Rock star banker Matthew Grounds’ new investment advisory outfit — dubbed Grounds & Co — may have disappeared from the financial headlines, but it certainly hasn’t been abandoned.

Margin Call gleans the fledgling venture is still going ahead: later this year, but without its star frontman, at least for the time being.

Grounds will “be on deferred delivery” and others involved will front the venture in its initial months, in the words of one source close to the action.

It will still be 40 per cent backed by Hamish Douglass’s Magellan, putting paid to chatter about issues between Douglass and Grounds a couple of months back over the details of his non-compete with his former employer UBS, which expires at the end of 2020.

One of the reasons for Grounds’ deferred delivery status is said to be the rigorous enforcement of his gardening leave by the Swiss bank. Mosman’s Balmoral Slopes ain’t such a bad place for his time away from the desk.

But one initial backer who apparently won’t be there for the new venture is Barclays Capital Markets, which was slated to take a 10 per cent stake but pulled the pin because of regulatory and compliance hurdles.

More than 50 new staff are still set to join, including Guy Fowler, Grounds’ former co-head at UBS, and another former UBS banker Chris Williams.

Another big-name frontman mooted was supposedly former local Deutsche Bank boss Michael Ormaechea.

When the venture finally takes off it will do so as Grounds’ former employer is looking increasingly wounded by the loss of talent from its ranks over the past year, including more recently big names Aidan Allen and Robbie Vanderzeil.

Long used to dominating the league tables for local equity market transactions, UBS fell to fourth in the rankings for the six months to June 30, the first time in 15 years it has finished outside the medal position.

Good innings

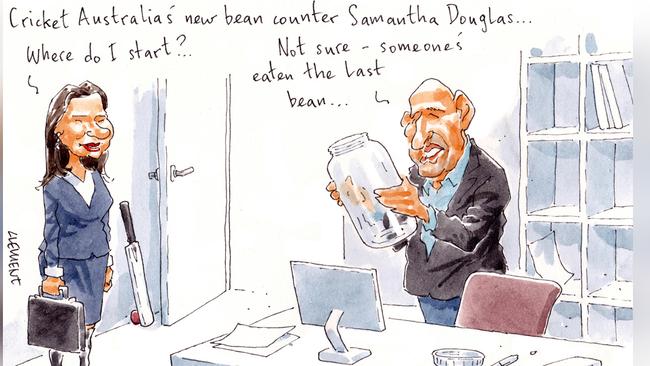

Cricket Australia’s search for a new chief financial officer is over. Their long-serving bean counter Todd Shand stepped down in January, but agreed to stay on to weather the COVID crisis.

The experienced finance executive Samantha Douglas takes the crease. She’s spent the past decade at NAB as general manager of financial control, having joined the bank in 2006. She previously held roles at Village Roadshow, Macquarie Bank and EY.

Not too much on her social media about any passion for the sport, rather just that she is a Carlton Blues fan.

Tim Morden, managing director at the Melbourne-based APAC recruitment firm SHK, was tasked with the recruiting.

The Old Ruytonian will be joining CA’s Jolimont Street from early August, and for the time being report to the overnight chief executive watchman Nick Hockley, who took over from Kevin Roberts. The board, which saw the departure this week of former Test fast bowler Michael Kasprowicz, continues to come under fire amid dire projections for the financial future of the flannelled game.

Wonder what her thoughts are on the revenue-sharing payment model that generates amazing annual incomes for its elite players.

Vale Svinos

One of the key names behind two of the biggest successful stories on The List — Australia’s Richest 250 has passed away in Melbourne.

Billionaires Eddie Hirsch and Avi Silver have been saddened by the death of George Svinos, who has been involved with their giant United Petroleum business for two decades.

Svinos had been group chief financial officer for the business for the past three years, and Hirsch and Silver said he was instrumental in United doubling in size and profitability since 2015. The duo were valued at $3.5bn on The List this year, with United now having more than 450 stores across Australia, enhanced by the 2017 introduction of the Pie Face retail business, which has more than 200 sites in five countries.

Before joining United, Svinos was a partner (head of retail) at accounting firm KPMG, where he had a long association with United.

Svinos died after a short illness, leaving behind wife Mary and three children Tess, Manny and Dimitri.

“George was well known for his tenacity, professionalism and loyalty to the company and the owners,” Silver and Hirsch noted.

Legal eagles

Corporate lawyer Amanda Banton and her new eponymous legal firm Banton Group have had a strong start to the financial year with the addition of former team member at Squire Patton Boggs, Ross Garland, as a partner.

The group has also added Andrew Horne, a former partner at Kirkland Ellis New York, as a consultant to push forward its practice in insolvency and litigation.

Banton Group lawyers have been responsible for some of the largest recoveries in Australia, including cases against Standard & Poor’s and Fitch.

On a pro-bono basis the Banton Group recently represent a grieving family who had been wrongly excluded from a MH17 class action appeal.

Moving on

The matrimonial St Kilda West home of the AFL glamour couple Jimmy Bartel and his estranged wife Nadia Coppolino, busy with her fashion line Henne, is up for sale. The former couple split mid-last year after five years of marriage.

They had bought the solid brick original home, built in 1904, for $3.76m in 2017, shortly after Bartel pulled the curtain down on his 14-year career at Geelong.

There’s been no change to the five-bedroom, three-bathroom home during their period of ownership.

There’s pressed metal ceilings, fireplaces, original William Morris wallpaper and tessellated tile flooring.

Despite some strong recent sales they may even see a loss on the home, having paid $3.74m, and buyers given a guide of $3.7m to $4m by listing agents Ben Manolitsas and Oliver Bruce.

Last weekend a nearby four-bedroom home sold for $3.67m, in one of Melbourne’s highest auction results. The suburb record was smashed late last year when a modern home not far from the beach was sold by the former IT services PS&C chief Glenn Fielding for $11.7m through Michael Paproth at The Agency. It toppled the $7.5m record set in 2018 when a converted church was bought by Icon Construction’s Ashley Murdoch from author Graeme Base and his wife Robyn.

Record price

There has been a stellar $17.8m hillside Bronte purchase by Pathzero founder Carl Prins and wife Kate.

The paperwork lodged by Kosmin lawyers shows the off-market deal was secured by lawyer Sarah Druce, wife of trader Keiran Horth. The Gardyne Street property is a contemporary residence which had an estimated $6m construction cost.

Bronte’s previous $16.8m high was on nearby Tipper Ave when Lisa Burgess-Hoar, wife of Frontier ad agency owner Neil Hoar, sold to Katie and Darian Jagger, boss of Cygnet Capital.

A decade ago Sydney investment banker Mark Carnegie and his then wife Tanya Nelson secured a record $13m for their hillside home, selling it to the Servcorp Moufarrige family. Carnegie had bought it in 1996 for $3.3m from the milliner Isabella Klompe and her late husband, Lend Lease co-founder Jack, who paid $1.6m in 1990.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout