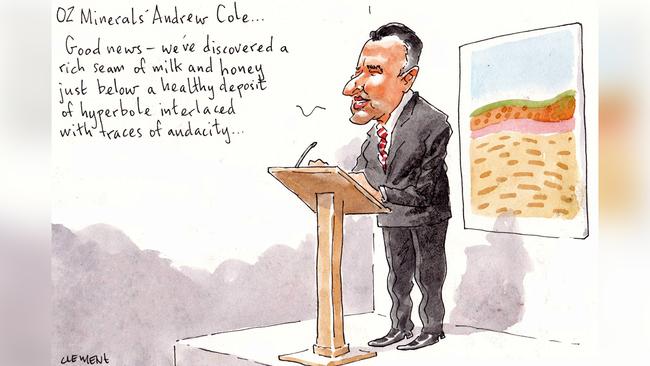

Having freshly rebuffed a BHP takeover offer, OZ Minerals chief Andrew Cole emerged on Friday armed with 54 pages of glossy slides and an impassioned plea to shareholders, even invoking motherhood statements to spruik his company and shoo away the temptations offered by the big miner.

Breaking from the banality of standard investor briefings, analysts were deluged with paperwork and visions for the company that sought to bury an underwhelming set of half-yearly numbers, entombed alongside any suggestion that BHP’s offer might well still be in play.

Regarded as a staid, conservative persona, Coles threw all to the wind with souped-up visions promising fortune and glory – a doubling of production forecasts, a suite of mine expansions, a pursuit of the megatrend driving demand for electric vehicles.

“We are focused on decarbonising our world for our children,” said Cole, who couldn’t have uttered such a stale platitude without an invisible gun jammed in his back. These are desperate times at OZ Minerals and Cole – not unlike the great Hyacinth Bucket – is intent on keeping up appearances.

The rest of his presentation was jazzed up with additional guff about a “sharpened future focus” and a “purpose driven company” with “refreshed strategic aspirations”.

It’s almost impossible not to attribute this flagrant hotdogging to BHP’s recent takeover play, which ended with a non-binding offer of $25 per share that was swiftly rejected without a skerrick of negotiation.

Unsurprisingly, there remains a paucity of information as to how OZ Minerals might fund this green dream, let alone its existing projects and expansions. It’s all a great mass of theory at the minute. Coles is clinging to the notion of using cash flow and partnerships to fill the gaps but, by the company’s own estimates, about $4bn in capital would be required to accomplish these feats. That’s about half of its market cap.

Meanwhile, revenue at OZ Minerals is down 6 per cent on consensus estimates, with the company reporting $909m for the first half and an EBITDA of $358.3m, or 36 per cent lower than those same forecasts.

We couldn’t also help but note Cole’s bemusing change of heart on the company’s West Musgrave project, which one month ago was in danger of being heavily delayed, as he told the Fin Review. By Friday, however, the outlook was back to being all milk and honey again.

Nothing to do with BHP’s offer, of course, although some analysts remained sceptical during the call. “We’re just working through the commercial packaging of the project,” Cole said.

Either way, for all its bluff and blarney, the presentation didn’t do much to move the needle on the market, with the company’s share price closing 0.76 per cent lower.

-

ScoMo be praised

Scott Morrison received plaudits from unlikely quarters of Twitter and other regions of the Left after it was revealed that he took a large contingent of his staff to see Top Gun: Maverick at Hoyts Cronulla after he was removed from office.

But it turns out the tickets weren’t even paid for by Morrison and were comped by the cinema itself, as he revealed in his parliamentary disclosures – grudgingly, we suspect, having left them to the last minute to upload on Friday.

So much for the virtue of generosity, as mentioned so often in the Good Book.

A number of other curiosities appeared on the form, including a return business class airfare to attend Perth’s Victory Life Centre, the Pentecostal church where the former PM made an ass of himself by telling the congregation to place their trust in god rather than the government.

And according to the forms that appearance was a paid gig, too.

-

Teal for real?

Meanwhile, yet another case of do as I say, not as I do.

Teal independent Kylea Tink has let it be known that she owns shares in two fossil fuel companies: Beach Energy and Viva Energy Group.

Not exactly what Margin Call expected from a Climate200-backed candidate. Viva owns a Geelong oil refinery and retails Shell-branded fuels across the country. Beach Energy, backed by Kerry Stokes, is in oil and gas exploration plus production.

Bear in mind that it was Tink who railed on Twitter last year against the Australian government for setting up a pavilion, sponsored by a fossil fuel company, at the COP26 climate talks.

This is also the same MP pushing the Albanese government to legislate fuel-efficiency standards for vehicles, so petrol-powered cars can be removed from the roads.

-

Driving in circles

This from the annals of an endless cross-examination which took place between Mercedes Benz and its Australian dealerships in the Federal Court.

Last week we brought you a snippet of evidence provided by Jason Nomikos, an executive with the German automotive giant, who had been accused under grilling of likening the company’s franchisees to a set of piglets.

Not so, Nomikos told Tim Castle SC, who is acting for the dealers – he had likened them to wild boars, which apparently hold a virtuous place in Germanic mythology for their courage and tenacity.

That’s where we left Nomikos a week ago, but it seems that he’s remained in place ever since, covering a marathon nine days on the stand and often answering the same circuitous questions asked of him days earlier.

“This is the fourth and fifth time that this very topic has been traversed,” said a fed-up Robert Craig QC on Friday, representing Mercedes.

“It’s going to end today,” said judge Jonathan Beach, who agreed that there had been “some repetition” and decided to put a foot down. “If the day is soaked up in duplication so be it, but it will end today.”

Castle appeared to have exhausted himself and had to be corrected by the judge, who took pity. “I think you need lunch,” Hizzoner said.

“I think I do.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout