It has been canvassed for two years, but CBA boss Matt Comyn has moved to dampen the prospect that he’ll be spinning off Aussie Home Loans.

That means its cashed-up founder Aussie John Symond might not get the chance to buy it back, should he ever have wished to do so.

Symond sold out in three tranches, initially in 2008, again in 2012 and then the last stake in 2017. It saw him take cash and equity in CBA, which he retains.

Comyn would only tell broking industry trade websites that CBA was still exploring options over the medium and longer term.

It was first mooted in 2018 and appeared quite likely after the passage of the Best Interests Duty Bill in 2019 following the Hayne royal commission.

“I think we don’t feel a near-term pressure to exit,” he told The Adviser, adding he’d been pleased with the performance of Aussie.

Abandoning its demerger plans was one of the options being considered.

Symond was quizzed on potentially buying back the pioneering brokerage last year in the wake of the royal commission fallout over banks and their mortgage broking outfits.

He advised that he’d expect the CBA would talk to him should the time ever come.

Margin Call reckons it would be lunacy for Symond, currently recovering from knee surgery, to consider buying it back. But he is cashed up from the sale of his megayacht Hasna.

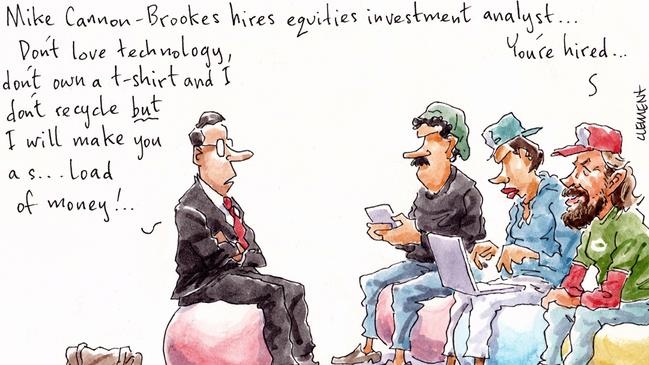

Grok seeking grunge

Billionaire Mike Cannon-Brookes is hiring. But it’s not to add to his 4400 strong workforce at his Atlassian start-up.

It’s for his boutique family investment office.

Grok Ventures is seeking another equities investment analyst to join the small team at their Surry Hills premises. The recruitment ad suggested the appointee was “more likely to be wearing T-shirts than suits”, MCB’s casual attire exemplar.

The new staffer will be “scouting, reviewing and filtering” investment proposals for listed equities, while critiquing and participating in team investment decisions in other areas such as start-ups, infrastructure, fixed income, hedge funds and cryptocurrencies. The job will require the exploration of the fundamentals of the transition to renewable energy.

Grok’s portfolio currently includes Brighte, the buy now pay later platform for the installation of energy-saving add-ons. There’s a stake in the food and organics waste management firm Goterra. Plus the China-based robotics and artificial intelligence company August Robotics.

Grok has recently taken on former JPMorgan analyst Sam Tidswell, who has spent time at the likes of Mark Carnegie’s alternative asset entity and Berry Liberman’s Small Giants Australia.

The office is run by Armina Rosenberg, who spent seven years at JP Morgan and a year at Audant Investments, the family office of property and equity market rich lister Robert Whyte.

After 24 hours online, Grok’s job posting had 36 applicants.

My work here is done

Former Vodafone chief commercial officer Ben McIntosh is tipped to shortly join the Bunnings executive team.

It comes five months after McIntosh resigned from the telecoms company just days before the Federal Court ruled on the merger with TPG Telecom.

McIntosh has been at the telco since 2014, having joined as director of sales. He was bumped up to COO in 2017. He left saying there was not much personally or professionally he could improve on at Vodafone so it was time to leave.

Lipstick’s lament

It was nearly 20 years ago when US billionaire Leonard Lauder, of the Estee Lauder cosmetics giant, coined the term “lipstick index” to describe the 2001 boom in lipstick sales.

He concluded women see lipstick as an affordable luxury, and sales stayed strong, even in times of duress.

But the duress the world is under now, paired with the social obligation or legislative requirement, of wearing face masks when leaving the house, has made buying the little red tubes quite redundant.

Masahiko Uotani, the chief executive of Japanese personal care company Shiseido, said on a call to investors earlier this month that COVID-19 had seen consumer behaviours around the world change dramatically.

“Frequencies to use make-up like lipstick are decreasing as people go out less and wear masks,” Uotani said after they company posted its worst loss since the early 2000s recession.

April’s Amazon sales of lip care and colour dropped 15 per cent, and COVID was only just starting to hit worldwide.

But it’s not to say all make-up has faded. It’s now all about the above the mask features. Think eyes and brows.

Sales of eye make-up rose 204 per cent in the three-month period to July, according to data insights firm Kantar.

Lipstick’s declining utility during isolation has meant social media tutorials from full-lipped influencers have thankfully all but disappeared.

Selling up

The newly minted Optus boss Kelly Bayer Rosmarin and her CBA husband Rodney Rosmarin have decided to list their Vaucluse home

The 2009 Brian Meyerson-designed home set in Peter Fudge gardens was bought for $4.5m in 2012, just as the Sydney property boom began.

Back then Kelly was at CommBank. Rodney’s been there for over 15 years and is currently general manager sustainable change.

Laing + Simmons Double Bay agents D’Leanne Lewis and Jacob Hannon describe it as the “quintessential Vaucluse home”.

Rosmarin took the top job at Optus from outgoing boss Allen Lew in April, having joined the telco as deputy CEO just over a year earlier.

Rosmarin and Beyer have had a luxury Bowral weekender since 2009.

Shareholder revolt

The latest financial results of Treasury Wine Estates are likely to fuel the intensity of class actions it is facing. The Tim Ford-led TWE, which saw a 25 per cent fall in net profit, is facing two sets of disgruntled shareholders who have seen their latest final dividend fall to 8c a share, down from 20c.

After their January earnings update, Slater & Gordon instructed Fiona Forsyth QC and Maurice Blackburn instructed William Edwards to pursue their respective class actions. TWE is represented by Michael Garner, instructed by Herbert Smith Freehills.

Ford only replaced Michael Clarke as CEO in July. And its chief legal officer Kirsten Gray commenced her role in March from Orica.

Court bungle

Oh dear. There was a Federal Court hearing on Thursday that was supposed to be ex parte.

Only issue was that it had inadvertently been published in the public court list, so Margin Call hopped online to report the matter.

There was an immediate application from ASIC’s barrister Jonathon Moore QC for the media present to leave the online hearing.

We did so.

The media exclusion was granted after ASIC made it known the hearing sought to protect the interests of investors, and that end would be assisted by holding the hearing in private. Moore expressed a fear that there was a flight risk with the chief executive potentially leaving the jurisdiction and that further assets could be taken overseas.

We’ll keep you posted.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout