Ruffled feathers at the ACTU

Gee, ACTU secretary Sally McManus was sore about Margin Call’s exploration of her links to private equiteer Ben Gray’s $4.1 billion tilt at private healthcare operator Healthscope.

At the insistence of Team McManus, let the record show: the head of Australia’s trade union movement has not given her consent for the $120bn industry fund giant AustralianSuper to exclusively bid with Gray for the Paula Dwyer-chaired, ASX-listed Healthscope.

“She did not and is not in a position to,” said a spokesman for McManus.

So if McManus hasn’t given her consent to the industry fund’s partnership with private equity, has she given it her blessing?

Neither McManus nor her expansive media team at the Australian Council of Trade Unions would answer.

It’s almost as if McManus doesn’t want to talk about it.

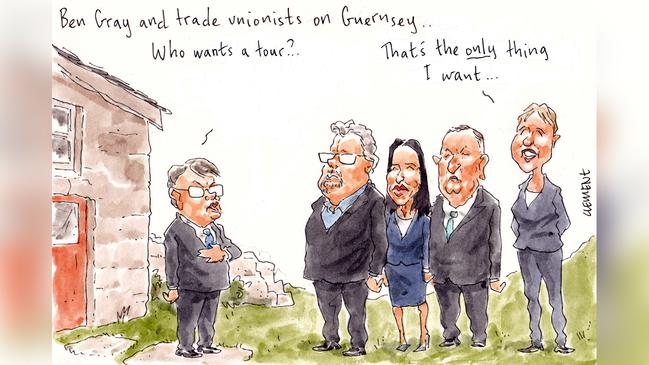

The ACTU’s “change the rules” brigade certainly were not happy with Margin Call’s report yesterday that revealed part of Gray’s BGH bidding structure extends to the Crown dependency of Guernsey, that floats off the coast of Normandy in the English Channel.

As a spokeswoman for Gray told Margin Call: “It’s a very stock-standard structure for a PE firm, which has investors from around the globe. It’s well understood and accepted as appropriate.”

And it’s true, there’s nothing novel about Masters of the Universe using an offshore structure.

But it’s a more exotic destination for our giant industry super funds.

Guernsey is a jarring locale for the industry super fund’s member directors from the union movement. AustralianSuper employer director and Australian Industry Group chief Innes Willox might be comfortable with it, but his fellow AussieSuper director and McManus’s predecessor as ACTU secretary Dave Oliver may be less so.

Remember, the ACTU is currently engaged in a McManus-led campaign to “change the rules” and oppose the Turnbull government’s proposed corporate tax regime.

Or at least they are outside of their industry fund’s boardroom.

Unions and ultra-capitalists are strange bedfellows.

Should Sally know?

To be clear, Sally McManus is not on the Heather Ridout-chaired AustralianSuper board.

So what is McManus’s relation?

Well, she’s on the related board of ACTU Super Shareholding Pty Ltd.

McManus holds 62.50 per cent of the ordinary shares in ACTU Super Shareholding, according to company records.

In a Willy Wonka-inspired flourish, McManus also holds its single “gold” share.

Team McManus wouldn’t reveal to Margin Call what powers come with that magical share.

ACTU Super Shareholding Pty Ltd is the outfit that, as outlined in the industry giant’s annual report, appoints the union member directors to AustralianSuper’s currently

11-person board.

To go by Team McManus’s response to yesterday’s story, it’s not clear that relationship is widely understood within the ACTU.

Or perhaps they just don’t want to talk about it.

Right now those five AustralianSuper member directors are McManus’s predecessor as ACTU secretary Dave Oliver, the head of the Finance Sector Union Julia Angrisano, national secretary of the Australian Manufacturing Workers’ Union Paul Bastian, former United Voice official Brian Daley and the national secretary of the Australian Workers’ Union Daniel Walton.

While McManus may not be in a position to officially give — or deny — consent to AustralianSuper’s tie-up with Gray’s private equiteers, you would think her position on the ACTU Super Shareholding Pty Ltd vehicle means she would be across the market-first partnership.

Team McManus wouldn’t tell us whether she was.

Two of McManus’s ACTU Super Shareholding Pty Ltd’s board mates are also member directors on the AustralianSuper board: the previously mentioned AMWU boss Bastian and former UV official Daley. Don’t these unionistas talk?

Another of ACTU Super Shareholding Pty Ltd’s directors Nixon Apple is an alternate director for Bastian. Apple is also listed as a member of AustralianSuper’s investment committee in its most recent annual report.

So whatever McManus’s thoughts are on the industry fund’s partnership with Gray’s ultra-capitalists — which for now she refuses to share with us — it would be strange to learn she is not well across the $4.1 billion Healthscope transaction.

Dwyer’s Way

Healthscope’s chair Paula Dwyer has just rebuffed BGH-AustralianSuper’s $4.1 billion offer for Dwyer’s still $4.1 billion firm. Dwyer, of course, is the same chair Gray installed when he floated Healthscope as the local boss of US private equity giant TPG less than four years ago.

This week she has answered any questions about her independence from Gray.

Less clear, is the cleverness — or otherwise — of BGH’s decision to lock in Ian Silk’s mustachioed AustralianSuper

(a 14 per cent shareholder in Healthscope) in its bidding consortium.

What we do know is that the exclusive arrangement — which thwarted the more lucrative, $4.35 billion offer by giant Canadian asset manager Brookfield — meant Dwyer felt uncomfortable allowing either bidder into a virtual Healthscope dataroom.