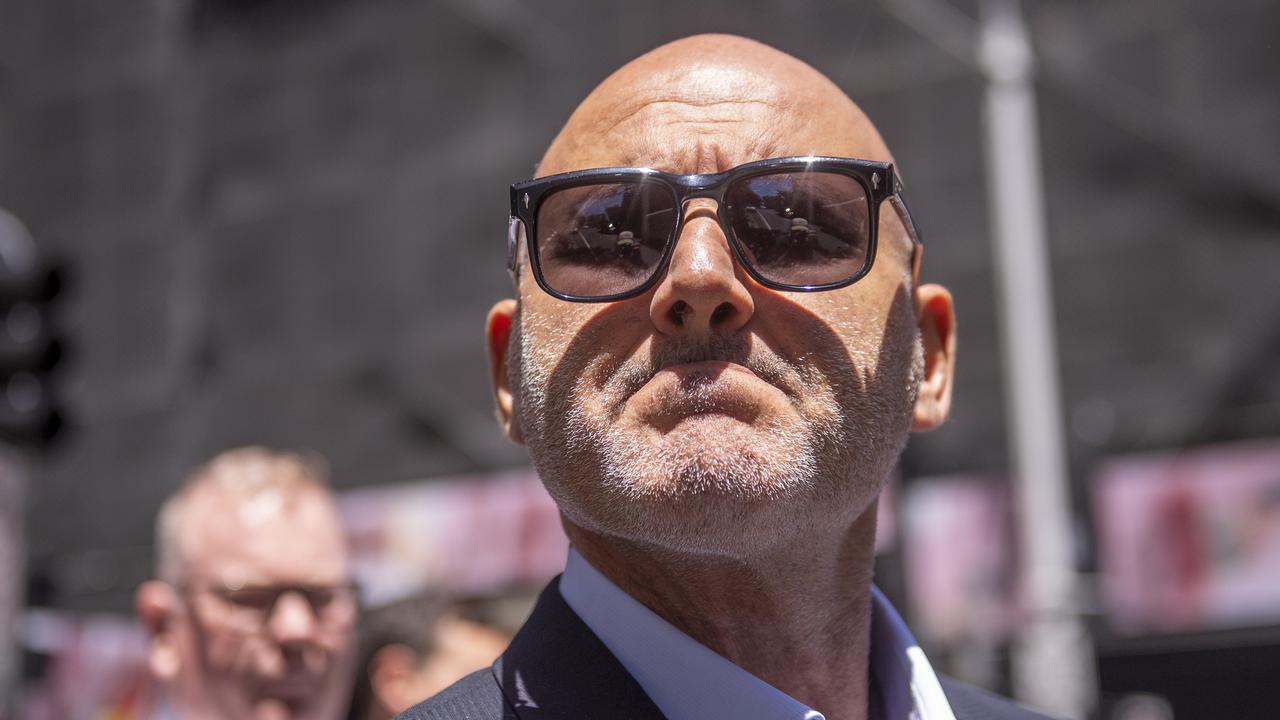

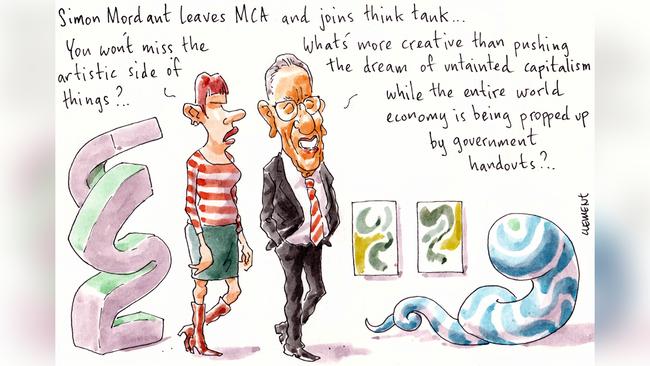

Seems Simon Mordant’s exit after a decade as chairman at the Museum of Contemporary Art Australia has coincided with a formal widening of his outlook towards promoting free choice and individual liberty.

Now not quite as arty, the executive co-chairman of Luminis Parters has joined The Centre for independent Studies (CIS) that defends cultural freedom and the open exchange of ideas. He’s also joining the Ethics Centre headed by Dr Simon Longstaff.

Nicholas Moore, the former longtime Macquarie Bank boss, chairs the CIS think tank, with the thought-provoking Tom Switzer its executive director.

“He is something of a renaissance man, having had several decades of distinguished experience in both the arts and business-finance community,” Switzer advised.

“Like all of us at CIS, he is committed to supporting sound market-oriented policies,” he added.

The Macquarie Street policy research centre was founded in 1976 by the classically liberal- minded Greg Lindsay in a shed at Pennant Hills. There was early backing from the influential Melbourne businessmen Hugh Morgan and the late academic Professor Lauchlan Chipman, with assistance from storage patriarch Neville Kennard whose family is still represented on the board.

