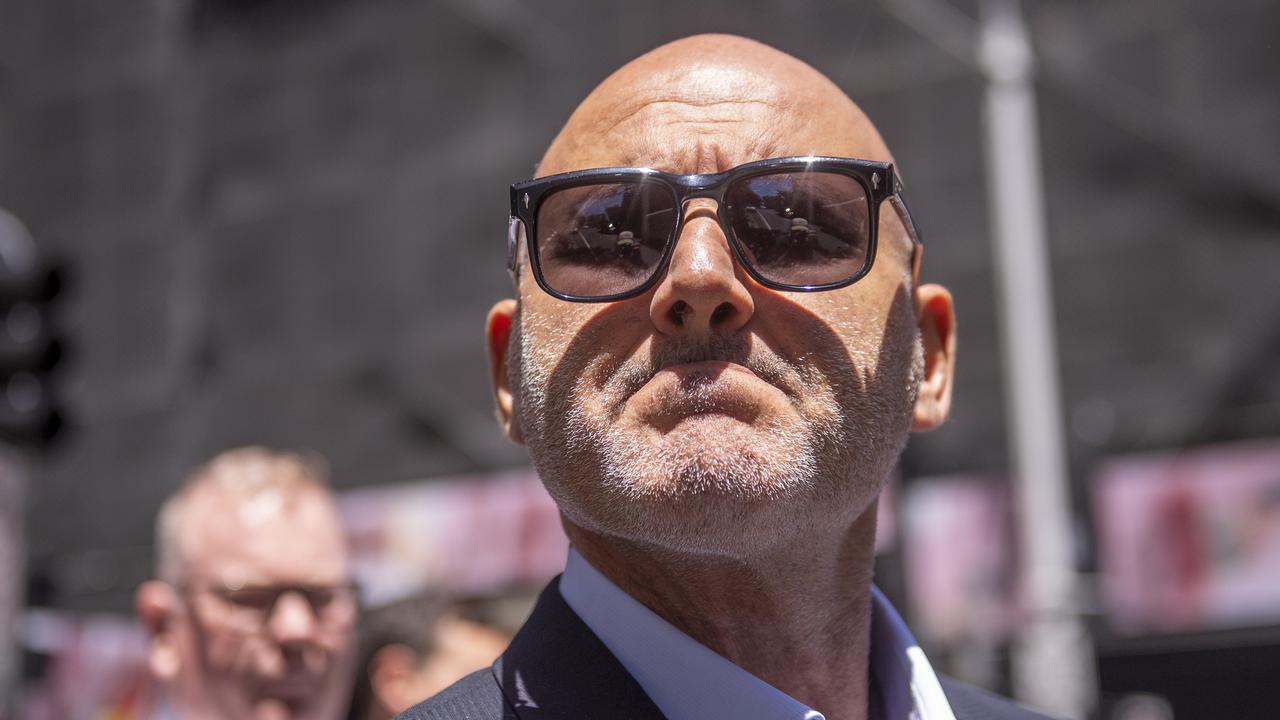

SYDNEY socialite stockbroker Oliver Curtis may be awaiting his (mysteriously delayed) day in court on insider trading charges, but in the meantime he’s getting on with business alongside dad Nick.

Margin Call can reveal that Curtis Jr, who alleged criminality aside is probably best known for being married to celebrity PR Roxy Jacenko, and his father, who is the chairman of rare-earths miner Lynas, are involved in a venture looking for shale oil in South Australia.

They are both directors of Melbourne company Petroshale, which has applied for five petroleum exploration permits in the Lake Eyrie and Arckaringa basins, in South Australia’s north.

The Curtis family is a major shareholder in Petroshale, owning 20 per cent of the company through their investment vehicle Wilkes Holdings.

Peloton Capital’s Shane Hartwig and Emmanuel Correia are also on the board, as is Melbourne lawyer and investor Josh Goldhirsch.

But it looks like any actual fracking is a long way off. According to Petroshale managing director Gabriel Kushnir, the company intends to develop the tenements but exploration plans and native title negotiations need to be finished first.

He declined to say how the Curtises became involved in Petroshale, and when asked if he knew how to contact Oliver, replied: “No.”

Nick Curtis was not in his office and couldn’t be reached yesterday afternoon.

Court’s cone of silence

EVIDENCE in Curtis’s insider trading case is suppressed by an extraordinarily broad suppression order imposed by a series of judges of the NSW Supreme Court (see Margin Call, Friday).

But just how secretive is the court? So furtive is it that even knowledge of what civil cases have been filed is considered too dangerous to spread beyond its hallowed halls.

On Wednesday last week, Margin Call asked the court’s media officer for a list of all the civil cases filed the previous day.

This is information routinely provided by other Australian jurisdictions. For example, the Victorian Supreme Court publishes a list of new filings every day on its website, and the Federal Court publishes each filing as it occurs on the Comcourts website.

But in Rum Corps Sydney, the state’s top court apparently feels it is not in the public interest for the public to know who is suing whom. Margin Call was told no list would be provided.

Adding insult to injury, the court won’t even say why not.

Money half smart

FANS of ASIC boss Greg “paradise for white collar crime” Medcraft who have been clamouring for him to crack down on financial institutions finally saw some steel displayed yesterday.

Did Medcraft’s mob take on the big banks? Financial planners? Dodgy directors? Not quite.

Instead, it issued a furious broadside at non-bank lender Mortgage House for ripping off the name of ASIC’s consumer website, MoneySmart.

Mortgage House named one of its loans MoneySmart, which “could have misled borrowers to believe the company was in some way endorsed or approved by ASIC”, ASIC thundered.

The company “admitted it did not check if ‘MoneySmart’ was trademarked”, the watchdog barked.

It’s not as if MoneySmart is hard to find — as Margin Call reported on November 24, ASIC pays a lot of money to be found on Google. Did no one at Mortgage House type the word into a search engine?

Crushing blow

PUT a cork in it. That’s the message from Federal Court judge Debbie Mortimer to well-known winemaker Andrew Garrett. Her Honour has been hearing one of the many legal sequels to a long-running stoush between Garrett and Treasury Wine Estates over the right to use his name and signature on bottles of plonk.

In complex circumstances way back in the mid 90s, Garrett’s successful South Australian wine business and rights to his moniker were sold to Mildara Blass, which is now a subsidiary of Treasury.

Unhappy with the result, Garrett sued in the Croweater Supreme Court. Those proceedings were settled in 2000, but his woes continued.

He claims the deal helped push him into bankruptcy at the hands of the ATO in 2004.

That case is still on foot, but in Garrett’s case against Treasury he has been told to go away and not come back.

Justice Mortimer last month found Garrett brought the Federal Court proceedings in part to evade South Australian Supreme Court orders declaring him a vexatious litigant.

She crushed any further litigation on the matter like a shiraz grape, banning Garrett from any further Federal Court action against Treasury.

For good measure, the judge has referred the case to state and federal authorities to consider if the ban should be extended to cover all proceedings Garrett might want to bring in the Federal Court.

butlerb@theaustralian.com.au