Pretender to the Lodge, Dutton holds an uncommon wealth

One-time rich-lister Malcolm Turnbull broke the mould when it came to wealth in our nation’s highest office.

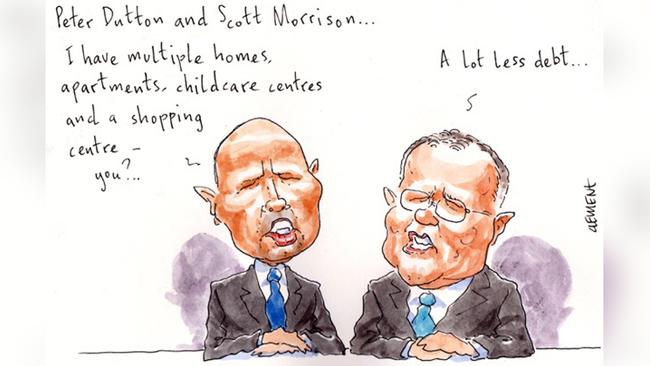

So what of the affluence of his duelling potential successors Peter Dutton, 47, Scott Morrison, 50, and Julie Bishop, 62, as they contemplate Australia’s top job?

For all his humble origin story, former Queensland cop Dutton is the richest by far of the trio.

Dutton, with his wife Kirilly Dutton, 44, have two sons. The pollie has a daughter from a previous relationship.

All of Dutton’s considerable wealth — his property portfolio alone is worth north of $10 million — is tied up in the Sunshine state. He’s nothing if not loyal. Or parochial.

No wonder Queensland Liberal National president Gary Spence is such a fan.

We now know plenty about multi-millionaire Dutton’s childcare operations: two centres in Brisbane run out of rented premises and which are now at the heart of a new constitutional controversy thanks to recent changes to the way childcare subsidies are paid.

The suddenly politically powerful Solicitor-General Stephen Donaghue will shortly opine on that arrangement. It’s not clear his verdict will be definitive by midday today though.

The Dutton family has also established a family trust, of which the Duttons and their children are beneficiaries.

The family lives in an expansive six-bedroom home with pool in a bushland setting in Camp Mountain, about 20km from Brisbane.

They bought the home in 2003 for $710,000. It is now worth as much as three times that.

The Duttons also have an extensive residential and commercial investment real estate portfolio, including a small shopping centre, Edison Plaza, in Townsville’s Wulguru (mortgaged to Shayne Elliott’s ANZ) that returns an estimated $140,000 a year in rent.

He also has a villa in Morton Island’s Tangalooma Resort and an apartment in Spring Hill’s Johnson Apartment that is run as an Art Series Hotel.

Rents there start at $450 a week.

If Dutton gets the top job and needs a break from the madness, there’s also the option of his $2.325m oceanfront home at the Goldie’s Palm Beach. The home is on what the locals call Millionaire’s Row.

And while in Canberra, Dutton stays in his fresh one-bedder in Kingston, for which he paid $515,000 in 2012.

Plenty of nest egg there, however today works out.

One humble abode

Less flush and with fewer first world headaches is Cronulla Sharks number one ticket holder Scott Morrison.

ScoMo, the member for Cook, lives in the Sutherland Shire’s Dolans Bay with his wife Jenny, whom he started dating when he was 16. They have two daughters.

The Morrisons bought the three-bedder home with a pool almost a decade ago for $920,000. It’s mortgaged to Matt Comyn’s CommBank.

Apart from that, there are no corporate structures, no directorships, no other assets, except for superannuation with MLC, the scandalous wealth arm of Andrew Thorburn’s NAB. Enhancing ScoMo’s Liberal credentials, there’s a family trust.

But it’s dormant. That’s a pollie’s life.

Quite the portfolio

As for the globe trotting, 20-year member for Curtin Julie Bishop, it’s more the sort of financial set-up you’d expect from a veteran Liberal.

The structure employed by the 62-year-old hitherto deputy boasts an obligatory corporate trust, a sprinkling of share investments (she’s backing Telstra’s Andy Penn), unit trusts and self-managed super.

Last night, JBish was working the phones drumming up support for her run at the leadership (and insisting this time she would not run as anyone’s deputy). When she is at home she rests her head in a waterfront apartment in the Perth suburb of Crawley.

The previously married Bishop (she doesn’t publicly expose the assets of new partner David Panton, but he owns some chemists in Victoria) has packed the unit with antique furniture.

JBish also has an investment property in the Adelaide Hills, where she grew up. The rebuilt historic pioneer cottage — owned by her company Isdell Pty Ltd — is at Basket Range and is rented out to holiday makers under the banner “The Waterfalls at Bishops”.

There you can live like a foreign minister for $300 a night.

And when she’s in the capital, Bishop has modest residence in Red Hill.

Who knows, by this afternoon she might be moving to the The Lodge nearby.

Hawks eye CKI bid

Investors in gas pipe owner APA will feel the full Peter Dutton effect today.

The prospect of a Dutton prime ministership has increased the chances of rejection by the Foreign Investment Review Board on national security grounds of Hong Kong’s CK Infrastructure Holdings’ $13 billion bid for APA’s 7500km-long east coast gas grid.

CKI is a Hong Kong outfit controlled by billionaire Li Ka-shing’s family, but security hawks, who include key Dutton backers Concetta Fierravanti-Wells, Andrew Hastie and Jim Molan, see the influence of Beijing at work behind the listed infrastructure giant.

That spooked investors. APA’s share price yesterday fell 8 per cent to close at $9.33. Its market cap is now just over $11bn, almost $2bn below CKI’s takeover price.

Even if Dutton doesn’t get up, there is concern among investors about whether the bid will be approved by a teetering Coalition in the current political environment.

That’s bad news for Richard Wagner’s Morgan Stanley investment bankers, who are advising CKI.

APA, which is chaired by Michael Fraser and led by managing director Mick McCormack, is well aware of the political sensitivities of the deal.

Indeed, after the CKI bid was announced in June, McCormack went on a trip to North America to meet with other potential bidders without links to Xi Jinping’s Middle Kingdom.

Margin Call understands the visit by McCormack — a big ice hockey fan and Canada-tragic — included Montreal, Toronto and British Columbia’s capital Victoria to meet with various pension fund behemoths.

While none would pay as much as CKI, a FIRB rejection could put APA in play; just ask local infrastructure funds management giant IFM, which with the eagle-eyed assistance of its advisers from Matthew Grounds’s UBS, is watching developments intently from the sidelines.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout