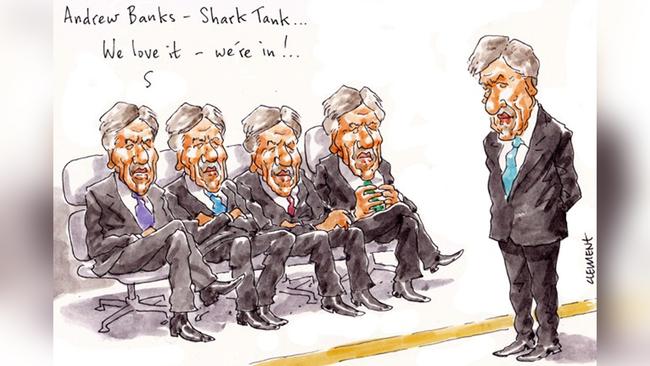

Plastiq fantastic for Shark Tank’s Andrew Banks

Entrepreneur Andrew Banks, who will shortly move into his luxury renovated Point Piper home with wife Andrea, is crowdfunding his latest start-up.

The star of Channel 10’s much-rested reality series Shark Tank has quickly secured some $165,000 for Plastiq.it, billed as a new way of shopping with loyalty cards. The injected funds more than doubled as the social media roadshow got under way on Wednesday.

Banks was “really excited. I was fed up with all my various loyalty programs and points and the fact that I had to remember which card for what brand.”

He said Plastiq could have easily just raised from venture capital firms, but he wanted “to create a community of shoppers and stakeholders”.

They will take just $150 to “share the success”.

At 900 members currently, the goal is to have 150,000 members by December who will benefit from savings of $250 a year by earning cash back on their in-store or online purchases.

Some 500 retailers are on board, including The Iconic, JD Sports, Woolworths, Caltex, and the Manly Warringah Sea Eagles.

Banks — who has many life mottos, including “I don’t think we should tip-toe through life towards death” — has been working on the project with CEO and co-founder David Anderson, who was previously (and briefly) boss at draft beer tech business Fizzics.

Banks has longtime business associate Tricia Stevens on the board, too.

They plan to use the fresh funds to expand their marketing, which saw them feature on the illuminated sidelines at Melbourne Storm games last year.

The former Los Angeles-based Banks couple have $1.4m Bokor Architecture alterations under way at their $21m non-harbourfront Point Piper home, with plans including zinc roofing.

Banks will call on landscaper Paul Bangay to create the gardens, while Thomas Hamel has been lined up for the interiors.

Banks, who started his career as an actor in England at The Old Tote Theatre Company, made his fortune in the recruitment industry, co-founding Morgan & Banks in 1985 with Geoff Morgan.

The Banks made headlines in 2010 for the $52m sale of their waterfront mansion, Villa Veneto, to the Penn family.

Wizard’s new spell

Expatriate funds manager Greg Coffey — long known as The Wizard of Oz — is thriving in his hedge funds comeback.

Last year the fund of the city whiz kid returned 28 per cent, easily beating the typical 6 per cent industry feat, according to calculations by the Hedge Fund Research Index.

Amid an era of low returns and Brexit apprehension, Coffey’s Kirkoswald Asset Management is reportedly set to stop accepting fresh cash from investors as its assets approach $2bn on its second anniversary.

After its February 2018 launch, the fund gained 5 per cent in its initial year. Operating out of Sloane Street, Knightsbridge premises before a move last year to Madison Avenue, New York, Kirkoswald Capital generated management and performance fees of £2.8m ($5.39m) in its initial year, according to the latest UK’s Companies House filings.

The investor returns came from a mix of equities, bonds and currencies, boosted by rallying interest rates in emerging markets.

Over his near two decades, Coffey regularly made headlines with annualised 17 per cent returns until his surprise 2012 retirement decision, aged 41, to spend more time with wife Ania and their children.

Coffey had established his reputation at GLG Partners, having spent a couple of years in the early 1990s at Macquarie Bank.

The Macquarie University finance graduate also worked at Moore Capital Management for billionaire Louis Bacon, who doubled his investment in the Kirkoswald fund after it showed a return of 4 per cent in its first seven weeks.

Coffey’s not all work no play however, being a keen golfer.

In 2010 he bought a 4900ha Ardfin estate on the island of Jura off the west coast of Scotland from the John Smith brewery family.

Amid all the deer, a spectacularly scenic 18-hole private golf course was designed for Coffey by Bob Harrison, who designed the Ellerston, Hunter Valley course for the late Kerry Packer.

“Epic” was the recent description of the course by Christian Faegemann, the Golf Magazine World Top 100 panellist.

The golf course contractors, who’ve built for Donald Trump, described Ardfin as the most logistically challenging course ever built in the UK.

In Sydney, Coffey retains a Balmoral compound, acquired over seven years at a cost of $18m, plus a Whale Beach retreat.

Mulder’s new rein

Terry Mulder, the former Victorian transport minister in the Baillieu and Napthine governments, has celebrated his first win back as a horse trainer.

It was in the last at Monday’s Hanging Rock Cup fixture for the owner-trainer.

The mare had previously had 10 places from 26 starts.

Mulder’s only horse in his Colac stables is the seven-year-old mare called, Press Release, who cost $4400 at an online auction. She is from Publishing out of Our Tintola (Show A Heart).

Mulder left Spring Street in 2015. He’s since taken a course to get back his horse trainer’s licence, something he did before getting into politics, where he was in parliamentary horse syndicates with colleagues including Denis Napthine and Robert Doyle.

Shearer on move

There were moving trucks outside the former 1930s Masonic Hall in Newtown, with Brett Shearer, executive at global logistics software developer WiseTech, recently helping the unload with his children and wife Bronwyn.

It had been a short trip for the vans as the family was moving from the nearby inner-west suburb Stanmore.

Shearer is the chief technology officer at the ASX-listed WiseTech, which ended 2019 in controversy surrounding reports of its financial accounts.

The adverse claims by investment adviser J Capital contributed to about $2bn being wiped off WiseTech’s valuation. WiseTech’s boss, Richard White,maintained the claims were “wrong” as the share price fell from $34 to $26 in October and now sits at around $24.

The Shearers paid a Newtown record $5.05m for the former Masonic Hall, which had been the three-decade work in progress of artist Tom Arthur and wife Sandra, who had paid $255,000 in 1987.

The Agency’s Ben Collier had a $5.5m guide, so well above the Newtown record that had stood since 2017, when Peter Yialas, the managing director at the ICT services provider DX Solutions, spent $3.85m on an 1870s home with pool.

The Shearers sold their Stanmore home for $2.84m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout