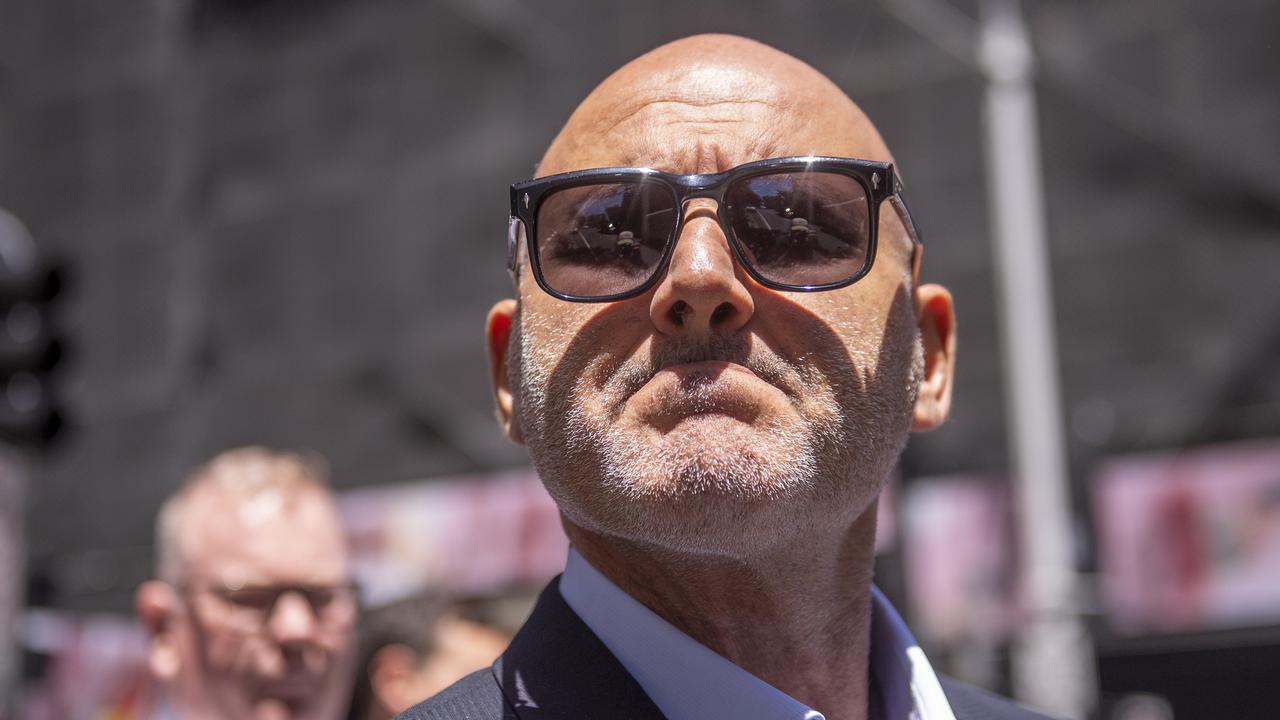

Mark Hutchinson can fish for another Vocation

If Vocation boss Mark Hutchinson decides he’s had enough of the embattled educator’s perpetually plunging share price, at least he can hook into an alternative career.

While “gone fishing” for most people represents a holiday, up until a few years back Hutchinson was a fishing instructor, reeling in piscine-fancying punters.

Thor’s company, Untamed Tracks, offered tours to everywhere from Cape York to, er, Mongolia, where it offered the chance to fly-fish for the giant taimen, or Siberian salmon.

There are even YouTube videos that make it clear Hutchinson is happiest with his shirt off and rod in hand.

One of them even shows the action man in the wilds of PNG, explaining how to catch fish using methods like poison and the webs spun by bird-eating spiders. The Untamed Tracks business was folded into another eco-tourism operator in 2007.

Nonetheless, a little bit of the company lives on inside Vocation. That’s because it changed its name to Avana and got into the training game before being tipped into the ill-fated float.

UBS still reeling in

GOOD to see the Chinese Walls are working at Swiss investment bank UBS, with the happy consequence money can be made from both Vocation’s rise and fall.

Vocation’s share price continues to drop like a lead sinker, down another 5.4 per cent yesterday after CFO Manvinder Grewal followed chairman John Dawkins out the door.

At 17.5c, it is a long way from the high of $3.35 in September.

UBS was there for the good times, both floating the company last year and going to market for a $74 million capital raising at $3.05 a pop in September.

And a notice filed by UBS yesterday shows it or its clients have made money on the way down too. UBS is no longer a substantial shareholder, having returned licks of stock borrowed to short the company during its tumble from grace.

A UBS spokeswoman said that to the best of her knowledge the shorting was done on behalf of clients, not for the benefit of the bank. But the bank won’t entirely starve: it continues to reap fees advising Vocation.

Wylie bows out

ONE of corporate Australia’s staunchest stoushes, Lazard corporate advisory boss John Wylie, is hanging up the gloves.

In a 24-year career, Wylie worked on everything from Wesfarmers’ takeover of Coles through the privatisation of Victoria’s electricity and gas through to Toll’s takeover of Patrick in 2006.

It was during that battle that Wylie, then at Carnegie Wylie, showed his dedication to his “client first” approach.

He took out newspaper ads to see off a fee-laden rival bid by Macquarie that proclaimed: “Don’t play at the Macquarie casino, where they rig the game”.

Wylie, who will stay on in an advisory role through 2015, is to be replaced by Lachlan Edwards and Andrew Leyden.

Fox’s Steinway sonata

ONESIE-wearing trucking billionaire Lindsay Fox has more Steinways than you — one — and now his partnership with Mark O’Connor, Exclusive Piano Group, has all the fancy pianos.

The business, which is expecting sales of more than $15m next year, just snared the exclusive Australian distribution rights to the Steinway range.

Fox, who donates his share of the winnings to arts charities, doesn’t play the Steinway he has at home. Instead, it plays itself. Apparently you just pop a disc in and tech magic does the rest.

Joyce a happy chap

YOU could never accuse airline miniature Alan Joyce of glorying in an opponent’s misfortune. An opponent’s good fortune, on the other hand ...

With deep cuts and a plunging oil price bringing Qantas back from a record $2.84bn loss, he’s a happy chap.

He reckons Nick Xenophon made the best investment of his life in October, a $500 bundle of Qantas shares bought purely so the independent senator could attend the AGM and grill Joyce.

“I think he’s probably doubled his money,” Joyce said yesterday.

butlerb@theaustralian.com.au