Scale founder David Collard’s debts prompt moving times

David Collard, the founder of lumbering enterprise Scale Facilitation, was due to be evicted by court order from his Park Avenue apartment in Manhattan over the weekend, a pad that rents for $US75,000 per month – and which he’d stopped paying for months ago.

A settlement document published online says that Collard was in arrears to the tune of nearly $600,000 owed to his landlord, Chinese billionaire Yiqian Liu, an enigmatic art collector who got fed up with not being paid. And that’s to say nothing of what Collard still owes to his long-suffering workforce in Geelong, and elsewhere, a matter now subject to a Fair Work Ombudsman inquiry. Meanwhile federal police are investigating Scale Facilitation and its companies over allegations of tax fraud, which, if proven, would place it among the largest grifts in Australian history.

Sadly, Collard is not the only person moving address. Margin Call has learned that his parent’s five-bedroom house in Geelong has been put on the market, with inspections to take place later this week. A “cherished home” that’s become available “for the first time in over 20 years” is how the advertisement describes the piece of real estate, setting an indicative price of about $1.1m.

Collard’s father, Kevin, was appointed a director of a Scale Facilitation subsidiary last year, although there’s no suggestion he was involved in the decision-making carried out by his son. Given the troubles facing Scale’s numerous companies, and its blocked-up cash flow, one can easily surmise the reasons for the sale.

Turnbull meeting

But back to that impressive NYC apartment. This mirage of Collard’s success is where dignitaries and Australian delegations were frequently hosted for dinner, where photographs would be snapped of a beaming Collard yukking it up next to some unsuspecting VIP. These would later be shared on the company’s encrypted messaging channel, the contents of which are now being leaked in prodigious quantities to Margin Call.

These networking events led to a great swath of the AustralianSuper board getting caught up in Collard’s dubiousness, with its CIO Mark Delaney one of about a dozen people who dined at the apartment and who, allegedly, requested a “one pager” to consider investing in Scale Facilitation. That account is Collard’s version of what happened, of course, hence the caution of a modifier.

Yet another person seemingly charmed by Collard and his ambitions for renewable energy was Malcolm Turnbull, who reached out to Collard in May during a trip to New York, beseeching him for some face-time. That was a few months after he and wife Lucy established Turnbull Renewables Pty Ltd, one of several green energy ventures in which the former PM is still involved.

“Hi Dave – good to talk the other day. I am in NY until 14 May and if you are in town and had some time would be good to catch up. All the best, Malcolm,” the former prime minister wrote.

And the purpose of the meeting? Turnbull’s a director of Fortescue Future Industries and has a stake in solar tech company 5B Holdings. Was he eyeing Collard as an investor?

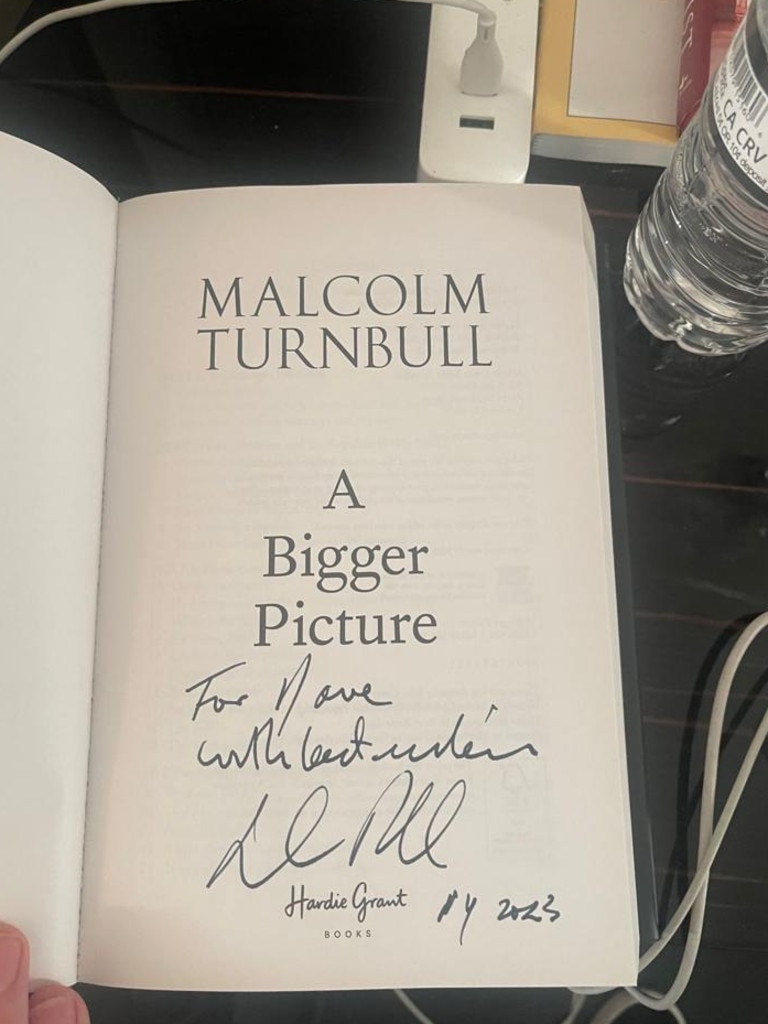

Turnbull didn’t respond to Margin Call’s enquiries, but what’s clear is that it went ahead. That much is known, because Collard received a signed copy of the ex-PM’s autobiography, A Bigger Picture, a photograph of which he dutifully shared on the company chat, calling it a “house warming gift”.

Labor pains

And speaking of free gifts, Labor gave away a couple to the opposition in parliament last week thanks to its inability to count numbers in the Senate.

Margin Call speaks of two inquiries that were voted into existence on Tuesday, neither of which the government wanted. The first will probe the Qatar Airways debacle; the second will examine the proposed development of the Middle Arm precinct on Darwin Harbour.

To scotch the politically embarrassing Qatar Airways matter, the government appears to have cut a deal with the Greens, promising to support the Middle Arm inquiry. This lesser of the two evils seamlessly passed 35-28 with Labor’s blessing.

In exchange, the Greens blocked the Qatar Airways inquiry, but that still left the government one person short of a majority, meaning it lost the vote and the inquiry got up 32-31 on the floor.

How could this happen? Margin Call hears Labor minders are still kicking themselves that no one bothered to check-in with independent senator David Pocock, one of the only crossbenchers who could have been tempted to vote with the government against the inquiry, perhaps with a bit of funding baksheesh, or some access, or a heads up on impending policy. All that work enticing the Greens, for nothing.

The result’s provided much amusement to everyone aware of the mess.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout