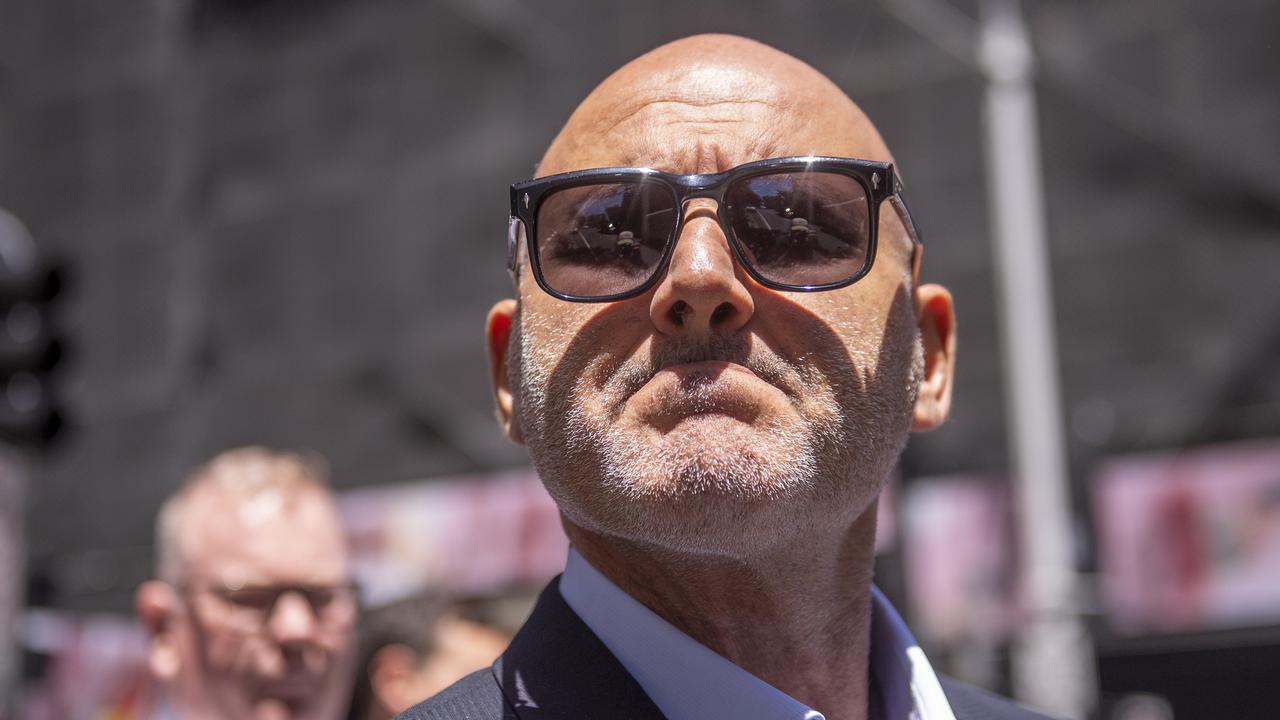

The only member of the Reserve Bank of Australia board from Perth, Mark Barnaba, has made a big splash in his home town.

The Harvard-educated investment banker has emerged as the mystery $8.5m buyer of the Mosman Park home of pokie king Malcolm Steinberg, founder of Leisure & Allied Industries, and his wife Frances.

The couple offered the 1480sq m block on the dress circle Saunders Street as a residential redevelopment project.

Margin Call is not aware whether Barnaba will proceed with the plans for the replacement neo-futurist six-bedroom MAED-designed residence, complete with helipad.

It is currently a four-storey 1970s cliffside home.

Either way it will be an upgrade for the busy Barnaba, who was recently appointed a director of the Damien Criddle-led specialist technology company GLX Digital.

He’s been Subiaco-based since 2000 when he bought a modest 1920s home for $800,000.

He was schooled at McKinsey & Company in Australia and overseas, and after five years at Macquarie Group, he was appointed to the RBA in 2017 by then-treasurer Scott Morrison, replacing oil man John Akehurst.

He resigned as Macquarie Capital’s head of global resources in 2017 when taking up the coveted position, given RBA board members are not permitted to be a director or employee of an authorised deposit-taking institution.

Barnaba will be able to advise board members at next week’s meeting that it took Steinberg some 2000 days to sell, not surprisingly fetching lower than the initial $13m price hopes of 2014. After the mining boom ended, Perth property has been in a downturn since 2014, with claims it’s bottomed emerging from the west every now and then.

Barnaba, who has been deputy chairman of Fortescue Metals since 2017, is a former West Coast Eagles chairman, heading the AFL team in the lean times from 2007 to 2010, but with one of the AFL’s strongest balance sheets.

Popular app

Jennifer Westacott says she is “a big fan” of the COVIDSafe app, and much of the Business Council of Australia elite were happy to show they were in lock-step.

They were headlined by NAB boss Ross McEwan who was minded to do so despite the day’s distractions and a UK app gremlin still on his phone.

Seek co-founder Paul Bassat was quick to download on Sunday, saying it was a simple process.

Mike Cannon-Brookes retweeted Bassat’s sentiment and shared his thoughts to his 62,000 followers.

“They (the government) are obviously operating with extreme urgency to get the app out. For you,” Cannon Brookes wrote.

“Give them a few weeks to clean up code.”

Cannon-Brookes urged tech-heads to remind people “how little time they think before they download dozens of free, adware crap games that are likely far worse for their data and privacy than this ever would be!”.

He suggested the angry mob mode should be turned off.

“We’re all in this together,” Cannon-Brookes said, adding the tech community could help the government.

“Find a bug,” he suggested.

Peter Strong, CEO of the Council of Small Business of Australia, called on Australians to download the COVIDSafe app.

“We need our economy to be able to recover,” he said.

Meanwhile, Australia’s richest man, Anthony Pratt, signalled he intended to download the government’s tracing app.

He hadn’t but was going to, Mr Pratt advised.

The Visy cardboard box boss is working from hometown Melbourne, so the Victorian health authorities can know exactly where he is.

Pratt recently celebrated his 60th with his family at their Raheen, Kew, estate.

They apparently enjoyed a vintage drop, a 1960 Penfold’s Grange Hermitage gifted by his sister Heloise Pratt.

And the Pratt Foundation has committed $1m to support clinical trials for COVID-19 treatments led by the Royal Melbourne Hospital’s infectious diseases clinician and co-lead of clinical research at the Doherty Institute.

Troy Hunt, the well-known web security expert, downloaded, as did trade union boss Sally McManus, economist Stephen Koukoulas and ABC’s deputy chairman and company director Kirstin Ferguson.

Comedian Charles Firth tweeted a warning about the app.

“I (accidentally) swiped right on the main screen and now I’m going out on a date with Peter Dutton tonight.”

Give generously

Andrew Liveris has joined Andrew “Twiggy” Forrest’s inner circle.

The former confidante to US President Donald Trump is the first appointment to the billion-dollar Minderoo Foundation’s board in six years.

Forrest and Darwin-born Liveris, who previously ran Dow Chemicals in the US before heading back to Australia, have been getting to know each other in recent years.

There was some bonding while watching the hockey at the Rio Olympics in 2016.

Liveris assisted Forrest last September by chairing proceedings when actor Harrison Ford addressed the Minderoo Foundation’s Sea The Future no-plastic-waste campaign at the United Nations HQ.

Liveris’s own philanthropy is emerging now he’s back in Point Piper, having been praised by Mr Trump as “one of the foremost leaders in manufacturing, one of the foremost leaders in the world of business”.

He acted as Trump’s manufacturing council head, having previously sat on an advisory panel for Barack Obama.

The Andrew Hagger-led Minderoo foundation has been active in recent weeks in the fight against COVID-19. Their campaigns have also centred on funding cancer research and improving indigenous work prospects.

The Minderoo board is a family affair boasting Twiggy’s wife Nicola and daughter Grace, who co-founded the initiative Walk Free, which has a mission to end modern slavery.

WA powerbroker Malcolm McCusker sits on the board, with his wife Tonya as an alternate director. Ditto the barrister Allan Myers and his wife Maria.

No sign yet of Paula Liveris.

But last year Liveris and wife Paula donated $13.5m of their own money for an academy in engineering, architecture and IT at the University of Queensland.

The JBWere Philanthropic Services Division, which tracks the top-end-of-town giving, indicated their donation saw them debut at number 11 of our most generous. The Minderoo Foundation ranked the nation’s second-biggest donor behind the Paul Ramsay Foundation.

Munce administration

Former champion jockey turned trainer Chris Munce and wife Cathy have put Munce Racing into voluntarily administration, but intend to train on.

The first meeting of creditors is scheduled for Wednesday with Geoffrey Hancock leading the administration. The ATO is a known creditor of the jockey who was affectionately nicknamed “the Dunce”. Presumably the creditors will be advised a few too many yearlings were bought without syndication members then coming forward.

His many current horses are still running, with the Dash for Dreams third at Ipswich on the weekend. Not enough winnings there, but he’s had couple of winners, including Scathing and Spirit Esprit, at other recent Queensland meets.

The administration appointment came after Joe Ivanovic at Financial Management Corporation, the company’s external accountants, approached Hancock in late March.

Mince wrote to reassure all owners “that it is business as usual at Munce Racing”.

“There will be no changes to how your horse is trained and cared for,” he told owners.

“Our vision for the future is that Munce Racing will become even better and stronger.”

Munce, who as a trainer officially only gets 10 per cent of recently reduced prize money, rode 42 Group I winners before turning to training in Queensland, with this base at Eagle Farm. As a jockey his wins included the big four, the Melbourne and Caulfield Cup, Cox Plate and Golden Slipper.

Debt extension

The listed real estate group The Agency advised shareholders on Monday it had secured continued financing for its $12m bank debt. Until May 1, for sure, and an indication their lender Macquarie was prepared to continue backing the agency until September 30. The mooted extension awaits formalisation.

No doubt Macquarie’s recent prevarication, and its preparedness to commit only to September, is due in part to the unknowns regarding the rental and sales market during and after the COVID-19 crisis.

Its shares, having halved to 4c, reflect a $12m market capitalisation.

Its managing director Paul Niardone has boasted the Agency’s prized asset was a rent roll valued at $23.5m. But the agency and their bankers will be hoping not too many of their 4500 tenants are angling to seek the much-mooted rent-free, eviction-free, six-month scenario. When updating shareholders earlier in April, The Agency suggested it had been in discussions with “other credible debt providers”.