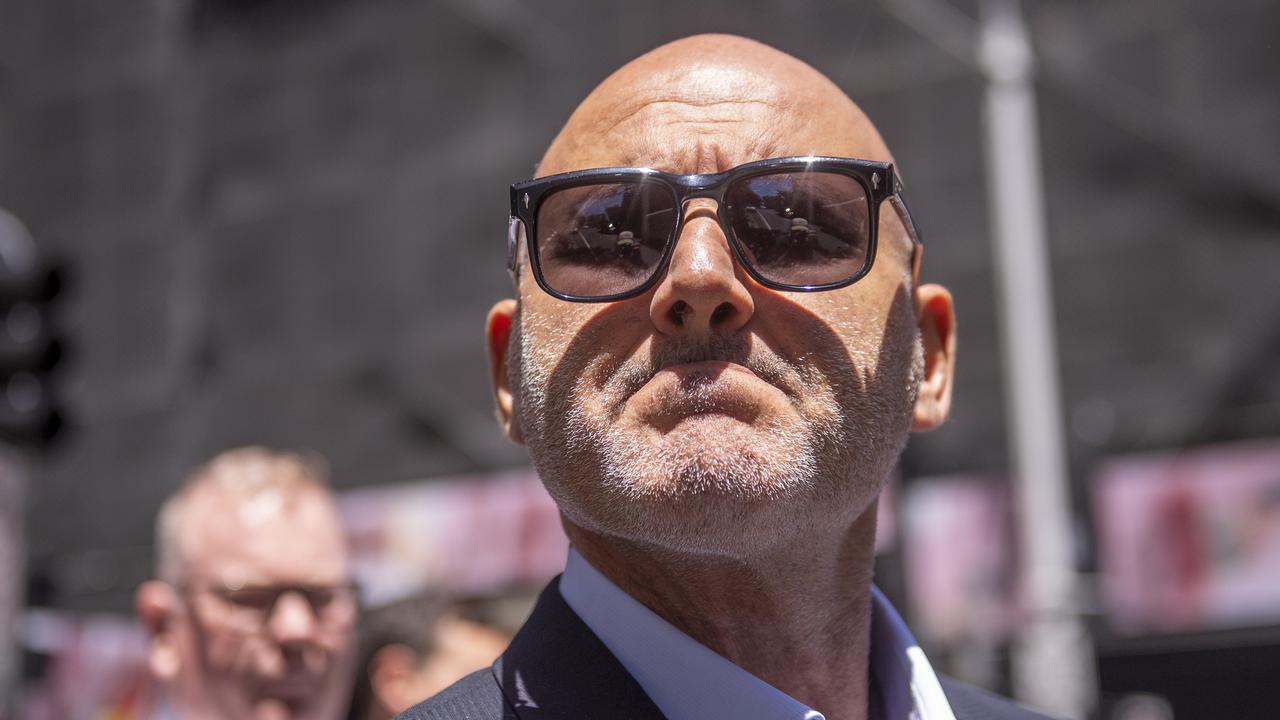

The 70 Merivale venues may be closed, but boss Justin Hemmes is opening the kitchens to deliver food Sydney-wide.

The service dubbed Merivale at Home delivers fresh ingredients from a select number of their top restaurants to cook at home. In the wake of COVID-19 dining restrictions, the entrepreneur is taking on the home delivery food giants, redeploying staff as delivery drivers during the shutdown.

The move is quite possibly set to be permanent and extended.

Margin Call could see the classy Hemmes ratchet it up further afield to include delivery by light plane, helicopter or tender.

“Our at-home meals are easy to cook, and will have you feeling like an exec chef in your own home,” Hemmes promises of the service that outdoes HelloFresh and Marley Spoon.

They are currently dishing up meal packs once a week from five inner-city restaurants — Mr Wongs, Totti’s, Fred’s, Bert’s Bar and Brasserie and Vinnie’s Pizza.

They needlessly advise the chocolate mousse should be eaten within 48 hours.

They’re also offering a bottle shop, with the thousands of wines and beers across their venues gathering dust in the cellar.

Cocktails can be whipped up, and keen wine drinkers can get in contact with the e-sommelier, who will more than happily recommend a wine for a dish.

Hemmes has divided his downtime between his Vaucluse harbourfront and his Narooma south-coast weekender.

Formula for failure

This time last year Australian Nutrition and Sports was undertaking an $8m capital raising ahead of its expected ASX listing, underwritten by PAC Partners Securities. Known mostly for its fitness products, and briefly sponsoring AFL team St Kilda, it is now in voluntary administration.

ANS had expansionary plans to grow its Chinese presence with its infant milk formula range.

ANS founder and former personal trainer Tom Lashan’s IPO roadshow advised that the $419,000 revenue in 2017-18 was up 92 per cent annually. Although there losses blowing out by 133 per cent to $2m.

St Kilda Football Club sits among the unsecured creditors of the Tullamarine-based entity, owed $78,000, with the sponsorship deal all over long before the club will play its second game in Shanghai.

Though apparently the Saints players with young families did enjoy the baby milk formula.

David Koch’s Port Adelaide escaped being caught up in the collapse.

ANS’s initial 2019 prospectus advised that there was a three-year referral agreement with the Power, who were tasked to identify potential Chinese business people and showcase ANS products in China.

ANS was said to pay Port a 5 per cent referral fee for products sold into China, given Port’s annual game in Shanghai, but the deal was dropped from being mentioned when an updated prospectus was issued after a query from ASIC.

ASIC then put the entire IPO on hold, enforcing an interim stop notice two days after the offer closed last April. The company’s former lawyers are seeking their fees incurred during the abandoned IPO.

Company non-executive chairman Peter Reilly has cited the inability to trade as a consequence of COVID-19 along with “cross border issues” between Hong Kong and China as reasons behind the collapse.

A deed of company arrangement would see unsecured creditors receive a return of between 2.04c and 0.31c in the dollar.

The Saints sit among the 32 unsecured creditors owed $4m, but $3m is being sought by related parties.

There was some $87,000 worth of perishable stock but it was deemed unlikely to yield any sort of return during the COVID-19 closure of gyms given its mid-May use-by date.

Challenge at Monash

Monash University vice-chancellor Margaret Gardner has always had a way with words.

Her notes to staff over the years have been renowned for their colourful turns of phrase, but there was none of them in her latest, aptly titled “Flesh and Bone”, about the challenges facing Monash, whose chancellor is Rio Tinto director Simon McKeon and on whose council sit the likes of McKeon’s Rio boardroom colleague Megan Clarke and Westpac director Peter Marriott.

Gardner revealed her university’s 2020 revenue shortfall would be $350m due to a $220m revenue decline in student fees and $130m in lost revenue from things like parking, donations, property and investment income.

A further $45m would be added to the shortfall from funding Monash College (which has taken a 40 per cent hit to its income) and hardship grants for most of the university’s vulnerable students.

This will be partially offset by a $200m cut in operating costs, including an $80m saving from the ongoing staff hiring freeze and the temporary 20 per cent pay cut Gardner and her senior executive team are taking, half of which is being put into a fund for students suffering hardship.

All of which means Monash will go into deficit this year and start 2021 in the same fashion as it draws on cash reserves and increases borrowings to pay for day-to-day operations.

A day in the Rio boardroom must seem like a walk in the park by comparison for McKeon and Clarke. Rio shares rose over 18 per cent between mid-March and mid-April, but e they have fallen back slightly over the past 10 days of trading.

Gill’s giddy-up

AFL boss Gill McLachlan’s love of the punt and racing in general is well known at the best of times. But imagine his excitement when there’s no footy on the field and all he’s doing is nutting out financial issues with clubs and figuring out when, or even if, a season will get restarted during the COVID-19 crisis.

Therefore, Margin Call can understand that McLachlan’s fever-pitch interest in the aptly named Search for a Cure handicap at Kembla Grange on Tuesday. The race, and a whopping $15,065 in prizemoney, was won by the John O’Shea-trained Live and Loaded, in which McLachlan has a share.

Other owners include McLachlan’s better-looking brother Hamish McLachlan (Gill is currently sporting what has kindly been described as a “holiday beard”), AFL legal boss Andrew Dillon, fund manager David Paradice and former Seven West Media CEO Tim Worner.

Such was the excitement in the family for Tuesday’s win that apparently a favourable comparison was made with the previously most famous McLachlan winner, White Nose.

Owned and bred by the AFL boss’s great-grandfather Hugh Patterson ‘HP’ McLachlan, White Nose famously upstaged the legendary Phar Lap to win the 1931 Melbourne Cup.

But word is the current McLachlan clan has high hopes for Live and Loaded, which Margin Call spotted at recent trackwork. We can only hope that the internet worked better for the AFL boss, forced to watch at home given the pandemic restrictions, than a recent press conference in which participants had a hard time hearing and seeing McLachlan, who clearly hasn’t got league sponsor Telstra to improve the dial-up internet he seems to be still using.

Guscic’s relief rally

From his lockdown on the Spanish island of Majorca, Webjet boss John Guscic is ahead on his recent plunge in the placement of his under-pressure travel company. As a show of faith in the company, Guscic picked up 516,000 shares at $1.70 each in the retail entitlement offer. With recent gains in Webjet, that has delivered the chief executive a near paper profit of $438,000.

It’s a start, but a long way back for Guscic, whose pre-raising pile of nearly seven million shares were worth $84m on paper. Today his holdings are worth closer to $25m. Whack.

Meanwhile US private equity firm Bain Capital, with the local arm headed by former Olympic diver for Australia Mike Murphy, may have got a leg-up if it opts to push ahead with a bid for collapsed carrier Virgin Australia.

Bain, which is considering signing on to the Virgin tyre-kicking exercise, tipped in $25m worth of shares in the institutional placement equating to 4 per cent of Webjet’s share register. Its holdings are now worth $37.5m, which ought to buy a few new tyres for a Boeing 737. Bain also eyed a sub-underwriting role of up $20m of additional shares in the retail offer, and wanted to get its hands on another 26 million shares but the scramble of retail investors prevented it getting hold of any more.