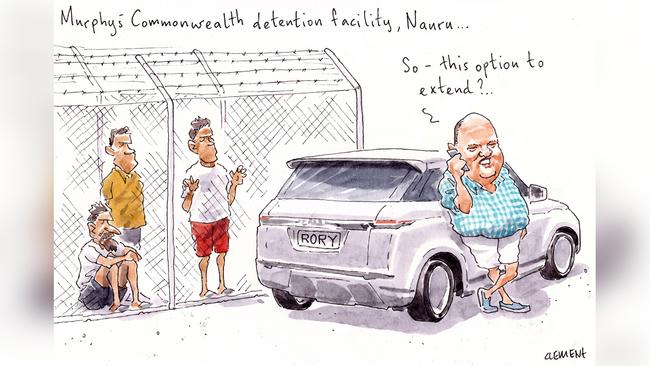

Murphy family in Rich List contention with Nauru profits

Their family name might not be familiar among the likes the Foxs or Forrests, but the Queensland-based Murphy family are moving up when it comes to the wealth stakes, in large part due to profits from running the commonwealth detention facility on Nauru.

Canstruct, the family construction business founded by patriarch Robin Murphy, last financial year notched up a profit of more than $100m.

The group was appointed on the key Nauru contract for garrison and welfare services by Peter Dutton’s Home Affairs Department in 2017 for an initial duration of three years, with a total contract value of $1.122bn.

Recently lodged accounts for the group’s parent company, Rard No 3, show the lucrative deal helped the family to net a profit of $101m for the financial year to June 30, up 45 per cent from the previous year, despite some COVID-19 disruption.

While the money-making contract for the company — now run by son Rory Murphy, and with brothers Adrian and Daniel on the board — was set to expire in June, the accounts show there’s plenty of legs in the deal still.

Documents lodged with ASIC note that the majority of its project revenue for the year had been received under a single contract with the commonwealth, with an expiry date at year end, but with an option to extend for a further six months until June next year.

Based on annual revenue figures of $334m for the past 12 months, the extension will no doubt be a bankable one, sure to add to their $158m cash on hand.

In statements accompanying the report, the group notes that the increase in profit was “mainly attributable to strong project revenue, and contributions delivered over the reporting period”, going on to say it had mitigated the effects of COVID-19 by “changing operating procedures and the way we deliver our services”.

Still, the impending end date of its key contract was cause for some provisions by PKF Hacketts auditor Shaun Lindemann, including $1.69m for entitlements of its workforce of 111 employees.

Earlier this year, the Yeerongpilly-based Canstruct was the only Australian firm named in the running for the redevelopment of New Zealand’s Scott Base research facility in Antarctica.

Services to be rendered at the potential development are a marked shift from Nauru, but no doubt the Murphys will be hoping their streak of profitability doesn’t let up.

Bank board bids fail

Westpac investors were quick to vote down the appointment of two seeming interlopers at Friday’s AGM, but it wasn’t for lack of trying.

After a tumultuous year for the bank, including the mammoth $1.3bn penalty for Austrac noncompliance, fireworks at the John McFarlane-chaired meeting were guaranteed, and ignited when it came time to vote on the bank’s board.

Two self-nominated candidates were put to shareholders, former Clayton Utz partner Noel Davis — who spruiked his experience on the board of Count Financial — and civil engineer Paul Whitehead.

In prerecorded videos to the meeting, as recorded by Westpac’s team, Davis didn’t hold back with his critique, pointing the finger at investor relations boss Andrew Bowden for contacting him ahead of the AGM and attempting to dissuade him from nomination.

“I was surprised to receive that call and its contents, but I haven’t withdrawn and the reason I have continued with my nomination is that the shareholders have suffered significant financial loss because of the risk and compliance breaches and I believed I had something to offer,” he told the meeting.

For what it is worth, Bowden maintains the courtesy call was simply part of the process, stressing that Westpac respected the rights of prospective directors, especially after a tough year.

Fellow nominee Whitehead, who proudly said he had no bank experience and would be truly independent, took aim at the “echo chamber of like-minded people agreeing with each other”, adding that the bank needed a “stronger moral compass”.

“As an engineer I build things, not destroy them,” he said. “I can help build a stronger, more ethical business on a firm foundation. The current way at Westpac needs to change, instead of building it is destroying shareholder value.”

Not to be downtrodden, chair McFarlane acknowledged the nominees, saying he would meet with each respectively … then swiftly urged shareholders to vote against them.

Final results from the meeting show shareholders overwhelmingly followed his advice. Both candidates received just over 1 per cent of the vote — giving a clean sweep to the board-endorsed candidates.

McFarlane, the former ANZ boss who was appointed in February to replace Lindsay Maxsted, was backed by 95 per cent of the vote, while returning director and former KPMG chairman Peter Nash took a larger 13 per cent protest vote but still clung on to his seat.

Both Chris Lynch, the former CFO at Rio Tinto, and Michael Hawker, ex-IAG chief, passed easily with more than 99 per cent of the vote after their recent appointments in September and December, respectively.

Agent’s art attack

Lockdowns across the country have prompted the uptake of all manner of pastimes.

For prominent sports broker and agent to the stars James Erskine, who formerly managed the likes of Muhammad Ali, Tiger Woods and Shane Warne, that pastime has been watercolours.

So impressive have been the results of the foray, that the comprehensive collection of 48 paintings has been put on display — at none other than Erskine’s own Liverpool Street Gallery in Sydney.

Launched earlier this week, the “Liverpool ’Till I Die” collection, despite taking its name from the England football club’s team song, contains almost none of the club’s trademark primary red hues, opting instead for soft pastels said to be influenced by “the weather, time of day, stillness and calmness” of places Erskine remembers from his life.

The title, while a reference to the gallery’s location, is perhaps more of a nod to the artist’s birthplace in Southport, Lancashire, not far from the home of the Premier League club.

Erskine is no stranger to the art world, a prolific collector of the work of others, but this is the first time he’s taken up the watercolour brush himself.

In a blurb accompanying his works, he said the move had only come after some coercion from wife Jacqui, though the venture is all for a good cause, with proceeds from any sales to go to Kings Cross women’s refuge Lou’s Place.

Erskine’s Sports and Entertainment Limited was started with sporting bigwigs Tony Cochrane, Basil Scaffidi and the late David Coe.

No word yet on whether they’ll be following Erskine into the art world.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout