Ross McEwan banks on NAB shares

NAB’s chief teller, Ross McEwan, is value investing in his own bank, lifting his share holding with a $731,000 outlay. McEwan has bought 47,500 shares on market at about $15.40, according to an after market notice late on Wednesday. The shares are a realtive steal being down more than 40 percent from the heights of more than $27.30 in February.

McEwan had been sitting on 5000 NAB shares, costing $127,000, which were bought in the heady pre-pandemic days on taking up the post late last year.

Last week, Royal Bank of Scotland, which he helmed between 2013 and 2019, suffered a near-50 per cent drop in first-quarter profit after putting aside £802m ($1.5bn) to help cover a potential bad debt surge due to the COVID-19 outbreak.

In his last year at the UK lender, McEwan was paid the equivalent of $7.7m until his November exit.

However, he also qualifies for an additional payment of $2.1m in coming months from his old shop as long-term benefits vest. The RBS board report card concluded that McEwan should be paid the long-term bonus given he made good progress overall against 2019 targets. They found McEwan “remained engaged until his departure”, but he didn’t get the full potential payment given he was marked down after “customer targets were not met” and return on equity was “behind target”.

Adding up for Marks

There’s plenty at stake for Nine Entertainment boss Hugh Marks in the upcoming six-week countdown to the media giant’s balance date.

Of course, there’s operational matters as the COVID-19 crisis affects fourth-quarter advertising revenues.

Marks, who has been the boss since November 2015, has already told the market that to support Nine’s second-half bottom line, $20m in costs will be taken out of the business by June 30.

Margin Call notes that broadcaster Alan Jones is set to finish up at 2GB on May 29, which will sop up at least some of that, albeit paid out in full.

But also on Marks’s mind will be the almost one million performance rights he holds that are set to vest on July 1.

The rights have a fair value at $1.14 each compared with Nine’s closing price on Wednesday of $1.42 and so are in the money to the tune of almost $270,000.

There’s been plenty of talk this week about Marks’s tenure at Nine, where he’s been on the board, first as a non-executive director, since early 2013.

He’s got six weeks to hang on if the rights are to vest, otherwise their issue will be at the discretion of his chairman, Peter Costello.

Also at the discretion of the Melbourne businessman should Marks’s time be up will be a further two tranches of 1.3 million rights that are due to Marks over the two subsequent financial years that are also well in the money.

The media chief, now based in Sydney’s Mosman, is entitled to 12 months notice from Nine if he is shown the door, with Marks on fixed pay of $1.4m a year. His contract also provides for a $1.4m maximum short-term incentive and the same in a long-term incentive.

Marks, who is on an open-ended contract, would not be allowed to work for another media outfit for a year.

Recent disclosures show Marks retains a total of 2.3 million ordinary shares that are worth $3.3m.

All that means if he was to leave, he’d exit with value approaching $5m and, if Costello is feeling generous, maybe even more. And any cash portion of that could certainly help the cost initiative.

We shall see.

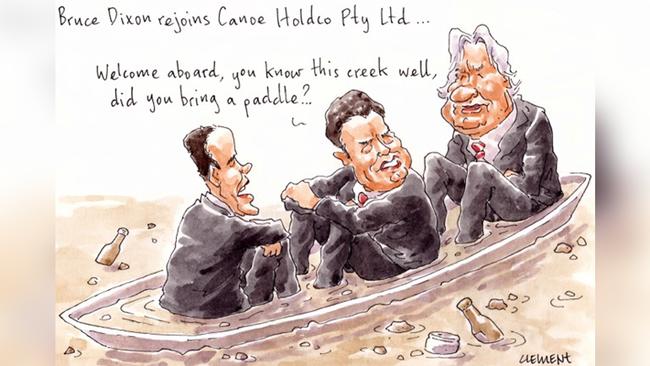

Dixon back at taps

The crisis besetting the hospitality industry has seen the barbarians at the gate from American private equity giant Kohlberg Kravis Roberts turn to an old pair of hands to help steady the ship at its struggling Australian Venue Co.

Enduring millionaire shareholder and pub group founder Bruce Dixon, 63, has just been returned to the board of the hospitality and brewing giant’s ultimate controlling entity Canoe HoldCo Pty Ltd as its boss Paul Waterson and KKR local chief Scott Bookmyer, who turns 50 next month, ponder the group’s several failed float attempts and revenue that has in recent months plummeted to virtually nothing.

Australian Venue Co is Australia’s second-biggest pub group, in “normal” times turning over more than $600m a year. Its sharemarket float was mooted to have been worth $1bn.

In recent weeks, Waterson, 48, has waged a punchy public relations campaign over the government’s shutdowns of the hospitality sector amid the unfolding COVID-19 health crisis.

In the campaign, Waterson presented himself as an old-fashioned corner publican, rather than as the chief of a billion-dollar-a-year, market-dominating operation controlled by one of the world’s biggest private equity operations.

Just yesterday, KKR revealed it had signed a deal to buy a bit more than half of Colonial First State from CBA for $1.7bn. Not your average publican.

As preparations towards a float of AHC geared up at the start of this year, including a roadshow to Asia, Dixon came off the board. That was in early February, but now the veteran businessman, who ran Spotless (and sold that to private equity too), is back to protect his investment.

Last October, non-executive director Shirley Liew was added to the board, but she just pulled the plug just before Dixon was added and as the operating crisis intensified.

Dixon netted about $200m when he sold the lion’s share of the hotel group to KKR in 2017.

He’ll be back on deck from his historic sandstone mansion at Flinders on Victoria’s Mornington Peninsula that offers uninterrupted views across the region’s hills, and cost almost $4m a decade ago.

Beer o’clock in NT

“Never did a town greet its visitors more boisterously,” acclaimed travel writer Jan Morris noted after she visited Darwin on a trip through Australia in the 1980s.

“And never did the beer flow quite so fast”, she added.

The Northern Territory’s beer o’clock reputation is set to roar back into being, as the first hotels in the country reopen amid the loosening in COVID-19 lockdowns. The NT’s genuine isolation saw the last infection more than three weeks ago, with just 30 cases in total, and thankfully no deaths.

The watering holes open noon on Friday to the joy of publicans and patrons alike.

Initial shipments of some 175,000 litres of booze have been trucked to the territory in a convoy, kegs rolling up the Stuart Highway.

Plenty of CUB to go with the top end favourite, Great Northern.

“Much eagerly anticipated, I’m sure,” Prime Minister Scott Morrison told a Canberra press conference last week.

Under the reopening guidelines, alcohol must be served with a meal.

It comes seven weeks after the lockdown decision that the boss of Lion Beer Australia, James Brindley, described as the most “soul-destroying day the industry had ever experienced”.

Darwin’s best known publican is Mick Burns, who owns The Cavanagh Hotel with business partner Brooke David. The duo held a stake in the 2019 Melbourne Cup runner Constantinople.

Two NT watering holes rank on an authoritative top 10 bucket list for Australian pubs, both having their own different draw cards for grey nomads escaping the capital cities.

Some 110km south of the capital is the Jason Smith-hosted hotel The Adelaide River Inn, complete with Crocodile Dundee’s now stuffed hypnotised buffalo co-star, Charlie.

At the Daly Waters Pub, 620km south of Darwin, is the bar lined with hundreds of bras. The walls are also covered in bank notes from all around the world. The historic 1930s pub was bought by Tim Carter, who owns Carter’s Retail Group, in 2017.

There’s a pub for sale nearer the southern border, known as the first and last pub in the Territory, depending on which way you are heading.

Tycoon’s ‘Iron House’

Jamie Pherous, the business tycoon who founded COVID-19 challenged corporate travel company Corporate Travel Management, has been building one of Brisbane’s most impressive mansions.

It’s coming after he paid a record $11.3m for the riverfront New Farm block.

Pherous and wife Louise will move from their nearby home when the four-level, six-bedroom mansion is completed.

The Courier Mail speculates the home, dubbed Iron House by architect Tim Stewart, will cost about $20m.

Pherous and Louise, who wed at Hayman Island in 2015, will have a rooftop terrace featuring a lap pool. They might have to scrap the main pool unless they win the court battle after complaints from surrounding neighbours.