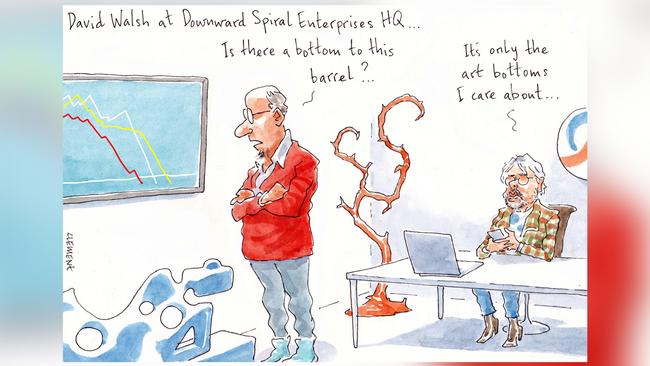

MONA’s owner suffering for his art

A decade on from the opening of his Museum of Old and New Art, there’s no doubt David Walsh has put Tassie on the map, but the exercise has also proved to be a drain on his personal finances.

The professional gambler and art collector’s latest accounts lodged with ASIC earlier this month show Moorilla Estate — the holding company for the museum — fell to a $19.94m loss for financial year 2020, with Walsh himself, the group’s only director, classifying the entity as a going concern.

Still, the bottom line result is an improvement on last year’s $28.85m loss, even after the oversized hit from the coronavirus pandemic.

Walsh reports that visitors to the museum dropped by 25 per cent for the year to 303,474 after he was forced to shut the doors in March — wiping out the 6 per cent visitor growth in the months prior.

Revenue for the year was down 16.4 per to $34.3m, with only one show — New Zealand artist Simon Denny’s Mine — on exhibit.

The bigger hit, though, has been to the 60-year-old’s own hip pocket — interest-free loans from his aptly named Downward Spiral Enterprises Pty Ltd to the museum ballooned by $56.8m in the past year to a grand total of $327.5m.

In the scheme of things it makes his $9.2m line of credit and $15.7m loan, both from Matt Comyn’s CBA, look like a walk in the park.

Still, it doesn’t seem to bother the multi-millionaire, who says he and other related parties will continue to provide financial support to ensure the entity is able to meet its obligations.

“MONA will lose more money closed than open (oddly, we haven’t seen a reduction in visitation) so, unlike Dark Mofo, I’m incentivised to keep it going. And I owe the staff, big time,” Walsh wrote in a letter back in March.

For the record, MONA has run at a loss every year since it was first established in 2015.

While the 2020 Dark Mofo festival got the cut thanks to COVID, there was a silver lining — and not just that we were all spared the gaggle of bare bottoms in the annual Nude Solstice Swim.

The museum’s wages bill was shaved by $2m for the year to $24.1m thanks in part to ScoMo’s JobKeeper scheme along with some state government payroll tax relief.

Venture adventure

Spare a thought for former Ausgrid chairman Roger Massy-Greene and ex-Seven boss Peter Gammell. They, along with one-time Ord Minnett managing director Walter Lewin and long-time fundie Connie McKeage, now make up the board of major venture capital outfit OneVentures.

The Paul Kelly-led OneVentures, which specialises in medical investments, had a successful year in 2020 — notwithstanding difficult conditions — with funds under management hitting $500m.

But this year is not off to the best start.

Dr Reddy’s Laboratories, one of India’s largest conglomerates, claims OneVentures duped it into buying the rights to an experimental treatment known as Xeglyze by letting it think it was close to being approved by the US Food and Drug Administration.

That sale was in September 2015, and appears to have been worth at least $60m.

Coincidentally, Blue Sky Venture Capital and its then investment director Elaine Stead were part of the $12m syndicate that backed the biotech in the first place in 2013 — details of which were brought up at the recent defamation trial of AFR columnist Joe Aston to prove her track record … but we won’t bring that one up again.

So why such interest in Xeglyze, a “next generation product” that killed head lice? Because, as Dr Reddy’s was told, it would generate more than $US100m ($130m) after four years.

That’s according to documents filed with the Victorian Supreme Court by Dr Reddy’s, which claims the FDA had made it quite clear in January 2015 that there were “major and significant concerns” about the drug. The Indian pharmaceutical giant only discovered the FDA’s real view, according to the documents filed earlier this week, in an email from the agency in June 2016.

Dr Reddy’s wants it declared that OneVentures engaged in misleading or deceptive conduct. For the record, Hatchtech — the vehicle through which OneVentures owned Xeglyze — has commenced proceedings against Dr Reddy’s in a Delaware court for $US45m.

As for Xeglyze? It was given the green light by the FDA in August. The delay in approval, according to Hatchtech’s media statement, was due to “manufacturing deficiencies at the Dr Reddy’s drug substance manufacturing plant in India”.

“The FDA’s approval of Xeglyze is the culmination of a nearly 20-year journey,” Hatchtech boss Hugh Alsop said.

Surely it’s just the start of this saga.

Crown changes

A year on from the start of James Packer’s Crown casino inquiry and it seems we all will have to wait a little longer for commissioner Patricia Bergin’s final word.

The NSW casino regulator late Friday announced the highly anticipated report was imminent, but would not meet the previously prescribed February 1 deadline.

Terms of reference for the inquiry, set out by the state government, tasked the former judge with determining the suitability of Crown to operate its Barangaroo casino given evidence of its non-compliance with anti-money laundering and counter-terrorism financing regulations.

But with 60 days of hearings and hours of testimony from the likes of chair Helen Coonan, chief John Alexander and director Michael Johnston, the task was nothing if not gargantuan.

The terms explicitly state that the commissioner was to report to the Authority in writing by February 1, the delay put down not to Bergin’s tardiness but rather the regulator itself.

“The Authority’s board will then consider the report, which is expected to be publicly released within the next two weeks,” a brief statement read.

“Authority chair Philip Crawford said no date for the release of the report had been fully determined.”

With a meeting of the board scheduled for February 17, the timing points to final release at or about that date.

Still, Crown has been making changes in the interim, and we’re not just referring to its new cocktail menus.

Former SkyCity chief Nigel Morrison was last week appointed to the board, a return to the company after he served as chief operating officer of Crown Melbourne before his stint at the Auckland-based competitor SkyCity.

For the past four years, though, it seems he has been busying himself as partner of investment firm St Lewis Capital — finer detail of which is difficult to find.

“The Board welcomes Nigel’s contribution as we continue to implement our reform program and deliver on our other strategic objectives,” Coonan said at the time, describing the current casino operating environment as “constantly evolving”.

That’s one way to put it.

Morrison’s appointment comes as John Horvath makes his exit after protest votes from shareholders at the casino group’s October AGM.

No doubt there will be more board and investor upheaval to come as Bergin makes her recommendations known, with the similar inquiry by Victoria’s regulator adding to the pressure — the commissioner of which is expected to be announced shortly.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout