Pay days amid the pandemic

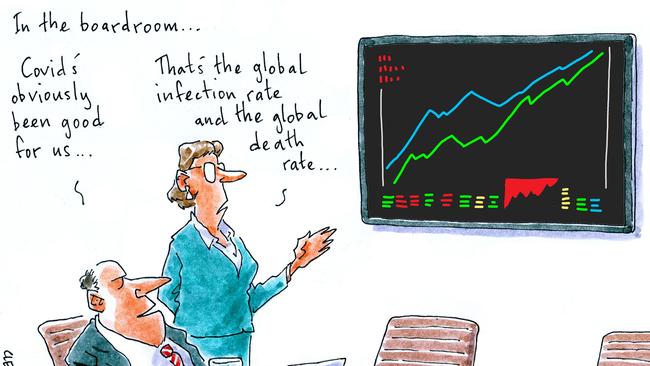

Were it not for the repeated references to COVID-19, lockdowns or panic buying, you would hardly think there was any unfolding pandemic based only on the interim earnings releases to date.

That, and the fat dividend cheques soon to make their way to the pockets of Aussie investors.

Of course, there’s always a select few of the investment elite set to reap outsized gains — none other than Fortescue’s Andrew Forrest and Seven’s Kerry Stokes to name just two.

The West Australian billionaires are set to add $1.6bn and $46m to their respective bank accounts, along with fellow west coast mining magnate Chris Ellison, who will net just over $22m after his Mineral Resources trebled its interim payout.

Pay days aren’t just reserved for the west, however, or just to those of the chairman or founder ilk.

Executives are also taking their share — just look at BHP’s Mike Henry, for example, who after the vesting of more than 100,000 shares in August will net a tidy $510,000, or even his predecessor, the recently knighted Andrew Mackenzie, who has $345,000 coming his way.

Over at heavyweight CSL, chief Paul Perreault and chairman Brian McNamee, meanwhile, are each set for a handy near $220,000 cheque come April 1.

In the retail world, Domino’s is a standout — its biggest investor, Jack Cowin,is reeling in sharemarket gains as well as dividends.

As Margin Call colleague Glen Norris aptly put it earlier this week, Cowin’s stockmarket gains just on Thursday were already enough to feed every man, woman and child in Australia and New Zealand with his budget $5 pizzas — what he’ll do with his $20m dividend cheque is a whole other matter. Might we suggest something from the gourmet range?

With earnings season only half over, though, there’s plenty more to come, including records likely to be smashed over at Harvey Norman.

Add that to the special dividend of last June and it is no wonder Gerry Harvey had a little extra cash to splash, the proceeds of his shares alone likely to cover at least a year’s worth of sponsorship revenue for his new tie-up with Super Rugby.

Love match

The crowds may be limited, but that’s not stopping Melbourne’s finest from stepping out to enjoy a spot of tennis and to revel in the freedom of being in public.

None more so than James Packer’s favourite banker Ben Gray, who was spotted in the Rod Laver Arena stands as Novak Djokovic took down Russian Aslan Karatsev in straight sets on Thursday night.

The BGH founding partner stepped out in a pair of shorts and was clearly smitten with his new squeeze, the Rail, Tram and Bus Union’s Victorian secretary, Luba Grigorovitch — the two are said to have become quite serious over the past 12 months (being locked inside together might have that effect).

Both could not keep their hands off each other as they worked through both white and red wines, with one spectator noting to Margin Call that the usually serious banker could hardly keep the smile off his face.

Not even less-than-premium seats could ruffle the so-called Mr X — the two sneaking down to the better rows to get closer to the action midway through the first set.

That said, all was over after just one hour and 53 minutes, with many in the arena left wanting more.

Casino house winning

Alas it seems Margin Call may have stumbled upon a rare gem in the casino world of late.

A good news story. And at Canberra’s very own Aquis Group, no less.

Shares in Tony Fung’sAquis Australia have shot up as much as 21 times over the past two trading sessions — settling at 40c for a gain of 247 per cent on Friday alone.

Responding to a “please explain” from the market on Thursday, chief Allison Gallaugher confirmed there was no explanation for the take-off in the stock.

Management will no doubt be keenly awaiting the details of the latest daily share settlements, with insiders confirming to Margin Call that they were indeed baffled as to the ever-rising share price.

The group’s latest quarterly is hardly the picture of a rocketing company — in its first full quarter after COVID-19 shutdowns, the group made just $9.3m from customers, leaving just over $7m in the bank at the end of December.

Whether the recent movement could be the group’s own GameStop moment … “it could very well be”. Though of course that’s all speculation, what those in local day trading circles are more than familiar with.

Aquis will be hoping those joining the register are more of the diamond hand type than those just out for local “tendies”, but we’re not holding our breath.

Copyright fight

While media behemoths such as Google and Facebook were hogging headlines, it seems a smaller player has crept under the radar.

Media monitoring outfit Streem, headed by Elgar Welch, was the subject of questioning before the Copyright Tribunal earlier this week, with details of its spat with Copyright Agency Limited (CAL) laid bare before the court.

Of course, the two are now bedfellows, after signing a landmark multi-year deal in October.

That didn’t stop CAL chief Adam Suckling from exposing just how fraught relations were between the two leading up to the final deal.

Under cross-examination by silk Cameron Moore, Suckling confirmed CAL had raised concerns that Streem was in breach of its reporting obligations, elevating those to the board in 2019.

Details from his CEO board report of July that year show the situation was so dire the group had even raised Streem’s reporting approach with a number of Streem’s key customers (the likes of corporate and government types) and continued to hold concerns all the way through the negotiation process until October last year.

Further, Suckling agreed with the counsel that in the “give and take of negotiations, that point was conceded by you in the ultimate licence”.

Fast forward to the announcement of said deal, and Welch told this very newspaper he “saw little point in going to court with my major suppliers”, adding that “it beggars belief that Meltwater and Isentia are still bickering over the price of content in court”.

Funny that.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout