It’s been total silence from the Australian Club’s inner sanctum since a messy confab last June over whether to allow women to join the country’s highest-profile men’s-only establishment.

Opposition to that move was led by a group known internally as the St Paul’s mafia – led by former Federal Court judge Peter Graham – after the University of Sydney college they attended.

Graham, for the record, was the author of a 10-page missive ahead of a vote on the issue that revealed one member had cautioned against allowing women to join as members because the club would attract “women you wouldn’t want”.

“The club provided a place where you could get away from ‘bossy women’,” he alleged another member had told an earlier meeting about the issue.

A majority, 62 per cent, of the 700 members who attended a special meeting last year voted against the proposal. The Macquarie St institution counts John Howard and Malcolm Turnbull as members; at the time, neither would say which way they voted.

In fact, the Australian Club conducted a second, secret survey of members following the meeting. Of the 1561 responses received, 53 per cent of members supported allowing women (who can currently enter the building only as guests of male members) to join the club.

The survey, leaked to Margin Call, found 41 per cent were against the admission of women members. The rest had no view.

A change of the rules requires 75 per cent support. Those previously reported to be in support of the proposal included former Morgan Stanley managing director David Kent, ex-Sydney University pro-chancellor Barry Catchlove, former Supreme Court judge Michael Pembroke and former Macquarie chairman Kevin McCann.

“With the benefit of these multiple insights from members and with the overarching principle that the general committee is seeking to act in the best interests of the club and all members, the general committee has concluded that there is sufficient support for this matter, and that the general committee has the obligation to further consider whether and if so, how best to admit women as members of the club,” wrote the organisation’s president, John Stanham, on July 6.

“The general committee, based on member input and through its own assessment, believes it should develop and evaluate alternatives that allow the general committee and members to explore the admission of women as members along with other models of club structure and membership that might be suitable.

“We will keep you fully informed through these important considerations.”

And that, according to our sources, was the last they ever heard of the matter.

This weekend will mark six months since Stanham’s missive.

–

Come what May

Former British PM Theresa May once claimed the “naughtiest” thing she had ever done was run through fields of wheat as a child. She may need to revise that observation after a week leading to an internal revolt against her successor, Boris Johnson, over the Partygate scandal.

But if there was any qualms about the strain in that relationship, it isn’t shared by the Liberal Party, which is gleefully spruiking May’s visit to Australia with its wealthiest donors.

Her fundraising engagement with the party’s Victorian branch has already been made public.

On Friday, NSW Liberal director Chris Stone sent around his own circular, inviting select donors to a private dinner this month with May the guest of honour.

“Numbers will be strictly limited,” he wrote.

The gathering will be at an unidentified home. Hopefully whoever hosts will have ABBA’s Dancing Queen on the stereo so she can perform her famous entrance at the 2018 Conservative Party conference.

–

A captivating result

There sure is a lot of money in detention centres.

Take Canstruct (owned by the Murphy family and operated from the Brisbane suburb of Yeerongpilly), the construction and services company that delivers projects in difficult and remote locations.

Which is where the commonwealth detention centre in Nauru comes in.

Canstruct was appointed on the key Nauru contract for garrison and welfare services by the Home Affairs Department in 2017 for an initial duration of three years, with an original total contract value of about $1.12bn that has since risen to $1.6bn.

It sure has been a tidy money earner for Canstruct, judging by financial accounts that lobbed with the corporate regulator at the end of this week.

The 2021 financial report for the group’s parent company, Rard No. 3, shows the lucrative deal helped the family to net a profit of $101m for the financial year to June 30, 2021.

Handily, that profit figure was pretty much exactly the same as the $101m result in 2020. Revenue has been $334m and $333m across both years.

Canstruct was founded by patriarch Robin Murphy, and was until recently run by his son Rory Murphy.

Rory was replaced as chief executive by chief operations officer Damien Cavanagh in November, marking the first time in Canstruct’s 50-year history that the company has been led by someone outside the Murphy family.

Canstruct’s balance sheet also shows about $318m in net assets – more than $100m more than a year earlier.

There is, of course, an element of risk in having so much of a company’s income and profit reliant on one contract, but a note in Rard No. 3’s accounts suggests the company will lodge another belter of a result later this year.

“The contract for the provision of garrison and welfare services on the Republic of Nauru has been extended up until June 30, 2022,” it says.

But given Home Affairs minister Karen Andrews last September announced a deal to “establish an enduring regional processing capability” in Nauru, the money could keep rolling in for Canstruct for some time yet.

–

Back to the future

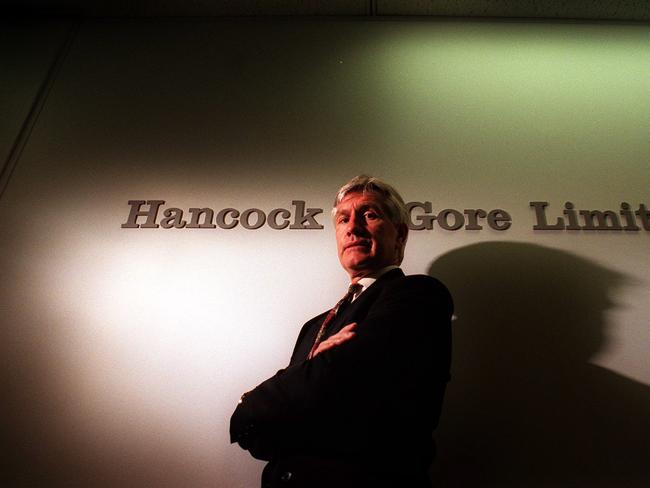

One of the oldest names in Australian equity markets is set to make a return to the sharemarket tables with diversified investor HGL gaining shareholder approval to go back to the old and venerable name of Hancock & Gore.

Hancock & Gore has a history stretching back to the late 1880s and almost 120 years of public company activity with a listing on the Brisbane Stock Exchange in 1904. The name was changed to HGL 20 years ago and in the early 2000s it was a hot stock with its shares trading at about $2, to give it a market capitalisation of almost $100m. It had a diverse portfolio including a 7 per cent stake then rock star fund manager Erik Metanomski’s MMC Contrarian investment fund.

It’s been a bit sleepy since. In 2019 it announced the appointment of former Crown Resorts chairman and former Howard government minister Helen Coonan to the board as its chair – she lasted 11 months.

Now former CVC boss Alexander ‘Sandy’ Beard, alongside former Hancock & Gore CEO and current director Kevin Eley, is leading the group and he also has skin in the game with about 12 per cent of the issued capital, and is going back to the future with the name.

Beard told Margin Call he sees the new Hancock & Gore as an “active not an activist” investor, so it will help small caps to grow their businesses and fashion new strategies, not look for bar room brawls and corporate dust-ups.

Beard has had plenty of that in the past, from the good old days of corporate brawls alongside former Guinness Peat street fighter Graeme Cureton. One of Hancock & Gore’s promising investments is a 17 per cent stake in Anagenics (the biotech formerly known as Cellmid) whose directors include former Coles boss and tennis fan Dennis Eck.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout