Navitas boss David Buckingham faces big test

It’s a big day for Navitas CEO David Buckingham as he turns up in Melbourne for a showdown with the most feared man in Australian private equity, Ben Gray.

A month ago, the 101 Collins Street-based private equity firm BGH — which Gray last year co-founded with Robin Bishop and Simon Harle — launched a $2 billion takeover tilt for the listed education firm, which Buckingham runs.

Bidding alongside the private equiteers are Ian Silk’s $140bn industry giant AustralianSuper (which is also working with BGH on its $4bn attempted takeover of private healthcare business Healthscope) and one of Navitas’s founders Rod Jones (who owns 12.6 per cent of the education outfit).

It’s a formidable ensemble for the Navitas board — led by Tracey Horton — to fend off.

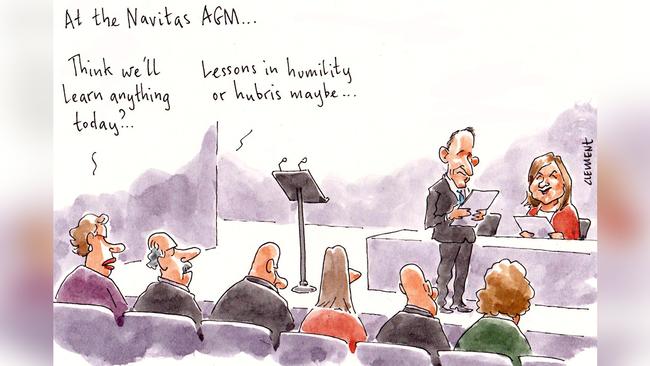

Adding urgency to the situation is next Thursday’s Navitas annual general meeting at Curtin University in Perth at which Horton will have to outline to shareholders — many of whom have expressed their interest in doing a deal — her board’s strategy for dealing with the BGH bid.

But before then comes today’s presentation by Buckingham and his Navitas executive team.

Their mission: to convince Gray and gang — one of the toughest dealmaking teams in the country — that they should pay more for their under-pressure business.

Hope they’ve made one hell of a power point!

Those lurking in the 101 foyer will be interested to see whether Jones, who co-founded Navitas in 1994, is along for the big day.

Until he stood down last night, Jones — a head-strong fellow with a fortune last valued at $450 million — remained a director on Horton’s board despite being in cahoots with the BGH bid.

Might the brazen Jones turn up at the Tower of Power today to keep Buckingham on his toes?

Not so healthy

Things seem to be less promising for BGH and AustralianSuper’s takeover play for private hospital operator Healthscope.

The market is not optimistic Healthscope chair Paula Dwyer and her board will allow the private equiteers and their industry super backers due diligence.

That $4bn decision — informed by the handsomely paid defence advice of UBS investment banker Kelvin Barry — is expected in coming days, perhaps as early as today.

Style and substance

She’s been the talk of this year’s Melbourne Racing Carnival: Rebekah Behbahani, the glamorous 27-year-old partner of Thorney billionaire Alex Waislitz.

And she’s not just a striking race day companion.

Margin Call can reveal Behbahani, who works at professional services firm KPMG, has a keen sense for business.

“I’m taking some time off from KPMG right now to work on my start-up,” Behbahani told us in the Birdcage at Flemington.

The venture is a Milan-based, dual-tone cosmetics business that she is pursuing with her older sister Venus Behbahani-Clark, one of the stars of Foxtel’s Real Housewives of Melbourne.

It’s named Venus Cosmetics, after her sister, and is scheduled to officially launch in February.

While distribution has already begun through an online channel, we gather negotiations are ongoing between Australian bricks-and-mortar distributors.

And is Waislitz — whom she starting seeing after his “Hedonistic Playground”-themed 60th birthday in February — backing the project with some of his $1.39bn fortune?

“That I can’t say,” Behbahani told us.

Back at work

It was hard to recognise Alex Waislitz yesterday when we spotted him — out of his red racing suit and back in his unassuming workwear — having a post-Melbourne Cup lunch at Cecconi’s with his trusted adviser Tony Gray.

Also in the Italian restaurant, and strapped in for a long lunch, Herald Sun institution Terry McCrann with GRACosway’s new Melbourne hire Tim Duncan.

Waislitz and Gray appeared to be working on the billionaire’s pitch for next Friday’s Sohn Hearts & Minds Investment Leaders conference.

Despite our best detective efforts, we were unable to establish the Thorney boss’s Sohn investment tip.

Eight more sleeps until all is revealed.

The Australian Sohn iteration will this year make its Melbourne debut, as was first flagged last November by Margin Call when billionaire Solomon Lew explained a clause he added to a $300,000 donation made from his Lew family foundation.

“There’s a hook to that donation,” Lew told us, mischievously, back at last year’s conference. “They have to bring it to Melbourne.”

As is usually the case, Lew has got his way.

Box seats

Box billionaire Anthony Pratt is not just in Melbourne for fun and games with his fellow billionaire friends trackside at Flemington.

Australia’s richest man, Pratt is also here for a series of board meetings of both the wider Pratt family’s Visy and his Pratt Industries.

For the first time this year, both boards will meet together, with newly appointed director Sir Rod Eddington, 68, straddling both boards.

Sir Rod, also the chair of key Visy client Lion Nathan, joined the governance structures last month after a personal invitation from Pratt.

Pratt’s mum Jeanne, 82, is co-chairman of Visy with her son, while his two sisters, Heloise (billionaire Alex Waislitz’s estranged wife) and Fiona Geminder each have a one-third stake in Visy and board seats.

Pratt Industries, which Anthony owns solely, is the US’s fifth-largest box manufacturer and the world’s largest privately held recycled paper and packaging company.

Also on the Pratt family advisory board is Herald & Weekly Timeschairman Penny Fowler, former Nestle Waters North America boss Kim Jeffery and London-based venture capitalist Ross Fitzgerald, a friend of Pratt’s and one of his closest confidants.