The centre’s attentions have been on everything from economic policy to indigenous affairs and health. On Thursday they are hosting episode six of their On Liberty podcast, with guest economist Judith Sloan. Salvatore Babones, political sociologist at the University of Sydney, hosts the podcast and has recently spoken to Alexander Downer, Peter Kurti and James McBrayer.

The heavyweight 30-member CIS board sees veteran director Chris Roberts as its deputy chair. The Mosmanite was formerly non-executive director of Telstra, Australian Agriculture and Petaluma Wines.

Veteran director Gary Weiss is on the board, along with Michael Darling, scion of the establishment pastoral and mining family, who has been on the board since the late 1980s.

Ross Grant, the investment bank founder, has been on the board since 2001, with April Palmerlee, chief executive of the American Chamber of Commerce in Australia, joining late last year. Crossing the country, Mark Barnaba, the Perth-based RBA board member, came on board earlier this year. He, along with Michael Chaney, the Wesfarmers chairman, represent the free enterprise West.

Overseas directors include Michael Rennie, a senior partner at McKinsey & Co now based in Dubai, and Dr Peter Farrell, founder of ResMed, who lives in California.

Mordant isn’t shedding all his art links with his global endeavours, including being a director of MOMA PS1 in New York, a trustee of the American Academy in Rome, a member of the International Council of the MOMA, and on the executive committee of the Tate International Council.

He has just become the MCA’s first international ambassador, as he hands the reins of the gallery at The Rocks to Lorraine Tarabay.

Improving with age

The fate of the 141-year-old McWilliams Wines business is becoming clearer with its administrators likely to be selecting a preferred bidder, possibly this month. There have been a number of offers for the cash-strapped company, a promising sign for its 650 creditors after the company collapsed in January.

All quite complex as there’s the premium vineyards, the wine stock and some $77m of accumulated losses, which could be handy for any enterprise seeking such.

Administrators KPMG have had to call on one of their tax experts to clarify just whether the losses could be utilised through a bid or deed of company arrangement.

Gayle Dickerson, who is the lead administrator, with Tim Mableson and Ryan Eagle have advised creditors the second meeting might not be until July 31.

Colliers agents Tim Altschwager and Nick Dean have been handling the international sales process, which saw the expression of interest pushed from March into April.

It comes after positive news on the quality of 2020’s near-13,000 tonne grape vintage after earlier concerns over smoke taint from the summer bushfires.

The group’s transition to a more premium offering received a boost at Liquorland, which went classier when it replaced McWilliam’s sub-$10 range, which Margin Call imagines was more suited to a plastic bladder than a bottle.

A COVID-19 lockdown sales rush in March saw McWilliam’s exceed sales expectations by $500,000.

Amber light

Amber Symond, the wife of Aussie Home Loans founder Aussie John Symond, is pushing back the gala launch of her new clothing line, Common Hours.

“Due to the current global environment, we will be revising the launch date,” Symond advised her clients.

Common Hours has seemingly been in the works since mid-2017, with the company registered three years ago by the Symond family lawyer, Rob Wannan, who gets to jump on to their superyacht Hansa every so often. (It is currently stuck in Florida, with an amended €92.5m price, down €5m on initial expectations.)

Amber, who married Aussie John at their Point Piper mega mansion four years ago, advised she had decided to reschedule “the launch and ensuing collections under better circumstances”.

Amber does not intend to sell to big department stores but through private trunk sales and her own website, which is UK-registered. Her mate Emma van Haandel is handling the paused publicity.

The website is offering pre-orders for its limited edition classic box-sleeve robe, crafted from Italian leather, and another robe made from French silk.

Each robe, priced between $5000 and $10,000, with delicate embroidery by Chanakya, an Indian company whose work appears on Dior, Armani, Gucci and Fendi couture. The robes are reversible, so there are no tags; instead the Common Hours name is embroidered into the garments, which are numbered 1 to 50.

“I wanted to work with rare, interesting and high-quality materials that are ethically sourced and produced.

“Robes are universally recognisable, practical and versatile. They have become my imaginary canvas.”

PwC shake-up

When a new CEO takes the reins there is always the prospect of a shake-up in the former bosses’ management team, and so there’s been speculation around the communications department at PwC.

Ahead of the retirement of long-serving boss Luke Sayers next month, Margin Call hears Sayer’s trusted head of corporate affairs, Stacey O’Dea, could be taking on a new role — promoted to chief operating officer of financial advisory at the big four accounting giant.

Before working with Sayers, who is retiring after eight years at the helm and three decades with the firm, O’Dea was the head of corporate affairs for MLC and NAB Wealth.

Her replacement is still being sought by Sayers’ successor Tom Seymour.

The former GRA Conway and Clemenger adviser Rachel Mulholland, who has been O’Dea’s understudy for the past five years, will become head of media.

Interestingly, they appear to be the most notable changes thus far among the top ranks at PwC since Seymour’s election by the firm’s partners last month.

Seymour, who has been the managing partner of the firm’s financial advisory business for the past four years and served on the executive board for eight years, won the popular vote of the firm’s more than 600 partners over Sydney-based chief operating officer Sean Gregory.

Gregory stays on the executive team as the chief strategy, risk and reputation officer.