Douugh, another fintech start-up, is gearing up for its initial public offering in August when it will join the flood of other fintechs on the Australian bourse.

Some $6m will be sought for the Sydney-founded, San Francisco-headquartered business.

Marketed as offering a “bank account with a brain”, its consumers can access an app that suggests how to cut back, and segment, spending via an AI assistant, which operates as a personalised wealth manager, something the big four haven’t been able to do well.

Not that Douugh is a bank or even a neobank, as it’s bypassing the bank part, instead partnering with existing institutions that have banking licences.

It has been around since 2017 when founded by Andy Taylor. His board seems set to include the former ANZ group markets boss Steve Bellotti and the ex-Pepper Group chief executive Patrick Tuttle.

Taylor was a co-founder of peer-to-peer lender SocietyOne.

The ASX listing will be via the currently listed Ziptel, a telecoms business that has been voluntarily suspended from trading since January.

Its initial IPO speculation in 2018 had an undisclosed Munich-based European family office as likely to underwrite the raising.

Canaccord Genuity Australia has been named the lead manager of the raising.

A portion will be handled by the crowd-funding platform Equitise.

By the way, the extra “u” was to secure a domain name.

Controversial name

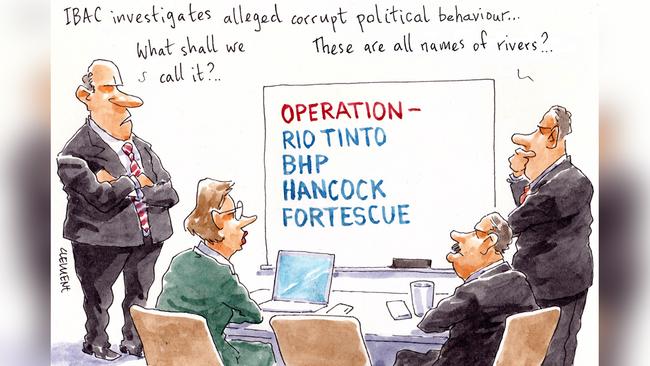

IBAC, Victoria’s independent Broad-based Anti-corruption Commission, has named its investigation into serious allegations of corrupt conduct among Victorian frontbench politicians Operation Fortescue.

Apparently IBAC selects its names from Australian rivers.

The Fortescue River feeds a lush garden of Eden in the heart of the north Pilbara desert in Western Australia.

The Fortescue name, however, is likely to be a little too close to home for Andrew “Twiggy” Forrest , who heads Fortescue Metals Group.

Margin Call would think Forrest and his legal counsel would be unhappy at the naming of the high-profile investigation concerning allegations of branch stacking in the Victorian ALP. The secret recordings that ended three ministerial careers in Victoria have sent shockwaves through the Labor Party.

Other IBAC operations have been named Tambo, Snowy, Ord, Ross, Fitzroy, Landsdowne, Yarrowitch and Gloucester.

Sleeping rough

Looks like the weather will be kind in Sydney and Melbourne, though not so much in Canberra, as the 1500 or so participants head into the Vinnies CEO Sleepout tonight.

We just need the donations to roll in.

Margin Call reckons Jason Clare, opposition spokesman for housing and homelessness, ought finger his parliamentary colleagues to get donations from their COVID-19 pandemic-immune salaries.

Clare’s not yet had one colleague — from either side of the house — publicly contribute to his charitable endeavour. The member for Blaxland raised $1600 last year on his first sleep-out when some $7m in vital funds were raised for the St Vincent de Paul Society across the country.

Last year’s top fundraiser was BankSA CEO Nick Reade, who raised over $200,000. He was followed by Vedran Drakulic, boss of Gandel Philanthropy in Melbourne, who raised around $180,000 and ERM Power CEO Jon Stretch from Brisbane who raised $106,000.

The sleep-out is sponsored by The Australian and Sky News, as its national partners.

