Rick Otton asset freeze is extended

The assets of the now annulled bankrupt spruiker Rick “Buy a house for $1” Otton remain frozen by the Federal Court.

Otton has been permitted $1200 a week in living expenses, but the recent court hearing affirmed that the freeze order would only cease on payment of a $6m fine by Otton.

It was 2018 when We Buy Houses Pty Ltd and its sole director, Rick Otton, were found to have made false or misleading representations about how Australians could create wealth through buying and selling real estate, following ACCC action.

The penalties of $12m against We Buy Houses, and $6m ordered against Otton personally, were the highest ever imposed.

The recent hearing saw judge Nye Perram, of the “wagyu and shiraz” Westpac home-lending judgment notoriety, accept that a long-term restraint of Otton’s superannuation fund would “deleteriously impact upon its ability to conduct investment activities”, but the judge decided to extend the freezing order.

The hearing heard Otton’s superannuation trustee recently changed with Jane Otton replaced by Jovan Sarai and Stephen Keliher.

Otton, who is banned from managing corporations for 10 years in Australia, “peddled false hope”, said ACCC chairman Rod Sims on his initial court victory.

Otton taught strategies via free seminars and paid boot camps that claimed people could buy a house for $1, without needing a deposit, bank loan or even real estate experience.

Justice Jacqueline Gleeson had deemed the free seminars were a waste of time, and that the boot camps an expensive waste of time.

Between 2011 and 2014, We Buy Houses generated $20m revenue from training programs.

Mail’s shock exit

One of Australia Post boss Christine Holgate’s highest-profile hires has walked after just eight months.

Margin Call understands that Holgate’s new, high-profile chief spin doctor and former Victorian Labor minister Phil Dalidakis tendered his shock resignation on Monday morning.

Dalidakis, a former minister in Victorian Premier Dan Andrews’ government, was persuaded by Holgate to leave the state parliament and join

the national mail service in June last year.

His role was to be executive general manager of corporate services. His predecessor

in that job was paid $1.5m a

year.

The resignation comes as operatives from Boston Consulting Group comb Aussie Post floor by floor seeking cost reductions. On Monday, Australia Post reported a 46 per cent drop in first-half pre-tax profit to $83m as losses blew out at its embattled letter division.

Former Optus exec Fletcher has a review of Holgate’s organisation under way, too.

Dalidakis’s exit follows news that Post’s long-serving chief operating officer — and resident festive season Santa — is poised to begin a six-month career break.

Company secretary Erin Kelly, who was not long back from maternity leave, was

also made redundant at the

end of last year, while many other senior staff followed former boss Ahmed Fahour

out the door to Latitude Financial.

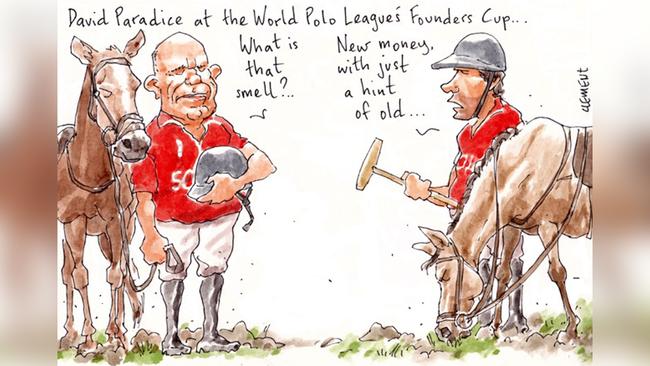

Paradice found

Sydney fund manager David Paradice is back in the saddle, although away from the desk.

He’s renewing his love affair with polo. Over the weekend his Scone team won two matches in Florida at the World Polo League’s Founders Cup.

Paradice, who founded the now $17bn Paradice Investment Services more than two decades ago, had only hopped off the jet when he was into the chukka a day later, despite not having played since last year.

“Para”, the self-confessed still-learning polo player, rubs shoulders with the world’s best in his four-strong team Scone, named after the rural NSW town where he was born.

Argentine polo players Adolfo Cambiaso, the world’s No 1 polo player, his 14-year-old son Poroto and fellow pro Diego Cavanagh line up alongside Paradice for Scone.

Onlookers say Argentinian polo is played at warp speed. “There’s not much room for error,” one observer told Margin Call. It was a windy, chilly day in West Palm Beach, but Scone notched up a 12-8 win, with Cavanagh scoring seven goals on the team’s season debut. Then the Scone team went on to win their second match 14-11.

Paradice is in good company off the field.

The World Polo League’s Founders Cup is co-founded by the Ganzi family, founders of Global Tower Partners.

The telecommunications tower company sold for $US3.3bn in 2013.

Wills sells up

The Belrose estate of esteemed retired company chairman Dean Wills is for sale. Wills led Coca-Cola Amatil as its chief executive from 1984 to 1994 when its worth soared from $400m to $8bn, then stayed around as chairman.

Aside from his business acumen, Wills was a car buff. His 12-car showroom garage at Belrose was among Sydney’s earliest and finest.

His fast prestige car collection rivalled that of Lindsay Fox and Peter Briggs. Wills was known to have bought 15 Ferraris over the years. But his showpiece was a 1994 McLaren F1 coupe, one of only 64 ever made. Racing identities Jack Brabham and Wayne Gardner would often drop around.

Wills, who also sat on the boards of Westfield, Transfield and Fairfax, bought the property with his late artist wife Margaret in 1994.

The three-level, six-bedroom manor that sits in 9490sq m grounds has been listed by Brian McMillan, of Sydney Country Living.

Horsing around

The rivalry between Melbourne horseracing officials saw an amusing Twitter exchange after Saturday’s meet.

The track at Caulfield was the hot talking point on Saturday, and Moonee Valley Racing Club honorary treasurer John Blight didn’t miss the chance to put the boot in.

A post by Blight, whose rogue Twitter account is now nowhere to be seen, suggested the track bias was an issue.

The ground closest to the fence was seemingly superior with eight of the nine winners sitting in the first three 800m from home, four leading all the way.

Host Josh Blanksby, who’s been in the top job at the Melbourne Racing Club for two years, took exception to the tweet, initially thanking Blight for the feedback.

“Impressed that you have such an expert opinion from the committee room where you enjoyed the hospitality,” Blanksby tweeted on Saturday night. “Look forward to perfect racing at Moonee Valley forever more — and on your business side …” as he ramped up the sarcasm.

The spat almost overshadowed the performance of Tagaloa, the $26 rank outsider ridden to victory in the $1.5m Group I Neds Blue Diamond Stakes by Michael Walker. Seems that Blight was finding winners hard to come by.

Packer Barham’s sale

Heiress Francesca Packer Barham has offloaded her South Yarra investment property.

The near $1000-a-week rental was surplus to the budding interior designer’s needs now that she spends the majority of her time between Sydney and London.

Packer Barham, the recent $15.8m Darlinghurst buyer of one of Sydney’s biggest one-level penthouses, bought the Grosvenor Street investment when living in Melbourne.

She’s spruced up the three-bedroom, 1890s terrace bought for $1.41m in 2015.

Listed two years ago asking $1.6m, it was relisted with hopes of $1.5m, and sold with price undisclosed on Saturday.

Williams Batters agent Philippe Batters secured the deal on a busy weekend in South Yarra for Batters, who also secured a sale for interior designer Thomas Hamel.

Three bidders drove the price to $2.81m, although there was just the one bidder after the Hawksburn Road property was announced on the market at $2.8m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout