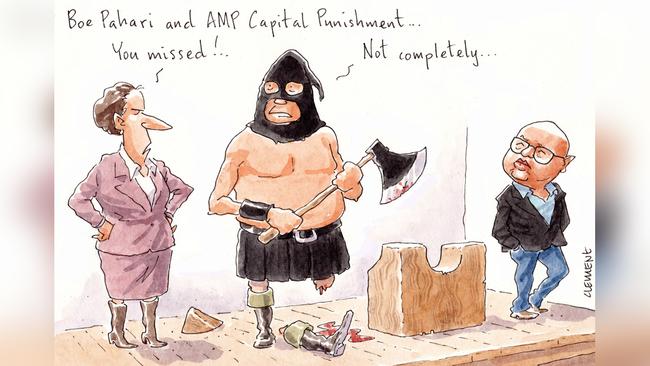

Once a headline, Boe Pahari leaves AMP as a footnote

In the end, the exit of controversial AMP executive Boe Pahari was consigned to an effective footnote in wider news from the troubled financial services group on Friday.

It was a bottom-of-the-page reference for a man who last year so enraged his female AMP colleagues and AMP investors, and was a key factor in the demise of former Commonwealth Bank boss David Murray as AMP chair in August last year.

AMP Capital’s London-based global head of infrastructure equity and northwest region Pahari is out the door with little fanfare after causing the now Debra Hazelton-chaired group so much pain last year.

It was Pahari, of course, who was elevated to run AMP Capital last year — one of the group’s highest paid and senior roles — and then demoted back to his old job less than two months later after it emerged that he had been penalised by the AMP board over a 2017 sexual harassment matter, which the board then characterised as “lower level”.

At the time, Pahari’s annual bonus was cut by 25 per cent, but his career at AMP rolled on, culminating in his 2020 promotion to run AMP Capital.

Pahari’s elevation, however, infuriated his female colleagues, created a public storm and precipitated chairman Murray’s resignation, with Pahari demoted back to his old gig, which he is now leaving.

“Mr Pahari will work closely with the infrastructure equity leadership team to ensure a smooth transition,” AMP said in its statement.

The 59-year-old exec is unlikely to be exiting with a pocketful of stock, with AMP’s annual report revealing he has just 218 AMP shares, along with 1.6 million share rights, the details of which are undisclosed. Whether the AMP board grants these to the departing Pahari remains to be seen, as is any payout he may have negotiated, which will become apparent in next year’s AMP annual report.

We look forward to that.

Keeping it real estate

The folks at Brisbane-based software company Octopus Deploy, husband-and-wife team Paul and Sonia Stovell, are keeping it pretty real for a pair who are being dubbed as Australia’s next Atlassian-style tech success story.

This week the couple revealed they’d sold a $US172.5m ($221m) undisclosed stake in their 10-year-old company to US venture capital giant fund Insight Partners, which had approached the tech entrepreneurs with a firm offer in October last year.

A deal was done to take in Insight Partners as a new shareholder alongside the Stovells and existing investor British software company Redgate, FIRB approval has been forthcoming and the rest is now part of Octopus Deploy’s young history.

The Stovells, who have three kids and started the business as an evening and weekend operation from home before taking the leap to full-time in the second year, say they have maintained “control” of their company, but documents are yet to be lodged to reveal the extent of Insight Partners’ new holding.

But there is no Mike Cannon-Brookes or Scott Farquhar-style multi-million-dollar historic harbourside mansion for these tech millionaires and their family — well, not yet anyway — now that they are on the international radar and potentially headed for unicorn status. The Stovells live in a very nice colonial Queenslander that sits on land that backs onto the Brisbane River in south west Brisbane.

They paid $2.2m in 2015 for the home, which is lovely, boasting some stunning river views, but by no means what you might expect from a family on such a heady trajectory.

Paul Stovell, who taught himself coding, grew up in South Australia’s Whyalla and we reckon it shows.

How very refreshing.

Memories banked

After what will be three terms in the federal parliament, George Christensen will leave with plenty of memories, but apparently little else when it comes to the accumulation of assets over almost 12 years in public office.

The 42-year-old member for Dawson via Manila was first elected to the House of Representatives in 2010, but since then has developed few income-producing assets from which to launch life post-politics. Christensen, who according to the Department of Finance as a backbencher is paid a base salary of $211,250 a year, doesn’t appear to own any real estate, living in a rented townhouse in Mackay, which sits within his Queensland electorate.

Christensen, who married April Asuncion in 2019 after the pair met in The Philippines, has a clutch of bank accounts and a credit card variously with NAB, Westpac’s RAMS and Bendigo and Adelaide Bank, which might explain some of where the retiring pollie might be stashing cash. Maybe perhaps some under the mattress, too.

No assets are disclosed for Asuncion.

As a parliamentarian, Christiansen has also been eligible for other lucrative allowances over the course of his time in office.

There’s an electorate allowance, travel allowance, payment for a phone and internet connection at home and an effective $19,500 a year for a car.

Christensen isn’t much for investing in the sharemarket, either — he hold no listed shares and discloses only a holding in a company, QPAY Pty Ltd, that we can’t see exists — not in the companies regulator’s records anyway.

He is a director and shareholder, however, of an entity called Imagio Pty Ltd, which is owned with his 66-year-old dad Ian Christensen, who also lives in his son’s electorate.

Happily though, on retirement at the next election — likely next year — Christensen will be entitled to a “resettlement allowance”, equal to six months salary, which in this case would be about $105,000. Plenty, you’d hope, to keep the wolves from the door at least for a while yet.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout