Next up, Roxy Jacenko The Musical

Never one to miss an opportunity, insider trader Oliver Curtis’s wife Roxy Jacenko is co-operating with Hugh Marks’ 60 Minutes on a tell-all on the life and times of the publicist.

Ahead of Curtis’s 2pm sentencing hearing yesterday in the NSW Supreme Court by Justice Lucy McCallum, Jacenko was dishing up her social media secrets to 700 or so of her followers at Sydney’s Shangri-La Hotel.

And alongside Roxy’s fans — who had paid about $200 each for the two-hour session — was none other than 60 Minutes executive producer Kirsty Thomson, best known for her tangled involvement with reporter Tara Brown’s recent foray into child snatching in the Middle East for a story on bereft mother Sally Faulkner.

Nine wouldn’t comment on whether a Roxy report was being prepared. But we understand she is on board, although she won’t sign a contract until things are resolved for her criminal hubbie. That could be as soon as next Friday, when Justice McCallum delivers her sentence.

Thomson was there yesterday with a cameraman getting the overlay of Roxy and her true believers.

The media manager looked magnificent in top-to-toe Gucci — a $3400 silver leather, pencil-pleated skirt and a $1700 pink-and-black striped sweater set off by a cutsie woven cat motif and embroidered with the words “blind for love” (tastefully written in French).

The Nine camera would have caught Jacenko confessing to her like-minded souls that she hadn’t slept much on Thursday night.

Probably awake wondering what to wear.

Mad for Oli

Only two of Roxy Jacenko’s morning accessories made it to the Supreme Court’s utilitarian court 11D: her black Range Rover and her black-suited bouncer.

Both were hired for the big occasion.

Otherwise, Jacenko had a full costume change. Off went the silver skirt and cat jumper. On went a sombre black Dior frock, a pair of YSL heels and a decidedly suburban blue Goyard Saint Louis tote. Her quiet sobbing underlined that this was no fashion show.

Husband Oli sported, if not quite a prison crew, an unmistakably less foppish fringe. His closely cut back and sides were a world away from the Riverview mullet he sported in happier days.

Father Nick Curtis was along, as was Kevin Hobgood-Brown, Nick’s business partner at the corporate advisory firm Riverstone that employed Oli.

Hobgood-Brown — who now works for HHK Advisory in Riverstone’s old offices — told the judge about Oliver’s good work ethic. By Hobgood-Brown’s account, the Chinese were mad for young Oli.

It was at times slow going after the grand drama recently staged over the road at the historic Saint James Court where the case was heard.

So fair enough if Roxy’s bodyguard left the court door unmanned for half an hour to sit on the sofas outside.

To go by the dress rehearsal yesterday, his clients will want that mighty frame well rested to negotiate the media scrum assembled for Curtis’s sentencing next Friday.

Doubles all round

Billionaire James Packer should pour himself a stiff vodka to mark a week in which he unveiled a $10 billion demerger of his international Crown gaming empire.

And Packer should make it a tumbler of the boutique VDKA 6100 given he has just increased his investment in its creator, ASM Liquor, to $32 million. He now has a 70 per cent stake in the Aussie distiller, whose annual revenues are approaching $100m.

Packer was tipped into the company by his former fellow Qantas director and continuing ASM shareholder Margaret Jackson.

Jackson used to chair the booze group but has been replaced by Packer’s luxury brand guru Sam McKay, who used to run the previously ConsPress-controlled Jurlique.

The billionaire has also put former Labor senator and now Packer strategist Mark Arbib on the ASM board. He replaced lieutenant Guy Jalland in overseeing the ConsPress investment.

The fresh capital raising has seen Packer tip another

$5m into the business — all the better to pursue the burgeoning Chinese middle class.

Punters can buy the tipple from Crown’s resorts, but they’ll have to fork out for the top shelf. It’s not the house pour.

Wade sends signal

Just as the market was starting to wonder whether the Chris Ellison-led Mineral Resources might be overvalued, chairman Peter Wade has given the bears more ammunition.

Wade yesterday advised the market he had offloaded the bulk of his holdings in the mining services company-cum-iron ore miner-cum-lithium developer-cum-oil and gas investor. Wade has collected just over $8m from the sale of 900,000 MinRes shares, leaving him with just over 500,000 shares in the company.

The last time Wade sold down some shares ended up being a very good signal to sell. In 2012, he pocketed $25m when he sold two million shares for $12.50 each, at which point MinRes shares promptly halved over the next six months.

However, we’re told that Wade’s sale doesn’t reflect his thoughts on the value in MinRes — instead it was in relation to a “personal financial matter”. Our guess? Probably a leftover tax bill.

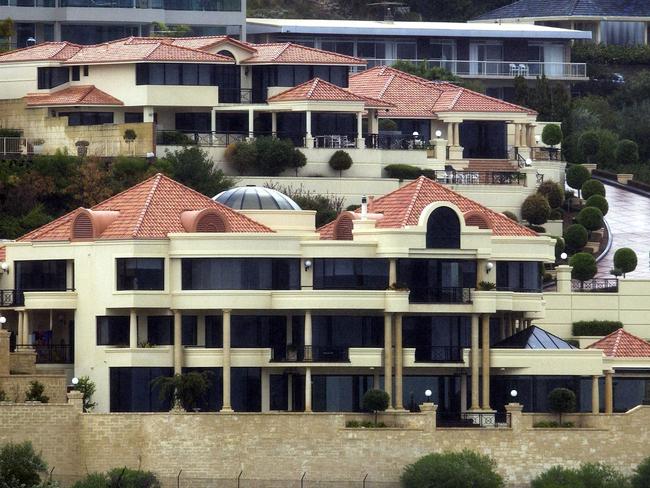

MinRes shares have been on a tear this year, running from just $3.49 in January to as high as $9.63 earlier this month. Rich-lister Ellison is perhaps best known outside mining circles for his 2009 purchase of the Swan River mansion of iron ore heiress Angela Bennett for a record $57.5m.

It will be a while before Perth mansions are trading at those prices again.

Chicken feed

It was a surprise to many that Melbourne’s respected legal shop Arnold Bloch Leibler involved itself with music streaming wannabe Guvera, which is backed by the Gold Coast-based private equity outfit AMMA.

The controversial float was blocked by the ASX on Friday afternoon. That was despite the best efforts of Mark Leibler’s legal shop.

Jonathan Wenig led the ABL team working for Guvera.

ABL were in line for a $1.6m payday if the deal to raise up to $100m came off. That payday now looks about as likely as Guvera ever listing.

On board with Kogan

Floats are a burgeoning revenue stream for the law firm. ABL is also the legal adviser on the

$50m raising by the Ruslan Kogan-founded online retailer Kogan.

The gig comes by virtue of Kogan exec and 30 per cent shareholder David Shafer, who went to the selective Melbourne High with Kogan.

Shafer was an M&A lawyer at ABL while Kogan was a budding entrepreneur out of his parents’ garage.

He was then persuaded by his friend Kogan to join the business fulltime.

After the float Shafer will have a 19 per cent stake in the company, which pays him a base of $300,000 a year.

The Kogan float continues the reputational repatriation of former Visy exec Harry Debney, who took the fall for the late Richard Pratt-controlled company’s role in the cardboard box cartel with Amcor.

Debney these days runs the Costa group and joins Kogan as a non-executive director.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout