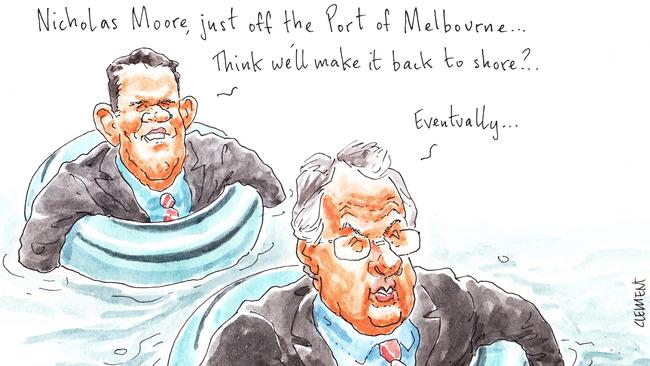

Nicholas Moore’s Macquarie out of port running

The results have been mixed over in the infrastructure arm of Nicholas Moore’s Macquarie Group (aka the “Vampire kangaroo”).

A Macquarie advised and backed consortium — which was led by IFM Investors — yesterday lost at the auction for Premier Dan Andrews’ Port of Melbourne.

The enormous privatisation was the culmination of a process that was a notable pocket of bipartisanship back at the November 2014 state election.

Macquarie and Co were beaten by a Queensland Investment Corporation-led consortium which — in another manifestation of these record low interest rate times — paid $9.7 billion for the Victorian port.

The QIC-led winning bidding consortium included chairman Peter Costello’s Future Fund, Global Infrastructure Partners and the OMERS pension fund, which houses the Borealis investment arm.

They were advised by John Knox’s Credit Suisse, the boutique advisory Gresham and a posse of lawyers at Herbert Smith Freehills.

So, no doubt about it, an unhappy result for Macquarie.

All the more reason for Moore’s troops to celebrate the good news coming out of New York.

Over the weekend Macquarie’s NYC-based senior vice-president Jonathon Laurie (who has a focus on infrastructure and real assets — things like ports, for example) won the TCS New York City Marathon Tune-Up, a 29km race held in Central Park seven weeks before the marathon proper.

Keep an eye on Laurie, 32, when the New York marathon — the world’s largest — sets off on November 6. He finished the tune-up in one hour 44 minutes and 13 seconds, smoking his nearest American challengers.

For his success, Laurie gets an award plaque — if he fills out an online form.

It’s not quite a 50-year lease on Australia’s busiest container port and its steady returns. But, nonetheless, some welcome good news for the Mac bank family.

Private views

Wannabe West Australian Premier Dean Nalder (previously the state transport minister) has been called many things.

Gutless. Self delusional. A dead ringer for Uncle Fester.

Unless his Liberal colleagues in the WA state parliament have had a dramatic change of mind overnight, Nalder — once a middle-ranked ANZ executive back in the John McFarlane era — has no chance of beating Colin Barnett in today’s party meeting.

But, despite the long odds, Nalder has his fans in the West Australian business community, including Multiplex heir and playboy Tim Roberts and Perth property king Nigel Satterley.

In his call for the leadership — formally made in Kerry Stokes’ West Australian newspaper and later followed by a text to Barnett — Nalder set himself up as a champion for privatisation.

“We must have the courage to go to the community and argue for the sale of government assets to free up funds to invest in new assets for the state,” Nalder wrote.

Back in the May budget, Barnett’s government flagged its intention to follow Mike Baird’s lead and sell the state’s electricity network, Western Power, which should reap well over $12bn.

Barnett has since suggested his enthusiasm for that plan — which would have been the centrepiece of the March 2017 election — might have fizzled.

Part of the problem has been that people like Nalder have been so devoted to undermining his leadership.

But after Labor left Victorian Premier Dan Andrews’s $9.7bn privatisation bonanza yesterday, Barnett might decide it’s an idea worth returning to — once he takes care of Nalder in today’s party room.

Scoping the situation

Before Nalder had gone public with his intention to challenge Barnett, he had excused himself from yesterday’s cabinet meeting.

Preparing for his assault on Barnett?

In a manner of speaking. Nalder was off on medical leave for a long-scheduled appointment.

It’s a delicate subject, and not one to be made light of.

We have been told by multiple sources in the Nalder camp that the ambitious Member for Alfred Cove was off for a colonoscopy.

He turned 50 in February, so the Gastroenterological Society of Australia would approve.

Indeed, it is likely to be the smartest thing he does all week.

Flat-out good deal

Scrutiny continues on aged-care operator Estia Health, following the departure last week of chief executive Paul Gregersen.

An ongoing source of intrigue is the opaque process around the sale of two Gold Coast apartments sold to its acting chief financial officer Steven Boggiano.

The pair of apartments — which Estia had bought last year as part of the acquisition of aged- care provider Nobel Life — were sold to Boggiano for a discount of 40 per cent on what the company had paid for them three months earlier.

A spokesperson for Estia has insisted that there is nothing untoward and the company has been fully transparent with the market.

They say the apartments were offered for sale to the general public at fair value.

The location of the material for this sales campaign — which appears to have delivered Boggiano a bargain — is a bit of a mystery, and one occupying the minds of investors, including at Maven Investment Partners. No prizes for guessing if that Hong Kong-based hedge fund is short or long the stock.

Interesting exchange

Not that it — or anyone else — had much of a chance to change positions on the ASX yesterday, as Dominic Stevens’ exchange crunched to a halt for most of the day.

Stevens is best known to many for leaving annuities giant Challenger abruptly to go on an extended family vacation.

Aptly, he was overseas yesterday.

To give the travelling Stevens his credit, it’s been less than two months since chairman Rick Holliday-Smith gave him the job and it seems he’s already become essential.

Down under donation

Less than two months before the November 8 election, the Hillary Clinton diaspora held a fundraiser down under on Sunday night in Sydney.

It was the first of the season, according to Dave Kennedy from the Hillary for America Abroad Finance Committee.

The event — held at the house of former US consul-general in Sydney Niels Marquardt — was organised around a visit by former US ambassador Jeff Bleich, now a partner at global law firm Dentons and in Australia on business.

It’s tough work to donate to a US campaign, as outgoing American Ambassador to Australia John Berry explained in this paper last week.

The Yanks only allow US citizens or permanent American residents of the US to donate.

They also have to be at least 18 years old, the donation must be their personal funds and the donor can’t be a federal contractor.

For his trouble, Bleich — a close friend of Barack Obama who remains upbeat about Clinton’s prospects — lost his luggage on his flight from Washington DC.

All we can do is wish him the best and hope the trip to Australia improves.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout