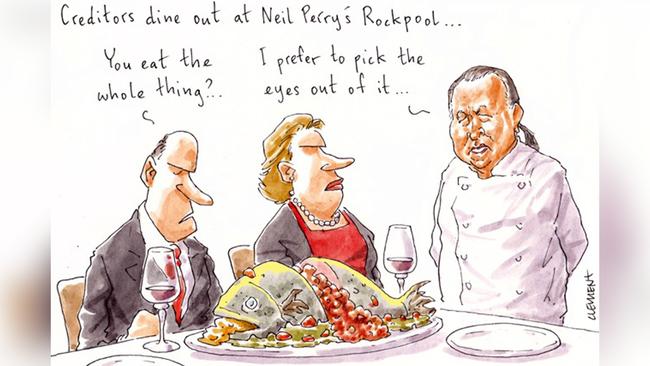

Rockpool debt in the deep end for Neil Perry

Any wonder the masters of the universe at Quadrant Private Equity are so prepared to flog part of their Rockpool Dining Group back to celebrity chef Neil Perry.

The Thomas Pash-led restaurant and hospitality roll-up is losing money knife over fork.

As the corporate undertakers from Korda Mentha pore over the carcass of fellow celebrity chef George Calombaris’s failed Made Establishment, Margin Call thought it prudent to look under the lid at what’s simmering at Quadrant’s Rockpool.

And it’s not that appetising.

Rockpool Dining Group lost $40.4m last financial year, according to audited docos slipped into the corporate regulator at the end of last year. That was from a bottom line loss of $46.2m in the year before.

Revenue from the Christopher Hadley-directed group (he’s also executive chairman of Quadrant) last year was $325m when Rockpool operated 72 venues with 2600 employees.

Bear in mind that high-profile chef Perry has taken just seven of the group’s restaurants off Pash’s hands.

The private equiteers plan to run the balance of the group as Pacific Concepts, with that business name reserved only on Monday as the deal came to light.

At June 30, Rockpool Dining Group had borrowings of just under $350m (all non current, which compared with $294m the year before thanks to a refinancing deal last September, including with the Shayne Elliott-led ANZ).

Also lending to the food group are non-bank corporate lender Metrics Credit Partners and Nikko Asset Management Australia.

Directors note in the accounts they think the group has sufficient funds to ensure it “continues as a going concern … to at least 31 October 2020”.

That’s because the debt facility was set to expire on November 2 this year, but Margin Call has learned the company has managed to have that extended two years beyond that, which at least gives some breathing room.

Still, interest expenses (which totalled $31.3 million last financial year and so far are being being accrued) will need to start being actually paid from next year, so healthy cash flow will be vital.

The debt is governed by a range of financial and non-financial covenants that the group says it was within at balance date, but fingers crossed for since then.

Perry, we suspect, has done his private equity masters a favour taking what he has off their hands.

We just hope he can make a better go of things back out there on his own.

Weiss not idle

Philanthropic veteran rag trader Peter Weiss and wife Doris have decided to make the more permanent move to their weekender at Palm Beach, on Sydney’s northern beaches, prompting the listing of their city bolthole.

Weiss, who recently donated $4m to research into lung disease to University of Sydney researchers based at The Westmead Institute for Medical Research, secured the Woollahra cottage in 2015.

It was bought for $3.75m from the estate of the late composer Peter Sculthorpe.

Margin Call recalls it was set to become a music fellowship residence, in Sculthorpe’s honour. However, those plans didn’t eventuate, and instead Weiss installed a lift to help him around their abode.

They periodically hosted musical recitals in the home’s studio.

1st City agent Simon Doak is readying the Holdsworth Street home for a pre-Easter auction.

The Weisses have entertained at their many Palm Beach homes over the years. They did have a hillside Peter Muller-designed, pavilion-style home but upgraded in 2016 to the waterfront when they spent $10m on the Wally Barda-designed home of rag trader-turned-farmer Gordon Smith.

Weiss, a longtime lover of the arts, was born in 1935 in Vienna, and came to Australia in 1939. His passion for playing the cello saw him become one of the early sponsors of a “chair” in the Sydney Symphony Orchestra. There was also a $1m donation to establish the Instrument Fund of the Australian Chamber Orchestra. In 2016, he bought the ACO a 1729 Guarneri cello.

Allen in the hunt

If you ask Greg Hunt, parliamentary newbie Katie Allen is destined for political greatness.

Minister for Coronavirus Hunt and Member for Higgins Allen joined forces on Monday night in Canberra for what they called a “tele-town hall” with paediatric doctor Allen’s constituents from Melbourne’s leafy inner east.

Via telephone Q&A, Hunt and Allen patiently answered question after question from local voters concerned about the unfolding COVID-19 international health crisis.

Former Royal Children’s Hospital professor Allen revealed the new coronavirus had, in fact, already landed right on Higgins’ doorstep.

Two of Allen’s constituents were passengers on Carnival Corporation’s Diamond Princess cruise ship, which for most of last month was the most dangerous place on Earth to be.

Allen revealed she’d spoken directly with both passengers, who are reportedly just fine. So no fancy face masks required for coffee in Toorak village just yet.

Meanwhile, in medico layman Hunt, Allen seems to have found something of a fan boy. “She is someone in my view who is a future health minister of Australia,” the incumbent gushed to Allen’s blue ribbon electorate. “We are very lucky to have her.”

All she has to do now is wait for Hunt to get out of the way.

Greig’s tax win

Andy Greig,the former Bechtel executive, has won his Federal Court appeal against the Federal Commissioner of Taxation to claim $11.85m of share losses in Nexus as deductions against his 2015 income.

The Scottish-born businessman, who resides in the Brisbane riverfront suburb of Teneriffe, successfully argued that he bought shares in the non-dividend-producing oil and gas company as a profitmaking venture. He’d made 64 acquisitions.

Federal Court judge Tom Thawley had ruled in 2018 that Greig was an ordinary investor who simply incurred a capital loss. However, the appeal found Greig was in the business of trading shares in Nexus.

The distinction between an income receipt and capital receipt is critical for determining tax outcomes, but is not always straightforward, with the appeal judges split. This week, judges Susan Kenny and Simon Steward agreed with Greig’s claim, but Justice Derrington ruled in favour of Thawley’s decision.

Justice Steward said he made his decision “after much hesitation”.

“It would, in my view, and generally speaking, be surprising if such trading, with its scale and periodicity, and with its express purpose of profitmaking, could be characterised as an affair of capital,” Justice Steward concluded after hearing the case put by barristers Brendan Sullivan SC and Rico Jedrzejczyk from Tenth Floor Chambers, instructed by PwC.

“His share trading was not a hobby; it was not a pastime; it was not private gambling or gaming. And it was more than a ‘mere’ realisation of an asset.”

The landmark Visy Packaging Holdings Pty Ltd v Federal Commissioner of Taxation, which concerned the acquisition of Southcorp, was cited along with the late 1980s Myer Emporium Ltd precedent.

A schedule of all Greig’s trades showed from 2007 to 2014 he’d purchased shares on 218 occasions, costing $26m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout