New Evans Dixon class action looming after IPO, learnings pain

More trouble is circling the scandal-plagued wealth manager Evans Dixon.

Margin Call has heard rumblings that a second class action is being prepared for possible assault against the listed curiosity, which was unleashed on the ASX in May 2018 after the merger of David Evans’s Evans & Partners with Alan Dixon’s Dixon Advisory.

Read more Margin Call: Lawyer v HR in AMP bullying showdown | Why Labor’s Joel Fitzgibbon is raising eyebrows

The 18-month life of that listed outfit — which has been criticised for having high fees and low returns — has been disastrous for those poor shareholders who bought in at the float.

An earnings downgrade pummelled two-thirds of the value of Evans Dixon’s shares, which after beginning their trading life above $2.50 are now worth a desultory $0.82.

That freefall in shareholder value happened in May, 12 months after the company first joined the ASX.

The birthday surprise left shareholders furious. Shine Lawyers has already flagged its interest in representing disgruntled clients in a class action.

Now we hear a separate case is being prepared. No one would accuse the nation’s class action lawyers of originality.

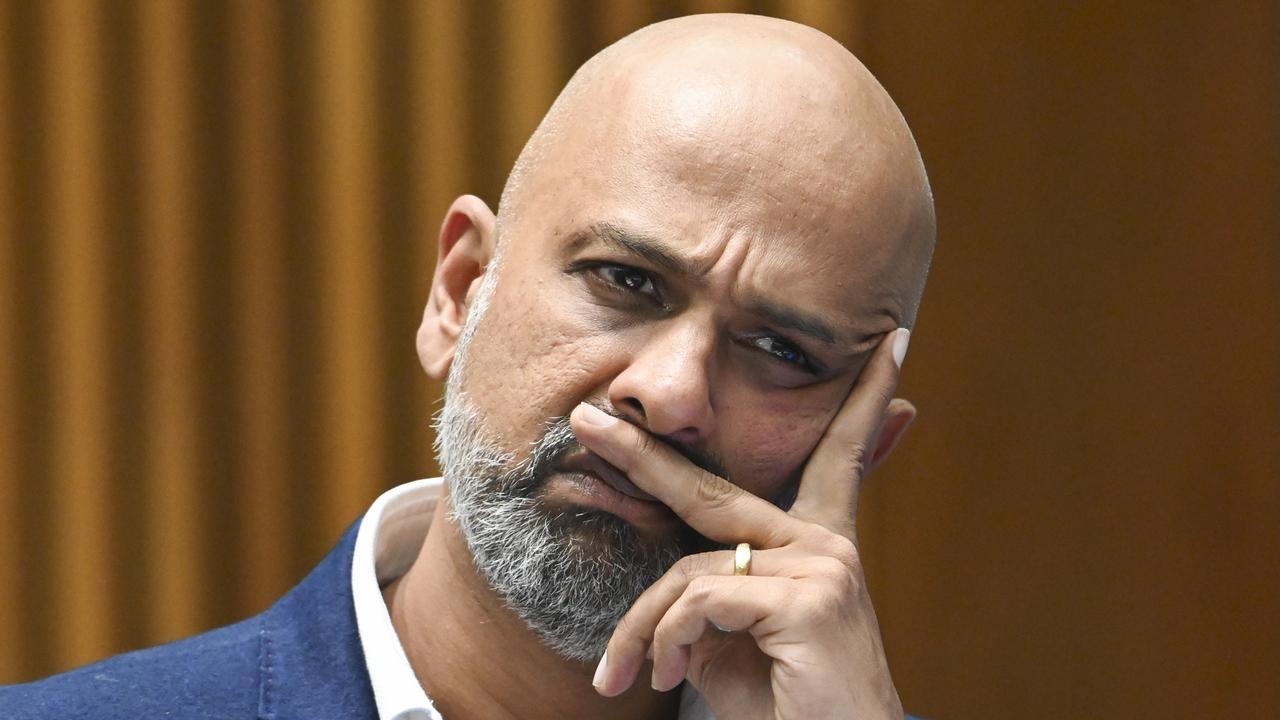

After an extended bout of leave, Alan Dixon, who reportedly signed up to the merger after a day at David Evans’s Greg Norman-designed golf course, permanently steps down from his executive duties at the business on Thursday.

If our legal mail is correct, he and his fellow founding board members are likely to have a bit more to do with the troubled shop yet.