Pleasant dreams

Speaking of not getting a good night’s sleep.

The $6.5m equity raising by the ASX listed anti-snoring firm Rhinomed is now proceeding after the proposed underwriter, US veteran investor W Whitney George, belatedly secured approval from Foreign Investment Review Board.

The Ron Dewhurst-led Rhinomed issued its prospectus in May but George’s underwriting of the raise was conditional on the company’s majority shareholder securing the nod of the FIRB.

Our busy sleep-deprived Treasurer Josh Frydenberg signed off on it Wednesday.

George, the New York-based president of the global asset management firm Sprott, will now fully underwrite the 84 million share issuance in the nasal and respiratory tech firm.

He currently holds around 30 per cent of the company. Having tried the device. George had a Victor Kiam moment and bought his initial stake. The Sprott chairman and one-time Melburnian Dewhurst is the third biggest shareholder with a 5 per cent stake.

Dewhurst is the non-executive chairman of Rhinomed, which sells the majority of their products in the US. Mute is its Rhinomed’s anti-snoring technology, a low-cost treatment for sleep apnoea which first found demand from US troops in Afghanistan.

Caravan capers

The ACCC has stopped the Caravan Trade and Industries Association of Queensland, aka Caravanning Queensland, in its tracks. The association was intending to offer a loyalty program to its trade members, offering discounted fees to exhibit at its popular caravanning shows.

But the proposed discounted fees came on the condition that the members did not take part in any competing caravan display events. The ACCC reckons the loyalty program raised serious competition concerns, with ACCC Commissioner Stephen Ridgeway saying it would make it harder for grey nomad consumers to “track down special deals”.

“Loyalty programs should reward members for purchasing more of your products or services, rather than linking the reward to an agreement not to purchase your competitors’ products or services,” he said.

In a draft notice the ACCC suggested the proposed loyalty program had the effect of substantially lessening competition in the supply of caravanning exhibition event services in the southeast Queensland region.

Apparently Caravanning Queensland’s substantial membership base comprises more than 85 per cent of local caravan manufacturers.

It organises the “must-attend” Brisbane Supershow event for caravanning retailers. Caravanning Queensland’s initial plan was to offer a 50 per cent discount on site fees for its ‘‘Let’s Go Brisbane’’ event to members who participate exclusively in Caravanning Queensland events throughout the entire year.

The ACCC was concerned smaller caravanning event organisers or new entrants would be unlikely to be able to match the deep discounts to persuade members to give up their Caravanning Queensland discount. Exclusive dealing is only a breach of the Competition and Consumer Act (2010) if the restriction is likely to have the purpose, effect or likely effect of substantially lessening competition. The ACCC was concerned the set up would see fewer opportunities for caravan buyers, who would also have to travel much further to attend caravanning exhibition events to compare features and prices of a broad range of recreational vehicles.

Trade secrets

Australia Post chief executive Christine Holgate has been enlisted to co-chair the federal governments’s new 18-member ministerial advisory council to improve transparency on free trade agreements.

Holgate’s appointment positions her next to co-chair Trade Minister Simon Birmingham.

With free trade agreement negotiations with the UK having started, and ongoing negotiations with the EU, Birmingham sees the forum as an opportunity to hear the views of experts from industry and consumer groups.

Joining our chief postie is Australian Workers Union national secretary Daniel Walton. No doubt there will be plenty of space allowed between the two after the unions warned Ms Holgate would send 2000 posties to the Centrelink queue as a result of her new controversial reforms. National Farmers Federation President Fiona Simson and Minerals Council of Australia chief executive Tania Constable are also on the council. Likewise Tony Battaglene, the Australian Grape and Wine chief executive and Bridget Fair, the chief executive at Free TV Australia.

Holgate’s role comes after Margin Call suggested Ms Holgate warranted being on top of the list of potential candidates to replace the outgoing Austrade chief executive Dr Stephanie Fahey on Saturday.