The human ponytail has called it a day. Neil Perry, possibly Australia’s most famous chef, announced his shock retirement as culinary director at Rockpool Dining Group on Monday.

The 62-year-old Perry will remain as a consultant and shareholder of the group, and still slave over the stove, as he instead focuses on the Hope Delivery initiative, one of his charitable endeavours.

Having spent four decades working in the hospitality industry, there appeared to be something brewing when the deal between Perry and his private equity backers to divide their restaurant empire was abandoned late last month.

It was 2016 when Perry sold his Rockpool Bar & Grill, glibly nicknamed Global HQ, Rosetta and Spice Temple restaurants for $60m to the Quadrant Private Equity-backed Urban Purveyor Group with hopes to turn the entire group into a $1bn ASX-listed company.

However, just before the pandemic, Perry decided it was time to instead exit, as he had backers ready to acquire his key restaurants back from Quadrant.

That prospect fell apart, a victim of COVID-19 lockdowns, with Perry instead supposedly hunkered down to re-establish the Quadrant empire, and expressing hopes of being fully operational by spring.

There were periodic rumours the chef and his American CEO, Tom Pash, were on different cookbook pages, and behind the scenes the former Bain Capital Credit vice-president Christopher Coates and ex-Morgan Stanley’s Victor Ha recently joined the Rockpool board.

It was 1986 when Perry first created headlines serving up dishes at Blue Water Grill overlooking Bondi Beach. Who will ever forget those mushrooms, lightly cooked in olive oil with Bermuda onions marinated in lime, accompanied by thin, raw slices of salmon.

$51m for waterfront

The long-delayed settlement of the Point Piper waterfront Routala came in at a cool $51m on Monday, only slightly down from its $55m asking price when it sold in late 2018.

Its buyers were David Wilkenfeld Fox, co-owner of the leading global dance wear company Bloch International, and his fashion designer wife Gazette Hazzouri.

They bought the Wunulla Road home 18 months ago from Gordon Fell, the founder of property business Rubicon, and wife Philippa .

It had been on the market through estate agent Brad Pillinger for just over three months, and often spoken about as being a $50m sale.

The Fells had paid a then-national record $28.75m in 2007 when buying from horse breeder and Guess fashion importer Warwick Miller.

Fox and Hazzouri have most recently been living at Saint Helier in the Channel Islands.

There’s also been removalists trucks next door at Herewai, where Alan Rydge’stenants, the Senes family, recently had Lawsons auction off their contents.

The entertainment industry family own six adjoining Point Piper properties, an ambitious harbourside compound, with natural rock grotto. The family patriarch, Sir Norman Rydge, picked up the initial Wunulla Road holding from a grazier, Anthony Hordern the younger, for £30,250 in 1960. It was one of the heritage-listed, 1930s Mediterranean-style duplex apartments in Herewai, a whitewashed block with stucco walls and Spanish roof tiles. The Rydge family secured the other duplex for $105,000 in 1968.

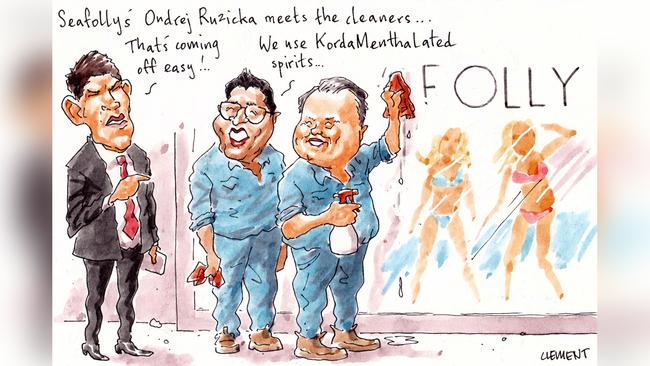

Seafolly’s fate

The writing was written into the hot summer sand, well before the announcement last week that Seafolly was in voluntary administration.

It was January 9 when ANZ, a secured creditor of the swimwear fashion company, called in KordaMentha to start taking a look at the books. They wanted to know the company’s financial situation, the consequences of insolvency and alternative courses of action.

The investigation ran for three months, with Shayne Elliott’sANZ stumping up $130,000 for the review of the fashion label that helped catapult the careers of Miranda Kerr, Jessica Hart, Cheyenne Tozzi, Gigi Hadid and Shanina Shaik.

Then in April, KordaMentha was contacted by Seafolly board member Ondrej Ruzicka to organise a meeting to discuss Seafolly’s finances. Ruzicka had only been on the board since September. He met with KM’s Scott Langdon and Rahul Goyal on April 28 to discuss the company’s financial position.

The KM team are finalising indicative bids for Seafolly, with about 50 potential buyers in the frame.

A nod and a Winx

Anything even remotely related to one of the world’s best horses, the virtually unbeaten, now retired sprinter Winx, could be worth its weight in gold.

That’s why Rosehill trainer Gerald Ryan fought off strong competition to pay $700,000 for a colt from champion stallion I Am Invincible, who came from the unraced Miss Atom Bomb, the half sister of Winx.

New Zealand horse Vegas Showgirl is the dam of Winx and Miss Atom Bomb.

Vegas Showgirl is a daughter of Al Akbar and was purchased by John Camilleri’sFairway Stud at the 2008 Magic Millions Broodmare Sale for $440,000.

Ryan said he paid a little more than he was hoping to pay, but he describes the horse as an athlete, and a big strong horse, suggesting he’d be ready to run in the autumn rather than racing him as a pre-Christmas two-year-old.

Offered by Bhima Thoroughbreds, the colt has already been broken in.

Meanwhile, Winx’s foal is expected in early October. I Am Invincible was the first partner to Winx.

A bigger Mac share

It was relatively small change but former RBA governor Glenn Stevens has upped his stake in Macquarie Group. The acquisition was part of the dividend reinvestment plan for its directors. He added 63 shares at $110, taking his stake to 3963, including the family super fund. Diane Grady also increased her stake.

However, Macquarie CEO Shemara Wikramanayake’sshare exposure fell backwards after she didn’t meet performance hurdles. Her performance share unit entitlement fell from 109,000 to 92,000. Macquarie’s profit for the 12 months ended March 31 was $2.73bn, down from a record $2.98bn. The earnings result was hit by impairment and other charges, relating to the pandemic, of $1.04bn.

Allan new wine boss

Dr Michele Allan has become the chair of Wine Australia. She’s hitherto been quite wholesome, currently chairing Apple and Pear Australia, and having previously chaired the Meat & Livestock Australia, the research body for red meat, and also heading the Grains and Legumes Nutrition Council.

It was last September when vintner Brian Walsh vacated the Wine Australia chair, with Agriculture Minister David Littleproud making the replacement effective last week.

Allan’s chief executive, Andreas Clark, has led Wine Australia since its inception in 2014. One of the board’s tasks will be to implement the recommendations that came in May after Effective Governance was appointed to undertake an independent review into the agencies’ performance.

The board has also just released its new five-year strategic plan that deals with each of the country’s 65 wine regions.

Walsh, who grew up in the McLaren Vale region where his parents owned the Aldinga Hotel, was best known for his time at Yalumba, which he joined in 1988 when many of the old family wine companies were transitioning from being a fortified producer to a maker of fine table wines.

In 2018-19, there were an estimated 6251 wine grape growers with a vineyard area of 146,128ha, producing a total of 1.73 million tonnes of wine grapes.

There were 2257 winemakers, with the gross value of farm gate production totalling $1.11bn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout