Scott Morrison rattles tin in Toorak for Liberal Party

It was the summer’s evening Prime Minister Scott Morrison came to Toorak to thank Melbourne’s establishment for their support — and ask for their money.

They came in their Bentleys, their Porsche Cayennes, their black Range Rovers to the National Trust of Australia home of JB Hi-Fi boss Richard Murray and his wife Jacqueline Blackwell.

Murray, chair of party fundraiser the Higgins 200 club, bought the place, Glyn, for $11 million at the end of 2016.

It was the perfect backdrop to demonstrate yesterday evening that, now that Michael Kroger is no longer the Liberals president in Victoria, the big end of town is back.

Or, at least, that’s how Kroger’s many enemies want to spin it.

Member for Higgins Kelly O’Dwyer, no fan of Kroger, was an early arrival, while her old boss and predecessor Peter Costello, now the chair of the enlarged Nine, was along with one-time Coles Myer boss and Olympic cyclist Peter Bartels. Costello and Bartels founded the Higgins fundraising outfit 25 years ago.

Kroger’s Cormack Foundation opponents Hugh Morgan and Charles Goode were also along.

Promising for Morrison (months away from beginning an expensive election campaign), so were Telstra boss Andy Penn and wife Kallie Blauhorn, Wesfarmers director Diane Smith-Gander and Flagstaff banker Tony Burgess.

As local Toorak ladies walked by with their dogs, hopeful of a glimpse of the PM, Chloe Barry, the wife of UBS banker Kelvin Barry (a colleague and sometimes property investment partner with O’Dwyer’s also UBS banker hubbie Jon Mant), entered solo. Such is the lot of a workaholic banker’s supportive wife.

While he lives just up the road from the Murrays, there was no sign of Westpac chair Lindsay Maxsted. Maybe his invite was lost in the mail.

Myer mired

So now we know.

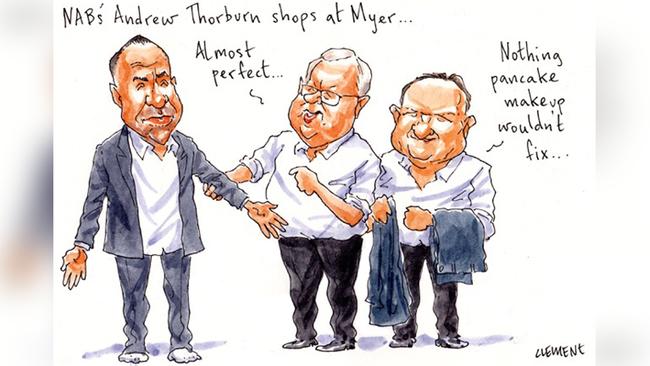

The future of Garry Hounsell and John King’s troubled department store Myer rests in the hands of National Australia Bank’s highly animated boss Andrew Thorburn.

Margin Call can reveal NAB is the new lender to the retail giant in a deal that was signed on November 22 — just before the group’s AGM at the end of last month.

Documents seen by this column show the bank, in return for lending, has security over all of Myer’s present and future assets in the deal that extends to February 2021.

Thorburn’s bankers have relaxed covenants that apply to the debt, as the retailer’s sales continue to plummet and its shares trade at about 40c, valuing the group at about $300 million.

Myer’s previous lender was Shayne Elliott’s ANZ Bank.

As part of the new lending agreement with NAB, Myer boss King and his chair Hounsell can’t sell any part of the Myer kingdom — except inventory, which appears to be excluded — without permission from Thorburn’s bankers.

Meanwhile King, who began at the start of June taking over from Hounsell as interim CEO after he removed Richard Umbers, appears to continue to reside in a company-funded serviced apartment in Melbourne at a rent in the order of $1250 a week.

Myer wouldn’t comment on King’s living arrangements or how long they would last. Right now, flexibility seems like a good approach for the former House of Fraser boss.

Waiting in the wings

Margin Call hears another bidder is sizing up GrainCorp.

Interesting.

It begs two questions. Will the unnamed bidder’s interest come to anything?

And, if so, which investment banking house on this wide brown land will advise them?

Thanks to the hedging approach taken by GrainCorp’s chair Graham Bradley and CEO Mark Palmquist, much of the investment banking community is already engaged.

GrainCorp has three different banking houses on the books — a team from John Knox’s Credit Suisse (running the numbers on GrainCorp’s malt business), Max Billingham’s Blackpeak Capital team (looking at the liquid terminal business) and David Mustow’s Macquarie team (running the official defence against the Goldman Sachs-advised $2.4 billion bid by Tony Shepherd, Chris “Crash” Craddock and their mystery backers).

And not on the books but engaged is GrainCorp’s unpaid adviser John Wylie and his Tanarra team.

Full marks

Nine’s shares fell almost 5 per cent yesterday after the enlarged media company’s Hugh Marks addressed his new troops at The Sydney Morning Herald and The Australian Financial Review.

Was it something he said?

While the numbers suggest otherwise, Margin Call has been told the Q&A with the new boss wasn’t too dramatic.

The journos tried to size up Greg Hywood’s replacement, while Marks tried to convince them he came in peace.

Asked whether he would direct the paper’s election coverage — specifically, which party the papers would back — Marks didn’t seem to know what his new staff were on about.

“He had a bemused look on his face,” one onlooker told us.

Apparently it was the first time the CEO had considered such interference. “We don’t do that at Nine,” one of his team told us.

While the company is now a relic, the Fairfax Media sign continues to hang above Nine’s Pyrmont outpost.

It won’t be going anywhere until the requisite council permission is cleared by Clover Moore’s City of Sydney. The cranes may be some months off.

As to Nine’s share price plunge, while it was an ugly debut, it could have been worse.

Have a look at Seven’s bloodbath.

Despite good reviews for its new cricket coverage, shares in Kerry Stokes’s media outfit yesterday plunged 10 per cent.

At just under $900m, Seven is now worth less than a third of its commercial television nemesis. But, really, these days media is just a hobby for the Seven billionaire.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout